Question: Question 8 Answer saved Today is 1 July 2021. Joan has a portfolio which consists of two different types of financial instruments (henceforth referred to

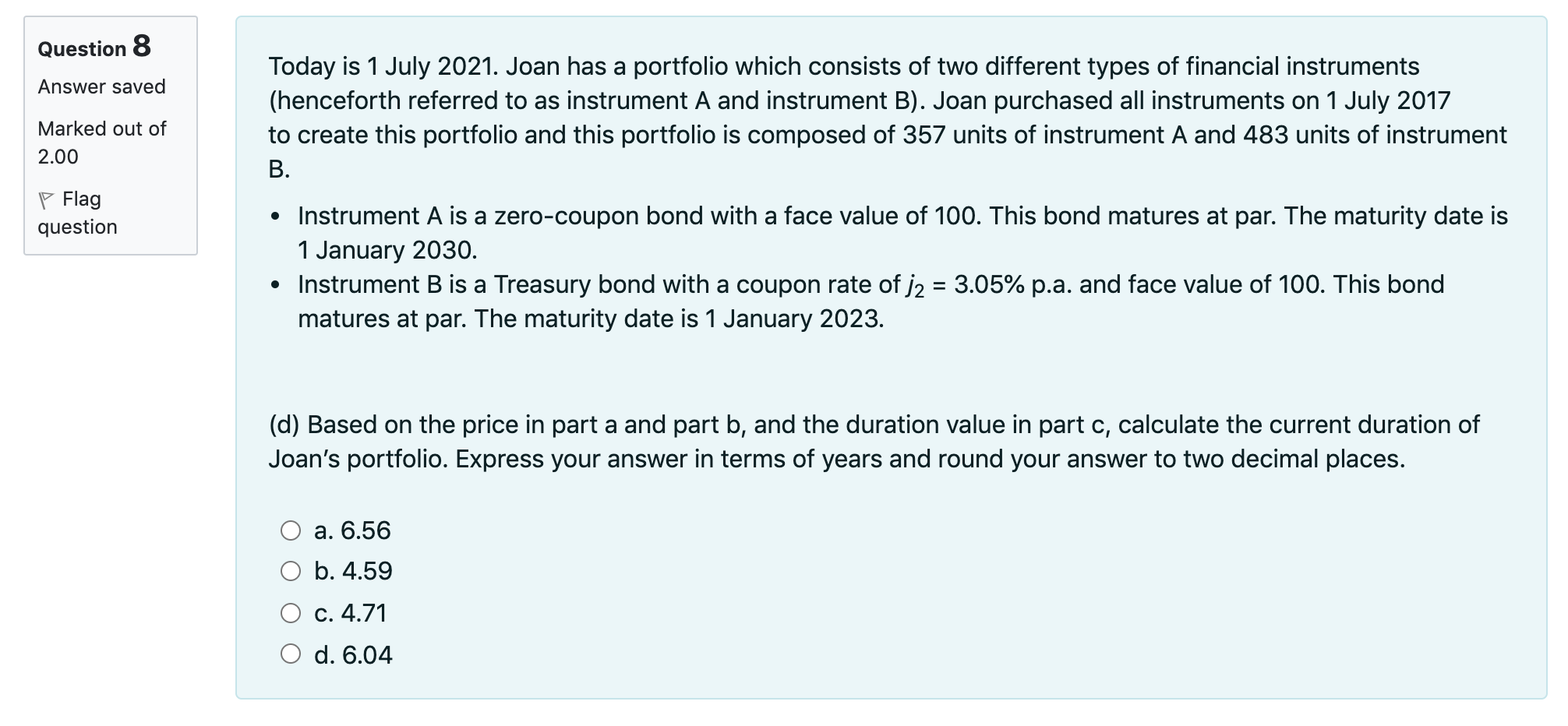

Question 8 Answer saved Today is 1 July 2021. Joan has a portfolio which consists of two different types of financial instruments (henceforth referred to as instrument A and instrument B). Joan purchased all instruments on 1 July 2017 to create this portfolio and this portfolio is composed of 357 units of instrument A and 483 units of instrument B. Marked out of 2.00 P Flag question Instrument A is a zero-coupon bond with a face value of 100. This bond matures at par. The maturity date is 1 January 2030. Instrument B is a Treasury bond with a coupon rate of j2 = 3.05% p.a. and face value of 100. This bond matures at par. The maturity date is 1 January 2023. (d) Based on the price in part a and part b, and the duration value in part c, calculate the current duration of Joan's portfolio. Express your answer in terms of years and round your answer to two decimal places. a. 6.56 b. 4.59 O c. 4.71 O d. 6.04 Question 8 Answer saved Today is 1 July 2021. Joan has a portfolio which consists of two different types of financial instruments (henceforth referred to as instrument A and instrument B). Joan purchased all instruments on 1 July 2017 to create this portfolio and this portfolio is composed of 357 units of instrument A and 483 units of instrument B. Marked out of 2.00 P Flag question Instrument A is a zero-coupon bond with a face value of 100. This bond matures at par. The maturity date is 1 January 2030. Instrument B is a Treasury bond with a coupon rate of j2 = 3.05% p.a. and face value of 100. This bond matures at par. The maturity date is 1 January 2023. (d) Based on the price in part a and part b, and the duration value in part c, calculate the current duration of Joan's portfolio. Express your answer in terms of years and round your answer to two decimal places. a. 6.56 b. 4.59 O c. 4.71 O d. 6.04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts