Question: Question 8 (5 points) Evershine Ltd. is a gold company and its EBITDA is highly sensitive to the price of gold. You have collected

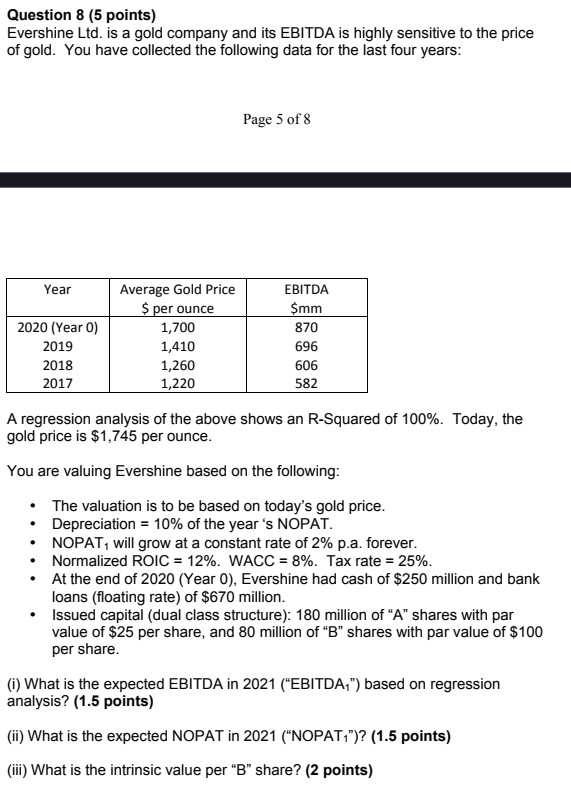

Question 8 (5 points) Evershine Ltd. is a gold company and its EBITDA is highly sensitive to the price of gold. You have collected the following data for the last four years: Year 2020 (Year 0) 2019 2018 2017 Average Gold Price $ per ounce 1,700 1,410 1,260 1,220 Page 5 of 8 EBITDA $mm 870 696 606 582 A regression analysis of the above shows an R-Squared of 100%. Today, the gold price is $1,745 per ounce. You are valuing Evershine based on the following: The valuation is to be based on today's gold price. Depreciation = 10% of the year 's NOPAT. NOPAT, will grow at a constant rate of 2% p.a. forever. Normalized ROIC = 12%. WACC = 8%. Tax rate = 25%. At the end of 2020 (Year 0), Evershine had cash of $250 million and bank loans (floating rate) of $670 million. Issued capital (dual class structure): 180 million of "A" shares with par value of $25 per share, and 80 million of "B" shares with par value of $100 per share. (i) What is the expected EBITDA in 2021 ("EBITDA,") based on regression analysis? (1.5 points) (ii) What is the expected NOPAT in 2021 ("NOPAT")? (1.5 points) (iii) What is the intrinsic value per "B" share? (2 points)

Step by Step Solution

There are 3 Steps involved in it

i To estimate the expected EBITDA in 2021 EBITDA based on regression analysis we can use the regression equation derived from the historical data EBIT... View full answer

Get step-by-step solutions from verified subject matter experts