Question: Question 8: (5+5+10 points) 1) Below we have the prices of 6%, 7% and 8% annual coupon bonds with 1,2,3 years left to maturity: $96.55,

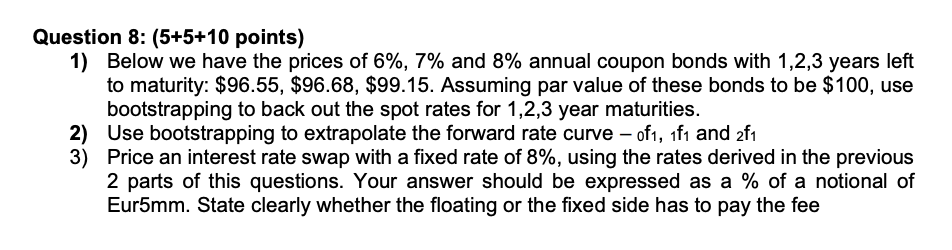

Question 8: (5+5+10 points) 1) Below we have the prices of 6%, 7% and 8% annual coupon bonds with 1,2,3 years left to maturity: $96.55, $96.68, $99.15. Assuming par value of these bonds to be $100, use bootstrapping to back out the spot rates for 1,2,3 year maturities. 2) Use bootstrapping to extrapolate the forward rate curve of1, 1f1 and 2f1 3) Price an interest rate swap with a fixed rate of 8%, using the rates derived in the previous 2 parts of this questions. Your answer should be expressed as a % of a notional of Eur5mm. State clearly whether the floating or the fixed side has to pay the fee Question 8: (5+5+10 points) 1) Below we have the prices of 6%, 7% and 8% annual coupon bonds with 1,2,3 years left to maturity: $96.55, $96.68, $99.15. Assuming par value of these bonds to be $100, use bootstrapping to back out the spot rates for 1,2,3 year maturities. 2) Use bootstrapping to extrapolate the forward rate curve of1, 1f1 and 2f1 3) Price an interest rate swap with a fixed rate of 8%, using the rates derived in the previous 2 parts of this questions. Your answer should be expressed as a % of a notional of Eur5mm. State clearly whether the floating or the fixed side has to pay the fee

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts