Question: Question 8 (30 points in total) Pediatric Care is a non-profit healthcare organization. Pediatric Care is considering to buy or to lease a new

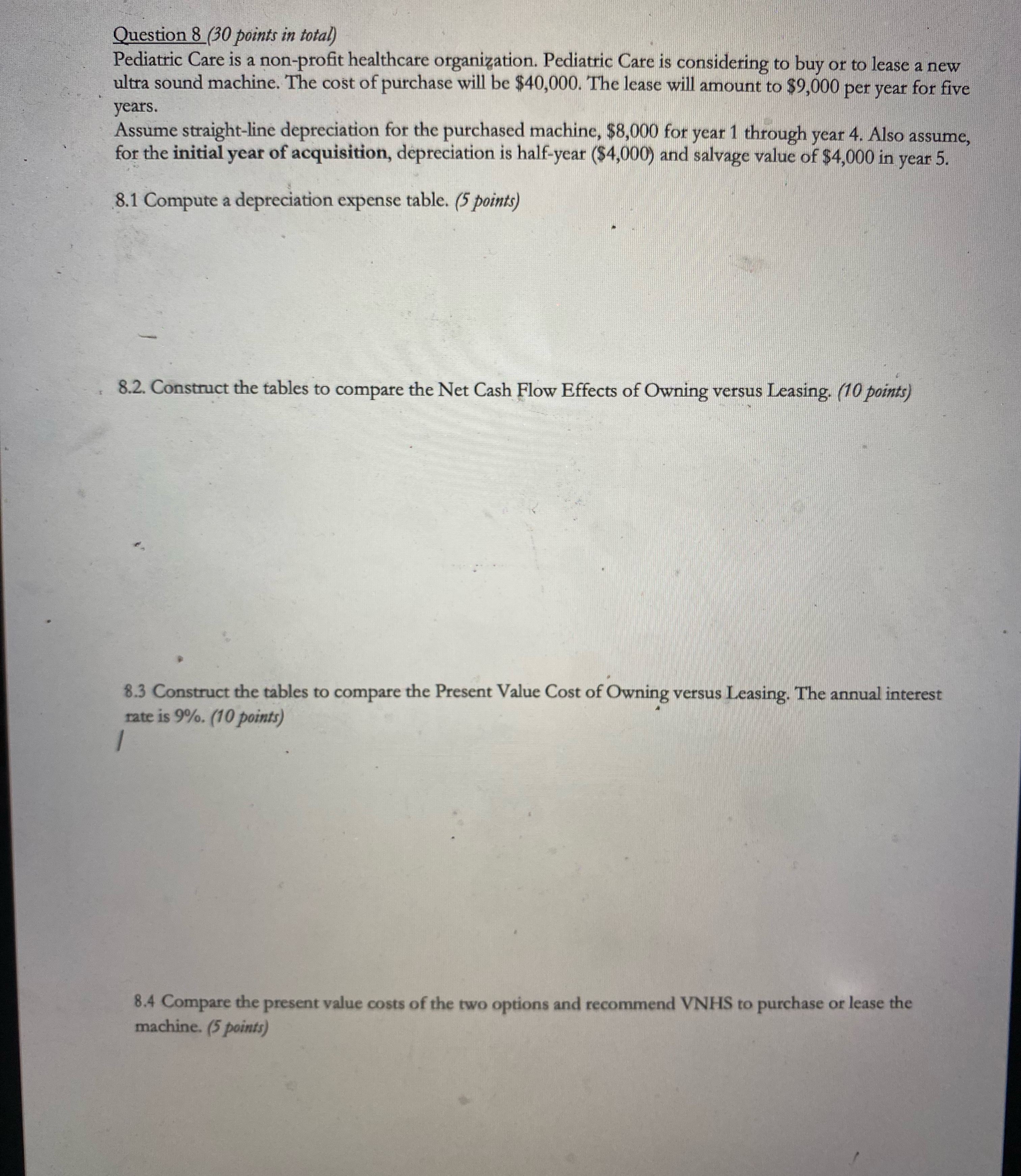

Question 8 (30 points in total) Pediatric Care is a non-profit healthcare organization. Pediatric Care is considering to buy or to lease a new ultra sound machine. The cost of purchase will be $40,000. The lease will amount to $9,000 per year for five years. Assume straight-line depreciation for the purchased machine, $8,000 for year 1 through year 4. Also assume, for the initial year of acquisition, depreciation is half-year ($4,000) and salvage value of $4,000 in year 5. 8.1 Compute a depreciation expense table. (5 points) 8.2. Construct the tables to compare the Net Cash Flow Effects of Owning versus Leasing. (10 points) 8.3 Construct the tables to compare the Present Value Cost of Owning versus Leasing. The annual interest rate is 9%. (10 points) 8.4 Compare the present value costs of the two options and recommend VNHS to purchase or lease the machine. (5 points)

Step by Step Solution

There are 3 Steps involved in it

81 Depreciation Expense Table Year Depreciation Expense 1 4000 2 8000 3 8000 4 8000 5 4000 82 Net Ca... View full answer

Get step-by-step solutions from verified subject matter experts