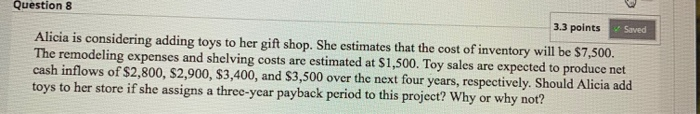

Question: Question 8 3.3 points Saved Alicia is considering adding toys to her gift shop. She estimates that the cost of inventory will be $7,500. The

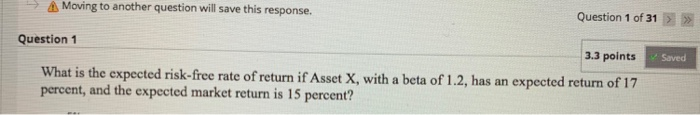

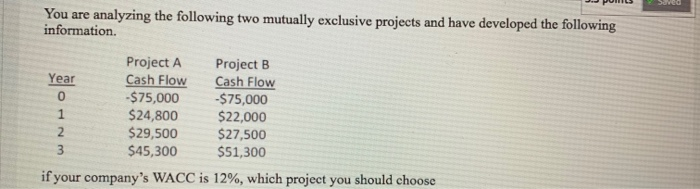

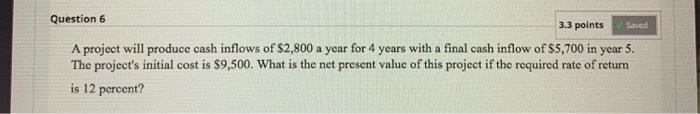

Question 8 3.3 points Saved Alicia is considering adding toys to her gift shop. She estimates that the cost of inventory will be $7,500. The remodeling expenses and shelving costs are estimated at $1,500. Toy sales are expected to produce net cash inflows of $2,800, $2,900, $3,400, and $3,500 over the next four years, respectively. Should Alicia add toys to her store if she assigns a three-year payback period to this project? Why or why not? Moving to another question will save this response. Question 1 of 31 Question 1 3.3 points Saved What is the expected risk-free rate of return if Asset X, with a beta of 1.2, has an expected return of 17 percent, and the expected market return is 15 percent? SUNO You are analyzing the following two mutually exclusive projects and have developed the following information. Project A Project B Year Cash Flow Cash Flow 0 -$75,000 -$75,000 1 $24,800 $22,000 2 $29,500 $27,500 3 $45,300 $51,300 if your company's WACC is 12%, which project you should choose Question 6 3.3 points Saved A project will produce cash inflows of $2,800 a year for 4 years with a final cash inflow of $5,700 in year 5. The project's initial cost is $9,500. What is the net present value of this project if the required rate of return is 12 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts