Question: Question 8 (5 points) Suppose it is currently January 1, 2018. A firm plans to add riskless debt to its capital reasons cannot do so

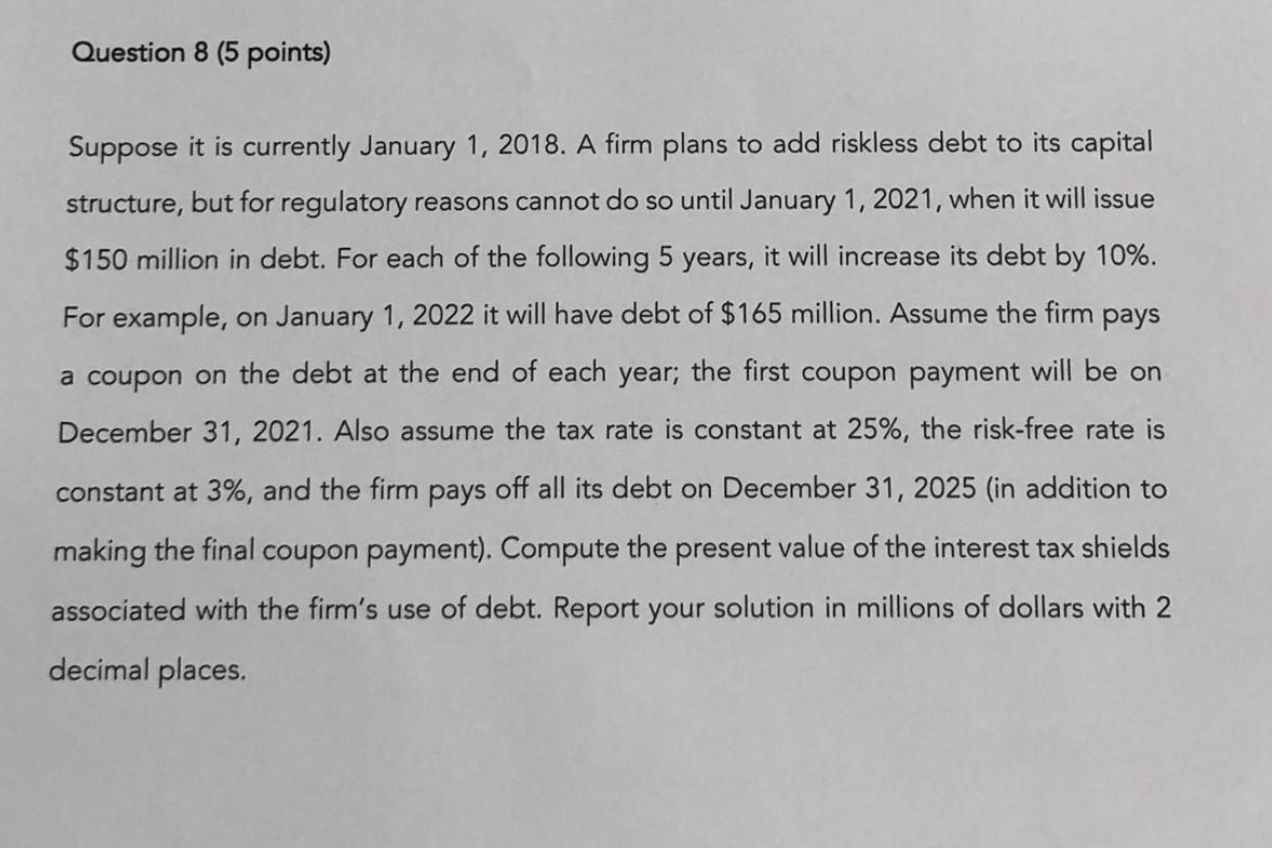

Question 8 (5 points) Suppose it is currently January 1, 2018. A firm plans to add riskless debt to its capital reasons cannot do so until January 1, 2021, when it will issue structure, but for regulatory $150 million in debt. For each of the following 5 years, it will increase its debt by 10% For example, on January 1, 2022 it will have debt of $165 million. Assume the firm pays a coupon on the debt at the end of each year; the first coupon payment will be on December 31, 2021. Also assume the tax rate is constant at 25%, the risk-free rate is constant at 3%, and the firm pays off all its debt on December 31, 2025 (in addition to making the final coupon payment). Compute the present value of the interest tax shields associated with the firm's use of debt. Report your solution in millions of dollars with 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts