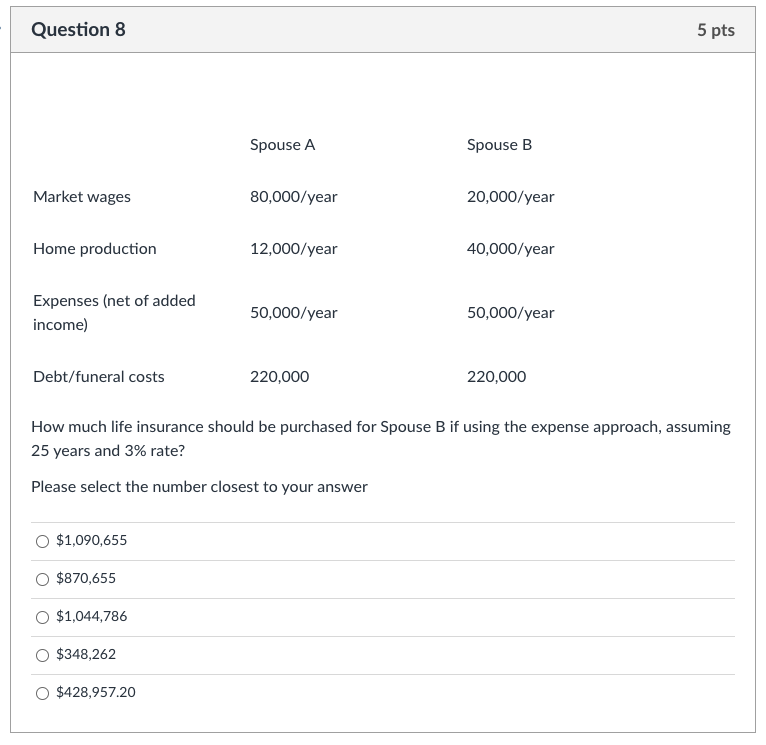

Question: Question 8 5 pts Spouse A Spouse B Market wages 80,000/year 20,000/year Home production 12,000/year 40,000/year Expenses (net of added 50,000/year 50,000/year income) Debt/funeral costs

Question 8 5 pts Spouse A Spouse B Market wages 80,000/year 20,000/year Home production 12,000/year 40,000/year Expenses (net of added 50,000/year 50,000/year income) Debt/funeral costs 220,000 220,000 How much life insurance should be purchased for Spouse B if using the expense approach, assuming 25 years and 3% rate? Please select the number closest to your answer O $1,090,655 O $870,655 O $1,044,786 O $348,262 O $428,957.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts