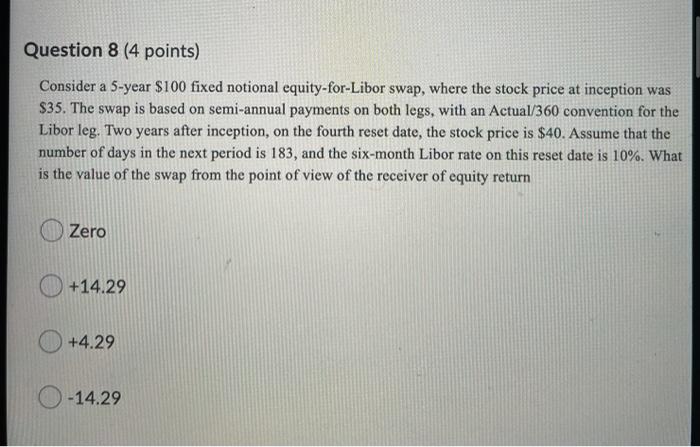

Question: Question 8 (4 points) Consider a 5-year $100 fixed notional equity-for-Libor swap, where the stock price at inception was $35. The swap is based on

Question 8 (4 points) Consider a 5-year $100 fixed notional equity-for-Libor swap, where the stock price at inception was $35. The swap is based on semi-annual payments on both legs, with an Actual/360 convention for the Libor leg. Two years after inception, on the fourth reset date, the stock price is $40. Assume that the number of days in the next period is 183, and the six-month Libor rate on this reset date is 10%. What is the value of the swap from the point of view of the receiver of equity return Zero +14.29 +4.29 -14.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts