Question: Question 8 5 Points Wind Ltd prepares financial statements to 30 September each year. On 1 October 2019 the company purchased an item of equipment

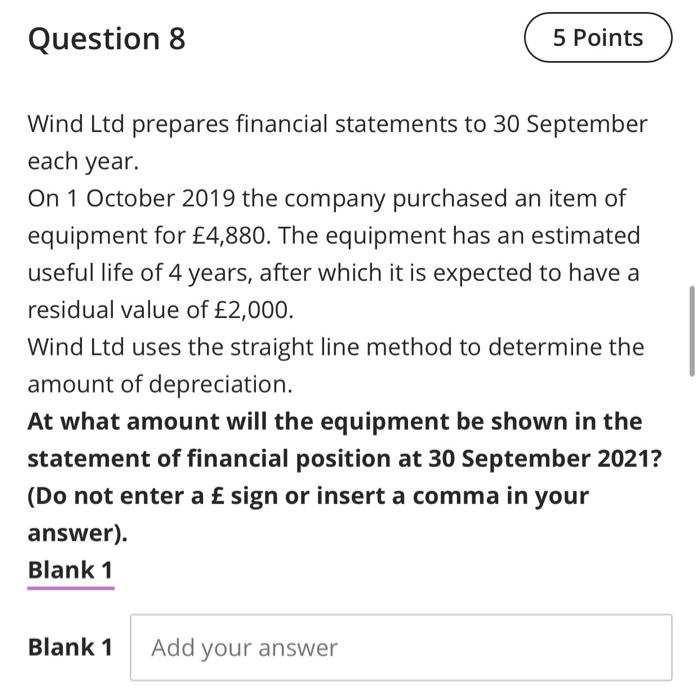

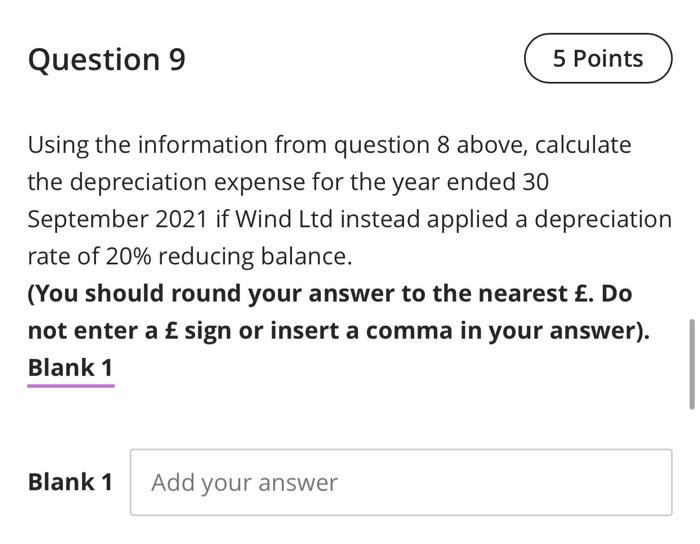

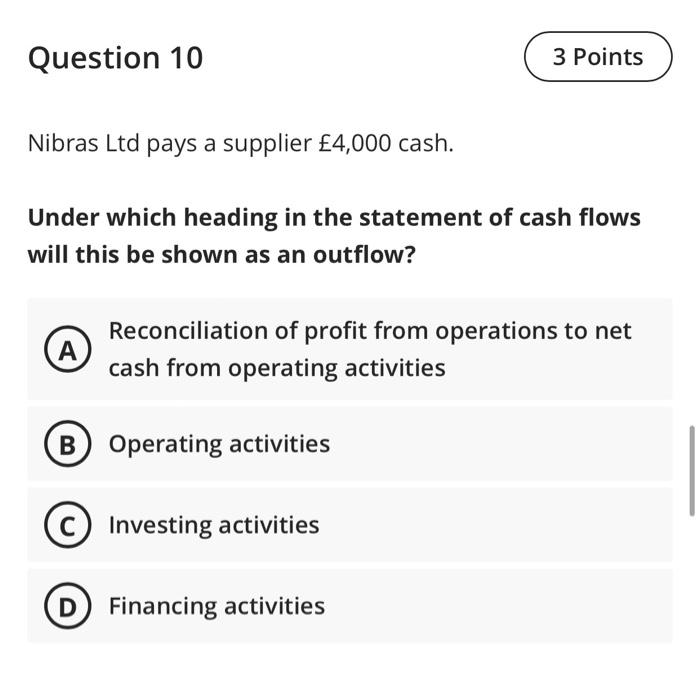

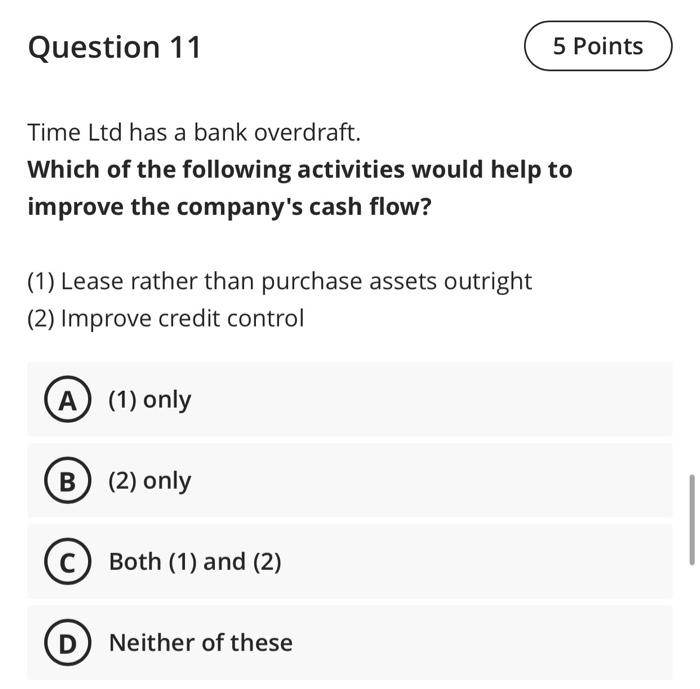

Question 8 5 Points Wind Ltd prepares financial statements to 30 September each year. On 1 October 2019 the company purchased an item of equipment for 4,880. The equipment has an estimated useful life of 4 years, after which it is expected to have a residual value of 2,000. Wind Ltd uses the straight line method to determine the amount of depreciation. At what amount will the equipment be shown in the statement of financial position at 30 September 2021? (Do not enter a sign or insert a comma in your answer). Blank 1 Blank 1 Add your answer Question 9 5 Points Using the information from question 8 above, calculate the depreciation expense for the year ended 30 September 2021 if Wind Ltd instead applied a depreciation rate of 20% reducing balance. (You should round your answer to the nearest . Do not enter a sign or insert a comma in your answer). Blank 1 Blank 1 Add your answer Question 10 3 Points Nibras Ltd pays a supplier 4,000 cash. Under which heading in the statement of cash flows will this be shown as an outflow? A Reconciliation of profit from operations to net cash from operating activities B Operating activities C Investing activities D) Financing activities Question 11 5 Points Time Ltd has a bank overdraft. Which of the following activities would help to improve the company's cash flow? (1) Lease rather than purchase assets outright (2) Improve credit control A) (1) only B) (2) only C Both (1) and (2) D) Neither of these

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts