Question: Question 8 (6 points) Saved. You were assigned to perform substantive tests of accounts recelvable of the engagement Marilyn. You find that accounts receivable balance

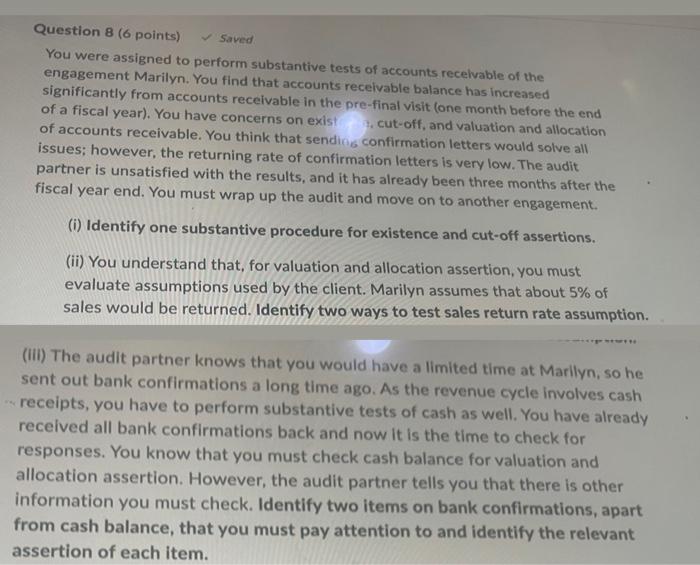

Question 8 (6 points) Saved. You were assigned to perform substantive tests of accounts recelvable of the engagement Marilyn. You find that accounts receivable balance has increased significantly from accounts receivable in the pre-final visit (one month before the end of a fiscal year). You have concerns on exist ", cut-off, and valuation and allocation of accounts receivable. You think that sendio 6 confirmation letters would solve all issues; however, the returning rate of confirmation letters is very low. The audit partner is unsatisfied with the results, and it has already been three months after the fiscal year end. You must wrap up the audit and move on to another engagement. (i) Identify one substantive procedure for existence and cut-off assertions. (ii) You understand that, for valuation and allocation assertion, you must evaluate assumptions used by the client. Marilyn assumes that about 5% of sales would be returned. Identify two ways to test sales return rate assumption. (iii) The audit partner knows that you would have a limited time at Marilyn, so he sent out bank confirmations a long time ago. As the revenue cycle involves cash receipts, you have to perform substantive tests of cash as well. You have already received all bank confirmations back and now it is the time to check for responses. You know that you must check cash balance for valuation and allocation assertion. However, the audit partner tells you that there is other information you must check. Identify two items on bank confirmations, apart from cash balance, that you must pay attention to and identify the relevant assertion of each item

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts