Question: Question 8 (5 points) Lease versus Buy Compare the two alternatives: Purchase tractor for $267,000, minus the $42,000 allowed for trade-in value of old

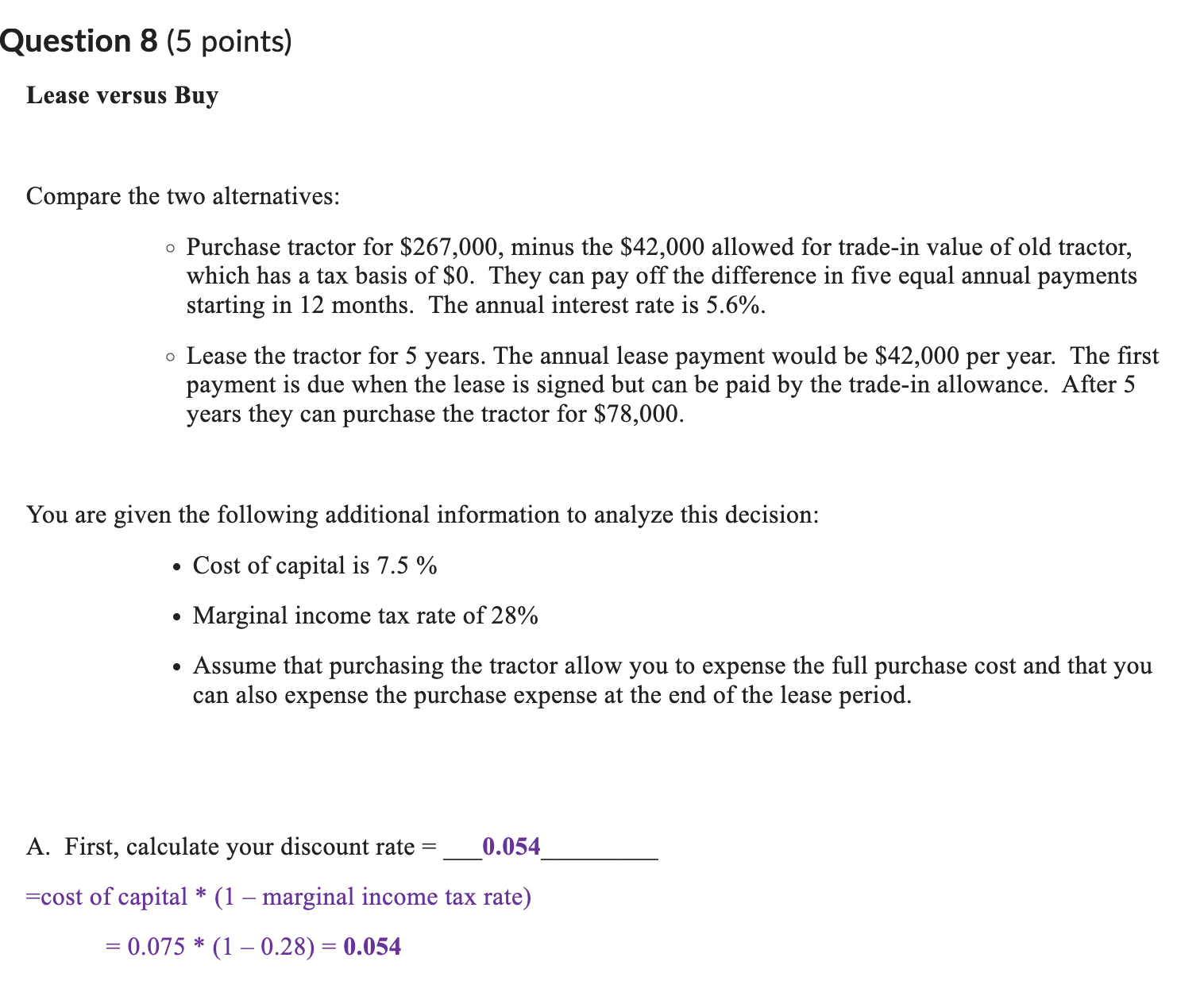

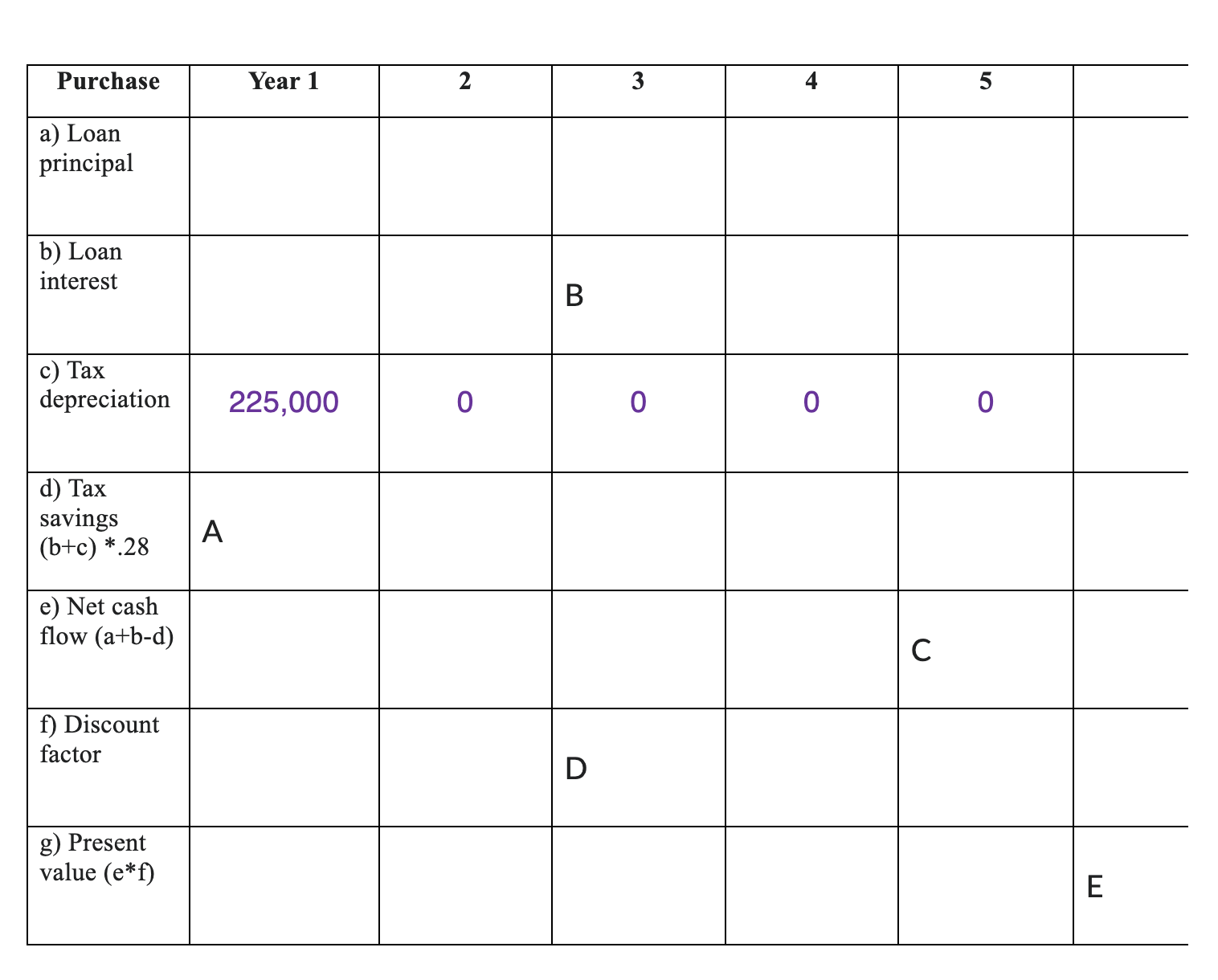

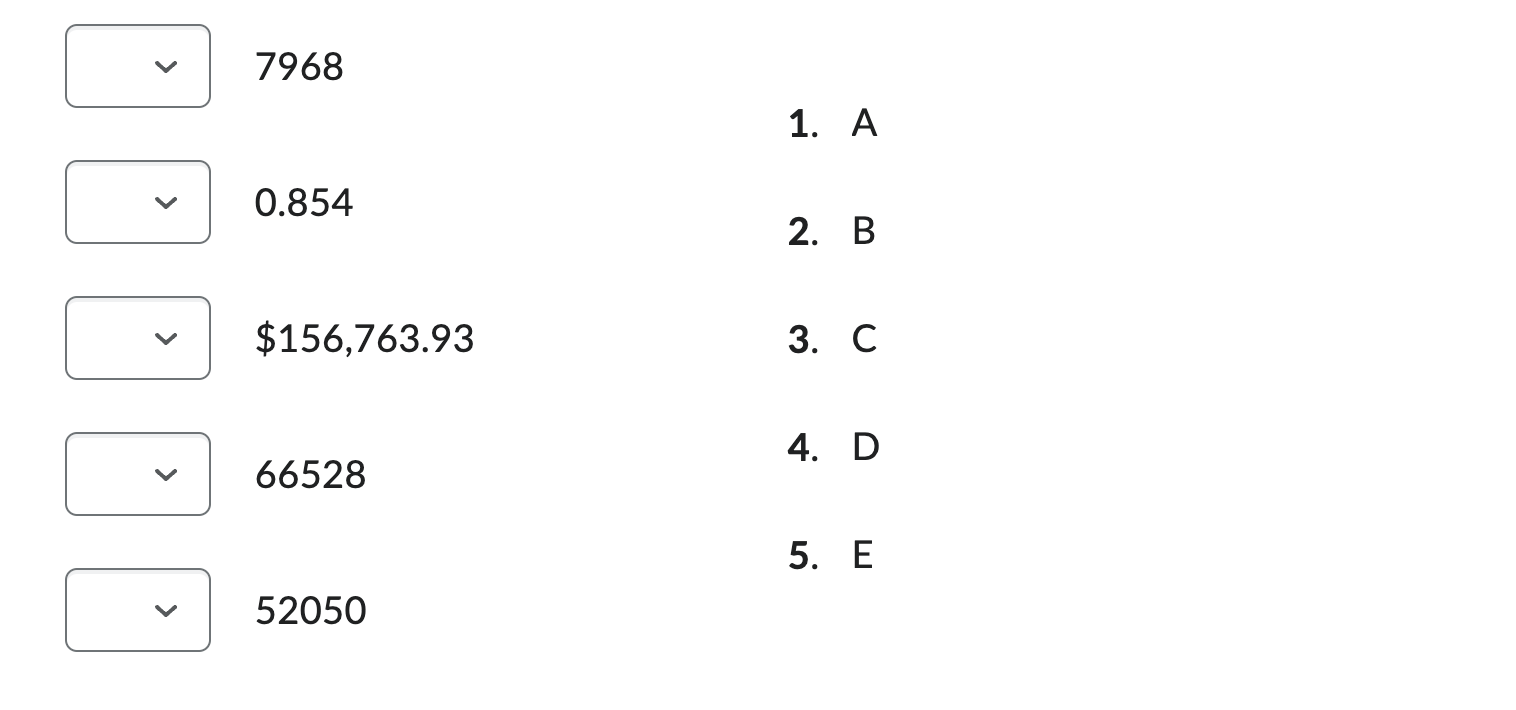

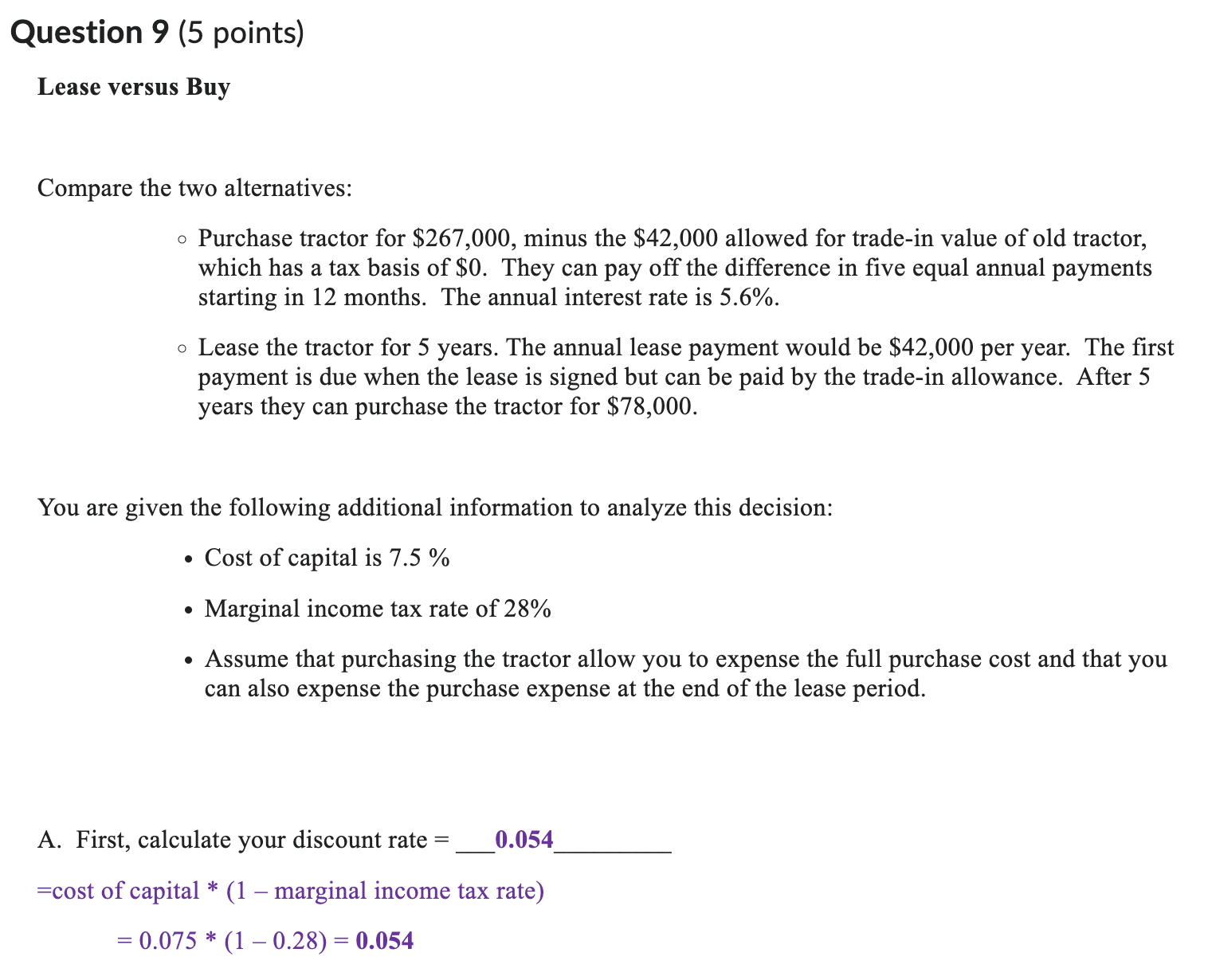

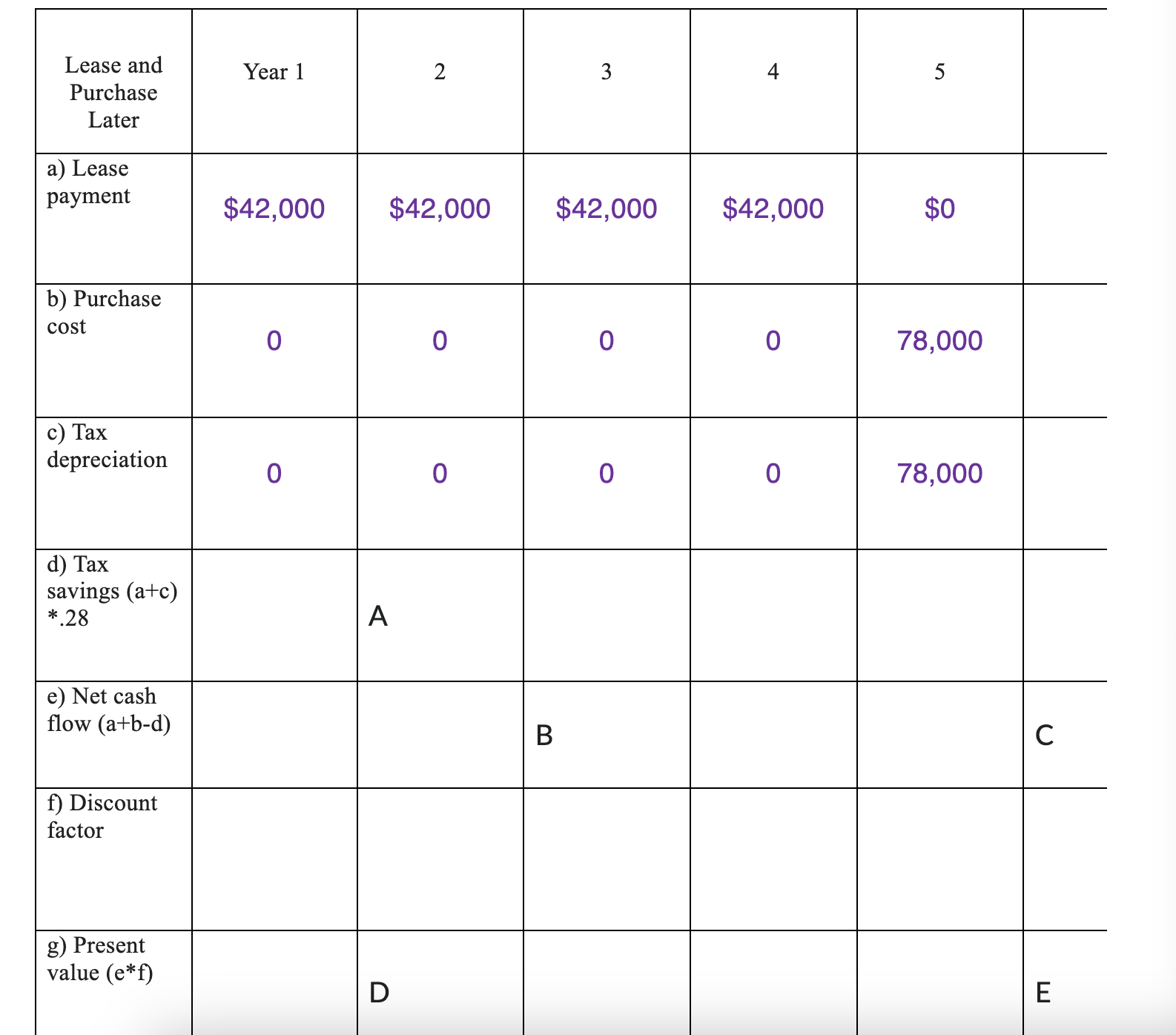

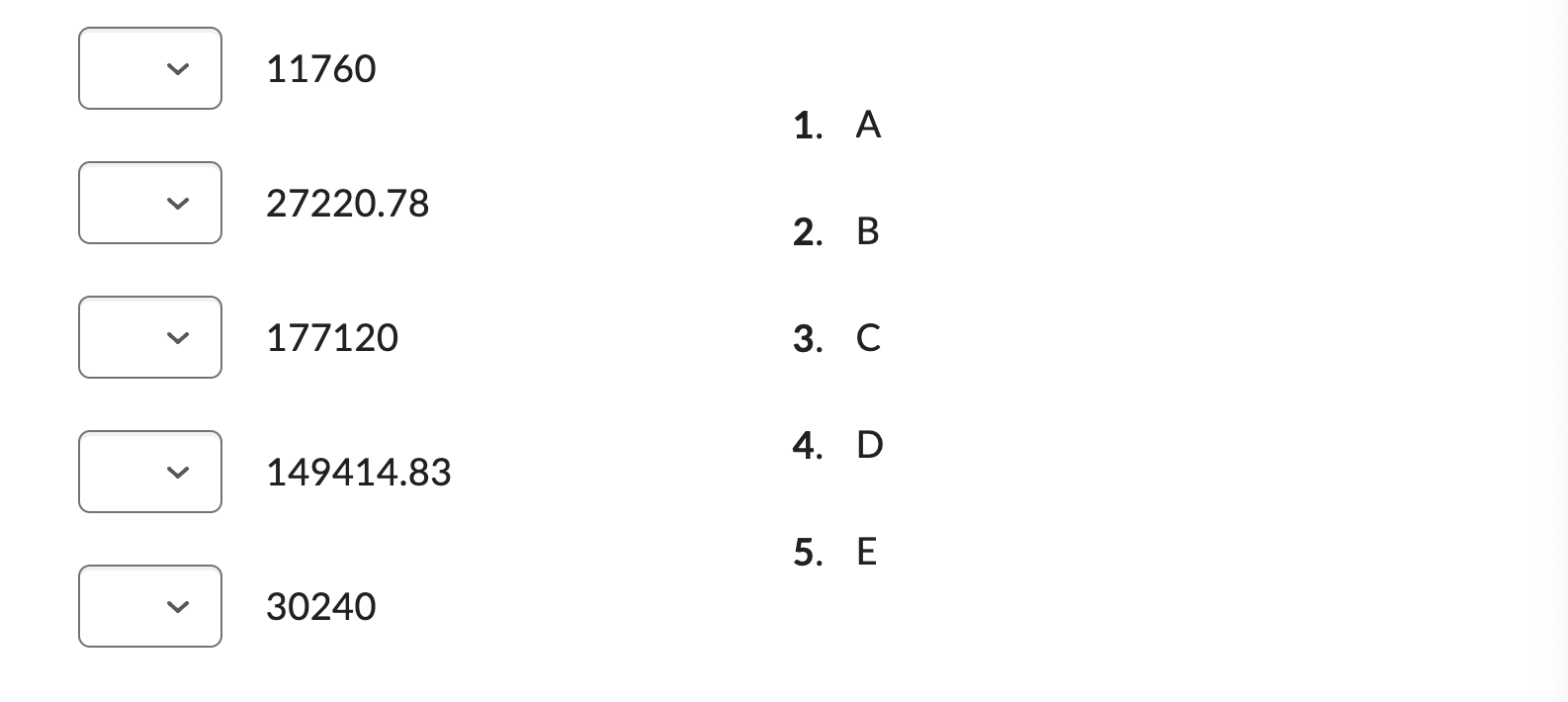

Question 8 (5 points) Lease versus Buy Compare the two alternatives: Purchase tractor for $267,000, minus the $42,000 allowed for trade-in value of old tractor, which has a tax basis of $0. They can pay off the difference in five equal annual payments starting in 12 months. The annual interest rate is 5.6%. Lease the tractor for 5 years. The annual lease payment would be $42,000 per year. The first payment is due when the lease is signed but can be paid by the trade-in allowance. After 5 years they can purchase the tractor for $78,000. You are given the following additional information to analyze this decision: Cost of capital is 7.5 % Marginal income tax rate of 28% Assume that purchasing the tractor allow you to expense the full purchase cost and that you can also expense the purchase expense at the end of the lease period. A. First, calculate your discount rate = 0.054 =cost of capital * (1 marginal income tax rate) = 0.075 * (1 - 0.28) = 0.054 Purchase Year 1 2 a) Loan principal b) Loan interest B 3 10 5 c) Tax depreciation 225,000 0 0 0 0 d) Tax savings A (b+c) *.28 e) Net cash flow (a+b-d) f) Discount factor g) Present value (e*f) D C E 7968 0.854 1. A 2. B $156,763.93 3. C 4. D 66528 52050 5. E Question 9 (5 points) Lease versus Buy Compare the two alternatives: Purchase tractor for $267,000, minus the $42,000 allowed for trade-in value of old tractor, which has a tax basis of $0. They can pay off the difference in five equal annual payments starting in 12 months. The annual interest rate is 5.6%. Lease the tractor for 5 years. The annual lease payment would be $42,000 per year. The first payment is due when the lease is signed but can be paid by the trade-in allowance. After 5 years they can purchase the tractor for $78,000. You are given the following additional information to analyze this decision: Cost of capital is 7.5 % Marginal income tax rate of 28% Assume that purchasing the tractor allow you to expense the full purchase cost and that you can also expense the purchase expense at the end of the lease period. A. First, calculate your discount rate = 0.054 =cost of capital * (1 marginal income tax rate) = 0.075 * (1 -0.28) = 0.054 Lease and Purchase Year 1 2 Later a) Lease payment 5 $42,000 $42,000 $42,000 $42,000 $0 b) Purchase cost 0 0 0 0 78,000 c) Tax depreciation d) Tax savings (a+c) * 28 e) Net cash flow (a+b-d) f) Discount factor g) Present value (e*f) 0 0 0 0 78,000 A D B C E 11760 1. A 27220.78 2. B 177120 3. C 4. D 149414.83 5. E 30240

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts