Question: Question 8 (5 points) What is NOT correct about nonconventional cash flows? Nonconventional cash flows of a project can produce multiple Internal rate of returns

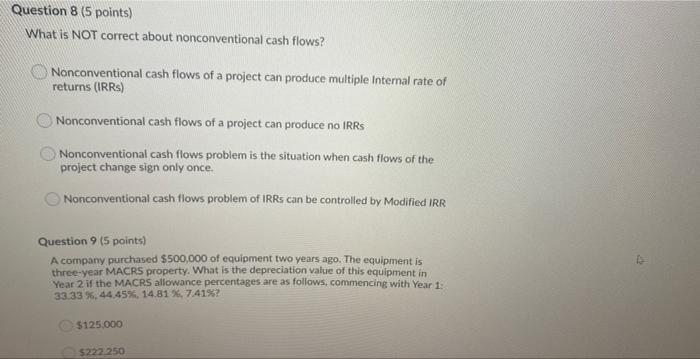

Question 8 (5 points) What is NOT correct about nonconventional cash flows? Nonconventional cash flows of a project can produce multiple Internal rate of returns (IRR) Nonconventional cash flows of a project can produce no IRRS Nonconventional cash flows problem is the situation when cash flows of the project change sign only once. Nonconventional cash flows problem of IRRs can be controlled by Modified IRR D Question 9 (5 points) A company purchased $500,000 of equipment two years ago. The equipment is three-year MACRS property. What is the depreciation value of this equipment in Year 2 if the MACRS allowance percentages are as follows, commencing with Year 1: 33.33 %. 44.45%, 14.81 %, 741%? $125.000 5222.250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts