Question: Question 8 a) If Cherry Jones was to take a short position in an option which of the following would have the greater risk? (2

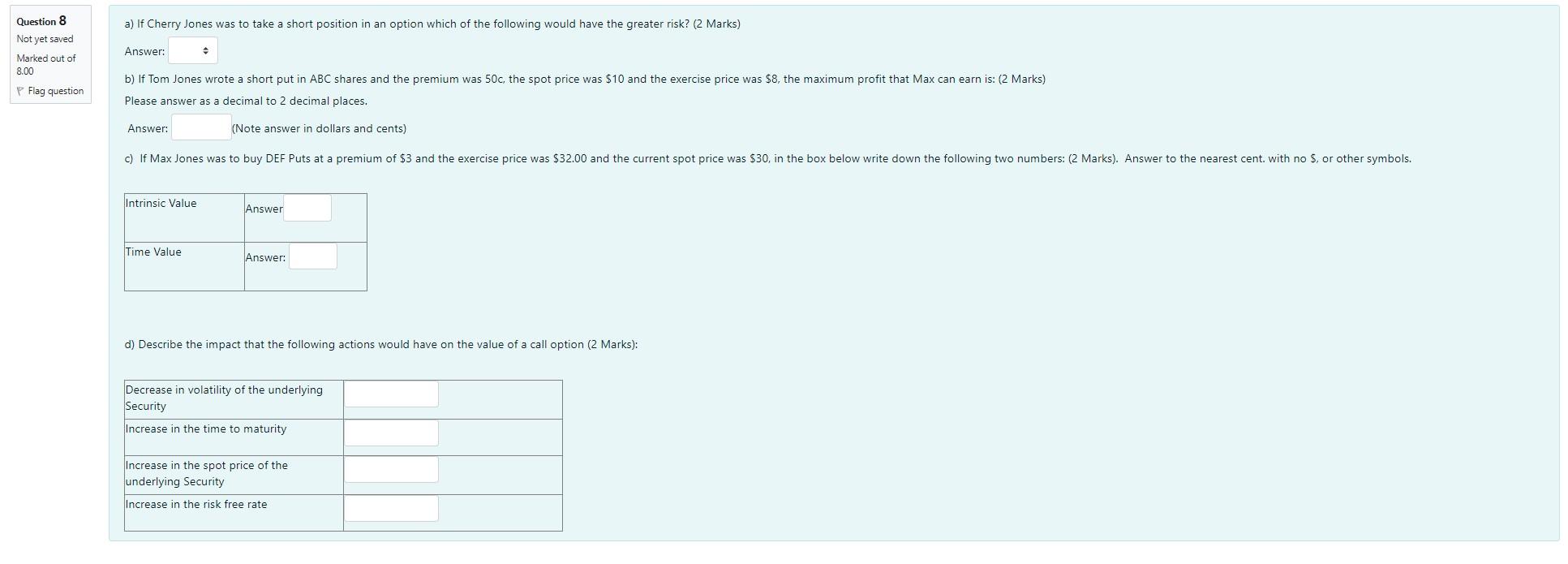

Question 8 a) If Cherry Jones was to take a short position in an option which of the following would have the greater risk? (2 Marks) Not yet saved Answer: Marked out of 8.00 b) If Tom Jones wrote short put in ABC shares and the premium was 50c, the spot price was $10 and the exercise price was $8, the maximum profit that Max can earn is: (2 Marks) P Flag question Please answer as a decimal to 2 decimal places. Answer: (Note answer in dollars and cents) c) If Max Jones was to buy DEF Puts at a premium of $3 and the exercise price was $32.00 and the current spot price was $30, in the box below write down the following two numbers: (2 Marks). Answer to the nearest cent. with no S, or other symbols. Intrinsic Value Answer Time Value Answer: d) Describe the impact that the following actions would have on the value of a call option (2 Marks): Decrease in volatility of the underlying Security Increase in the time to maturity Increase in the spot price of the underlying Security Increase in the risk free rate Question 8 a) If Cherry Jones was to take a short position in an option which of the following would have the greater risk? (2 Marks) Not yet saved Answer: Marked out of 8.00 b) If Tom Jones wrote short put in ABC shares and the premium was 50c, the spot price was $10 and the exercise price was $8, the maximum profit that Max can earn is: (2 Marks) P Flag question Please answer as a decimal to 2 decimal places. Answer: (Note answer in dollars and cents) c) If Max Jones was to buy DEF Puts at a premium of $3 and the exercise price was $32.00 and the current spot price was $30, in the box below write down the following two numbers: (2 Marks). Answer to the nearest cent. with no S, or other symbols. Intrinsic Value Answer Time Value Answer: d) Describe the impact that the following actions would have on the value of a call option (2 Marks): Decrease in volatility of the underlying Security Increase in the time to maturity Increase in the spot price of the underlying Security Increase in the risk free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts