Question: QUESTION 8 3 points Save Answer The annualized forward when the euro/U.S. dollar exchange rates are EUR 0.9823 per USD spot and EUR 1.0025 per

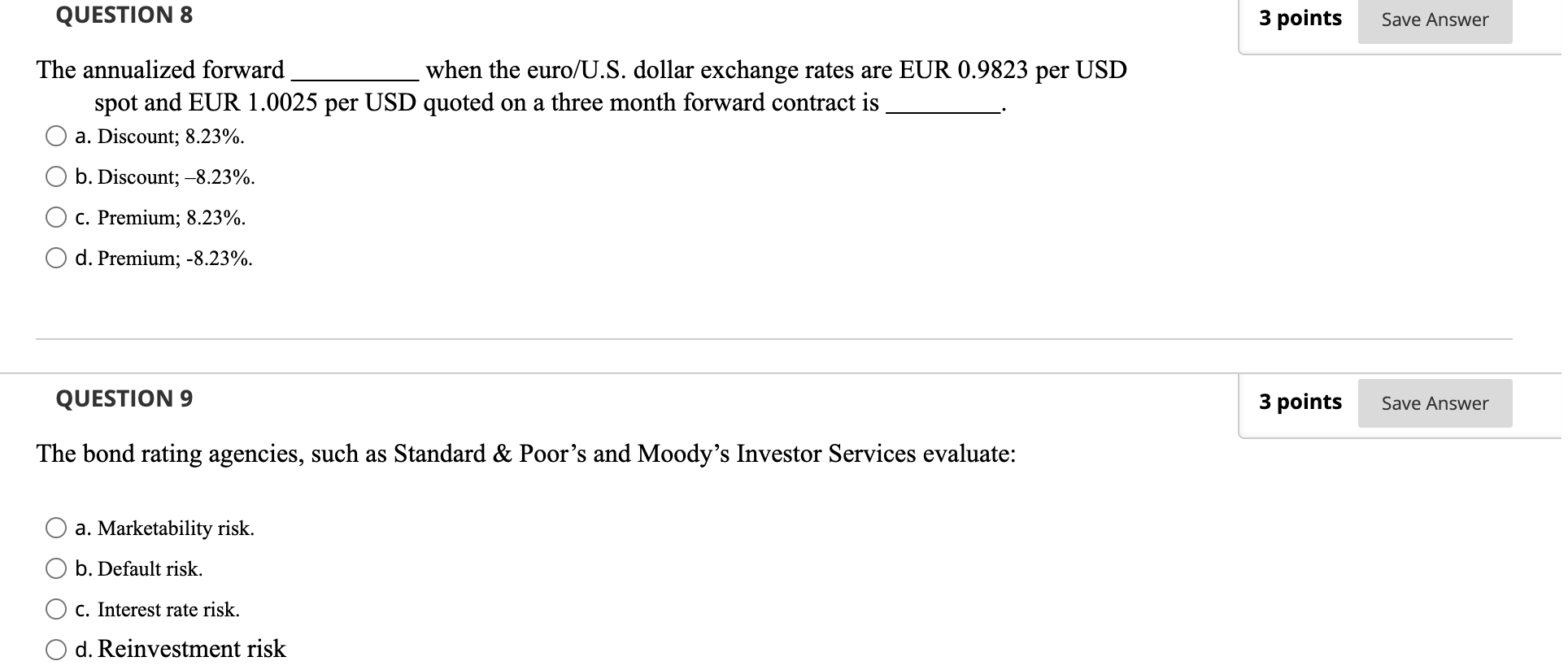

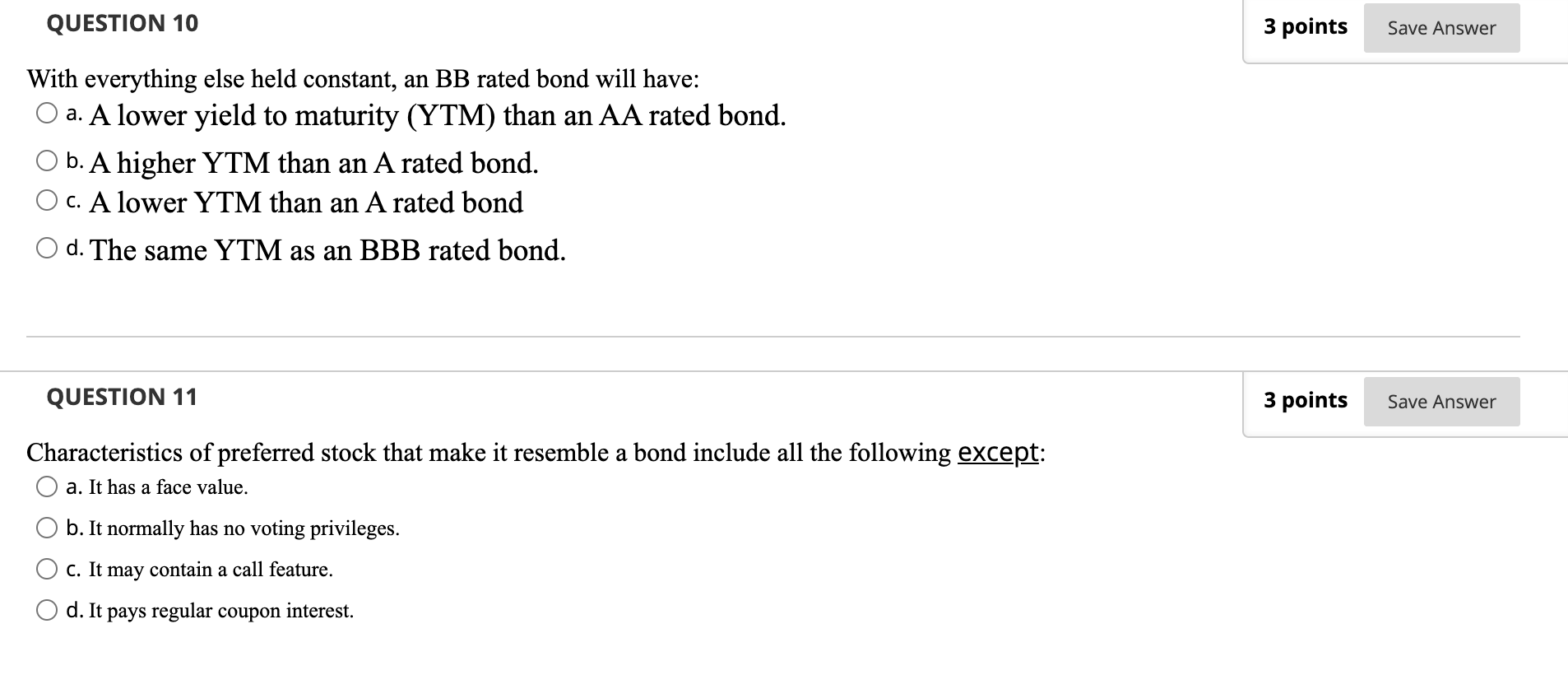

QUESTION 8 3 points Save Answer The annualized forward when the euro/U.S. dollar exchange rates are EUR 0.9823 per USD spot and EUR 1.0025 per USD quoted on a three month forward contract is. a. Discount; 8.23%. b. Discount; -8.23%. c. Premium; 8.23%. d. Premium; -8.23%. QUESTION 9 3 points Save Answer The bond rating agencies, such as Standard & Poor's and Moody's Investor Services evaluate: a. Marketability risk. b. Default risk. c. Interest rate risk. d. Reinvestment risk QUESTION 10 3 points Save Answer With everything else held constant, an BB rated bond will have: a. A lower yield to maturity (YTM) than an AA rated bond. b. A higher YTM than an A rated bond. C. A lower YTM than an A rated bond O d. The same YTM as an BBB rated bond. QUESTION 11 3 points Save Answer Characteristics of preferred stock that make it resemble a bond include all the following except: a. It has a face value. b. It normally has no voting privileges. c. It may contain a call feature. d. It pays regular coupon interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts