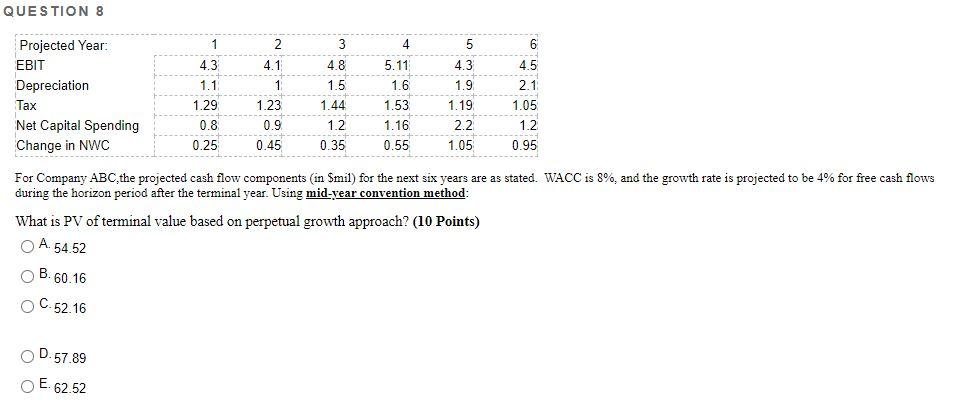

Question: QUESTION 8 4 LO Projected Year: 1 2 3 5 6 EBIT 4.3 4.1 4.8 5.11 4.3 4.5 Depreciation 1.1 1.5 1.6 1.9 2.1 Tax

QUESTION 8 4 LO Projected Year: 1 2 3 5 6 EBIT 4.3 4.1 4.8 5.11 4.3 4.5 Depreciation 1.1 1.5 1.6 1.9 2.1 Tax 1.29 1.23 1.44 1.53 1.19 1.05 Net Capital Spending 0.8 0.9 1.2 1.16 2.2 1.2 Change in NWC 0.25 0.45 0.35 0.55 1.05 0.95 For Company ABC, the projected cash flow components (in Smil) for the next six years are as stated. WACC is 8%, and the growth rate is projected to be 4% for free cash flows during the horizon period after the terminal year. Using mid-year convention method: What is PV of terminal value based on perpetual growth approach? (10 Points) A. 54.52 B.60.16 C.52.16 D.57.89 E. 6 62.52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts