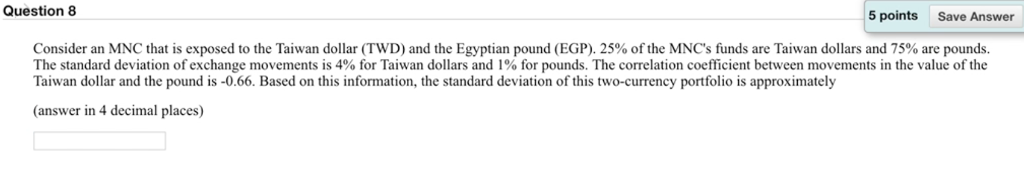

Question: Question 8 5 points Save Answer Consider an MNC that is exposed to the Taiwan dollar (TWD) and the Egyptian pound EGP) 25% of the

Question 8 5 points Save Answer Consider an MNC that is exposed to the Taiwan dollar (TWD) and the Egyptian pound EGP) 25% of the MNC's funds are Taiwan dollars and 75% are pounds. The standard deviation of exchange movements s 4% or Taiwan dollars and % or ou nds he correlation co e cent between movements n he Viue he Taiwan dollar and the pound is-0.66. Based on this information, the standard deviation of this two-currency portfolio is approximately (answer in 4 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts