Question: Question 8 /b, Question 9 / b, Question 10 / b, Question 13 / b, Question 14 / b , Question 15 / a ,

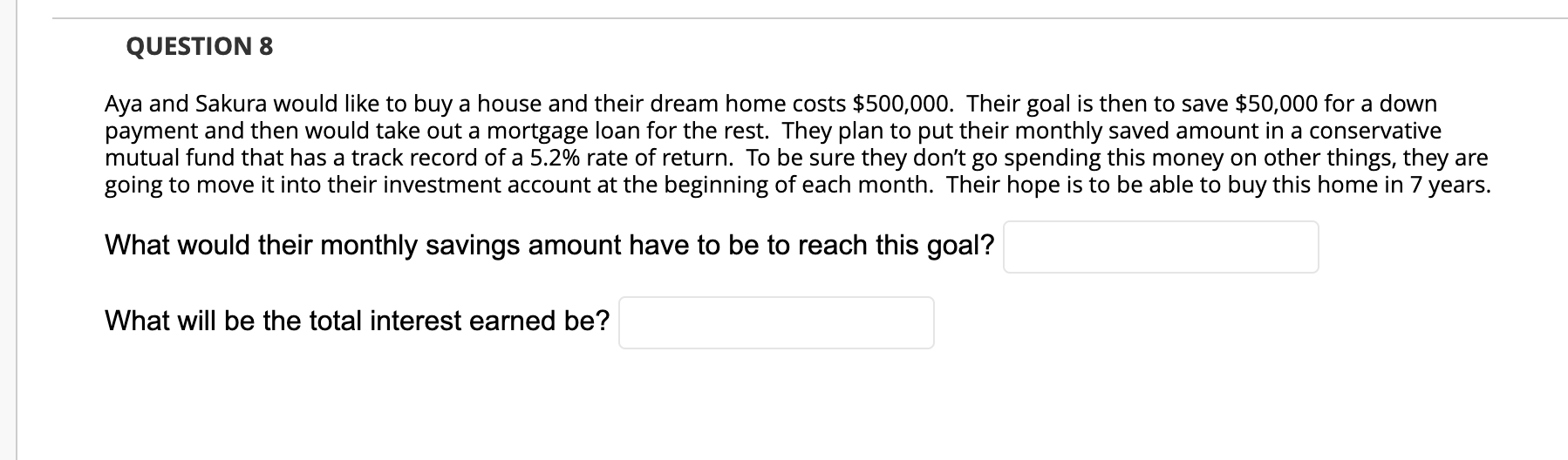

Question 8 /b,

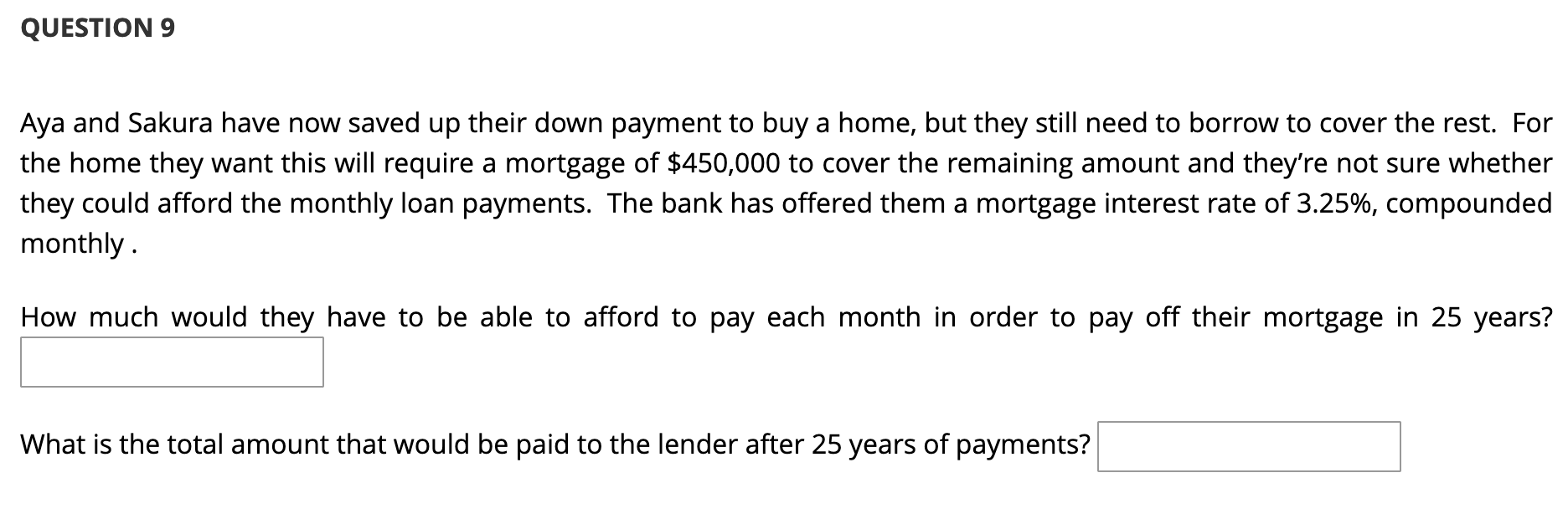

Question 9 / b,

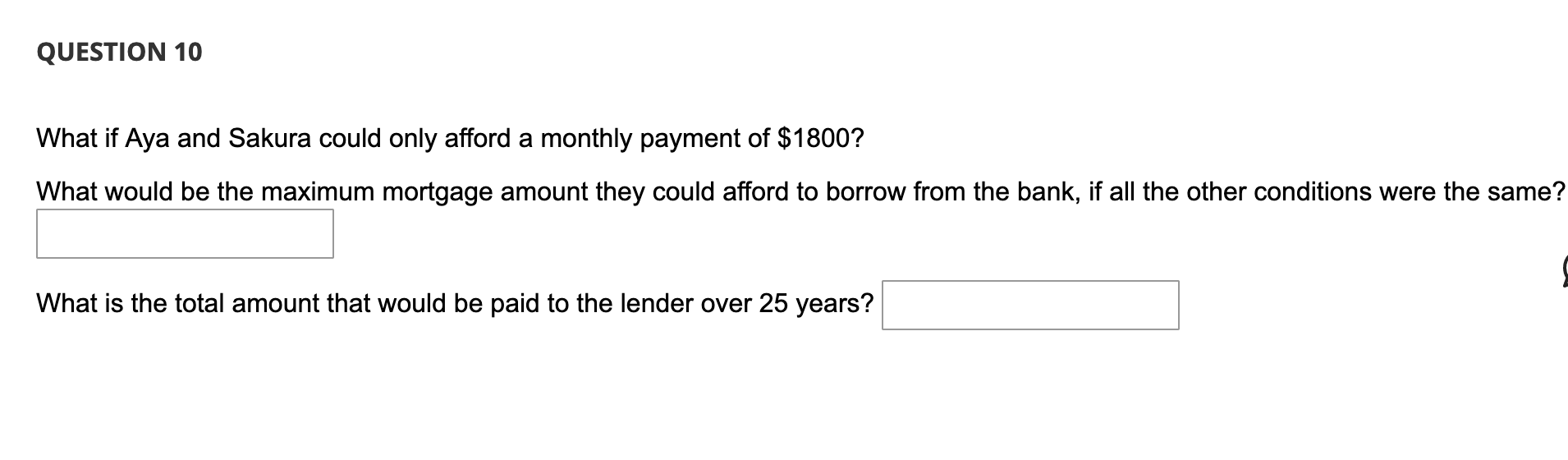

Question 10 / b,

Question 13 / b,

Question 14 / b ,

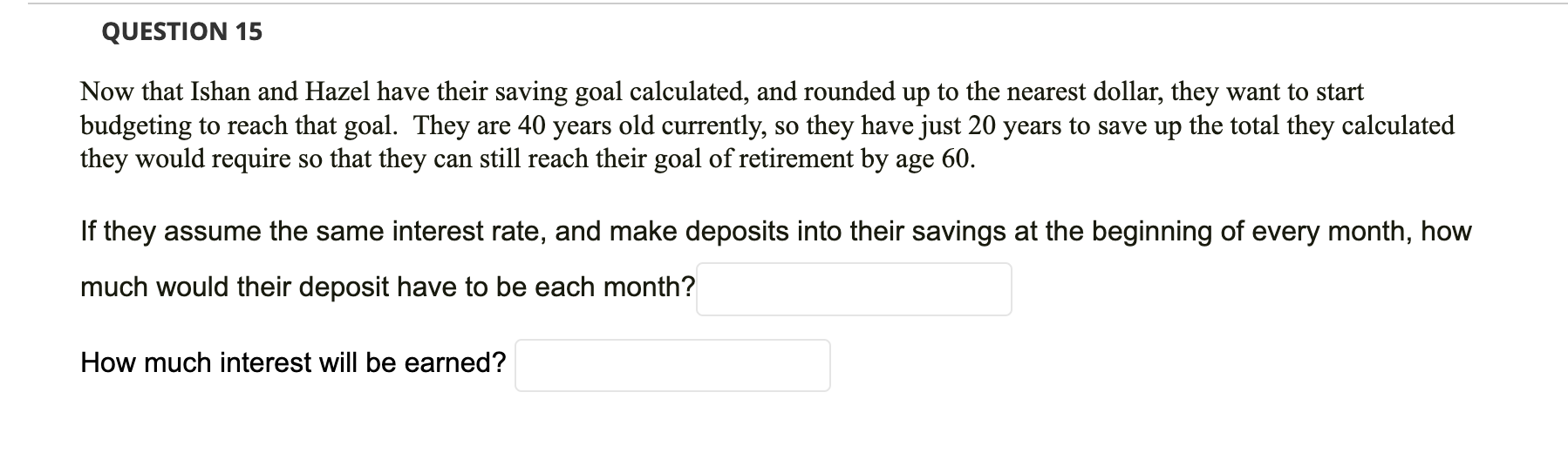

Question 15 / a , b ,

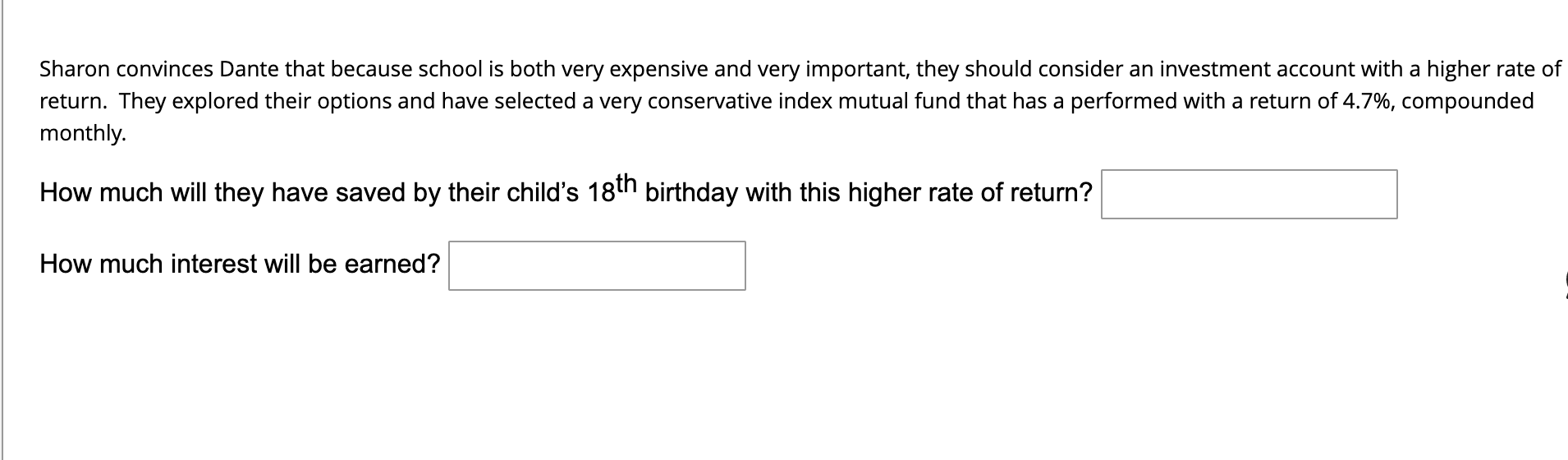

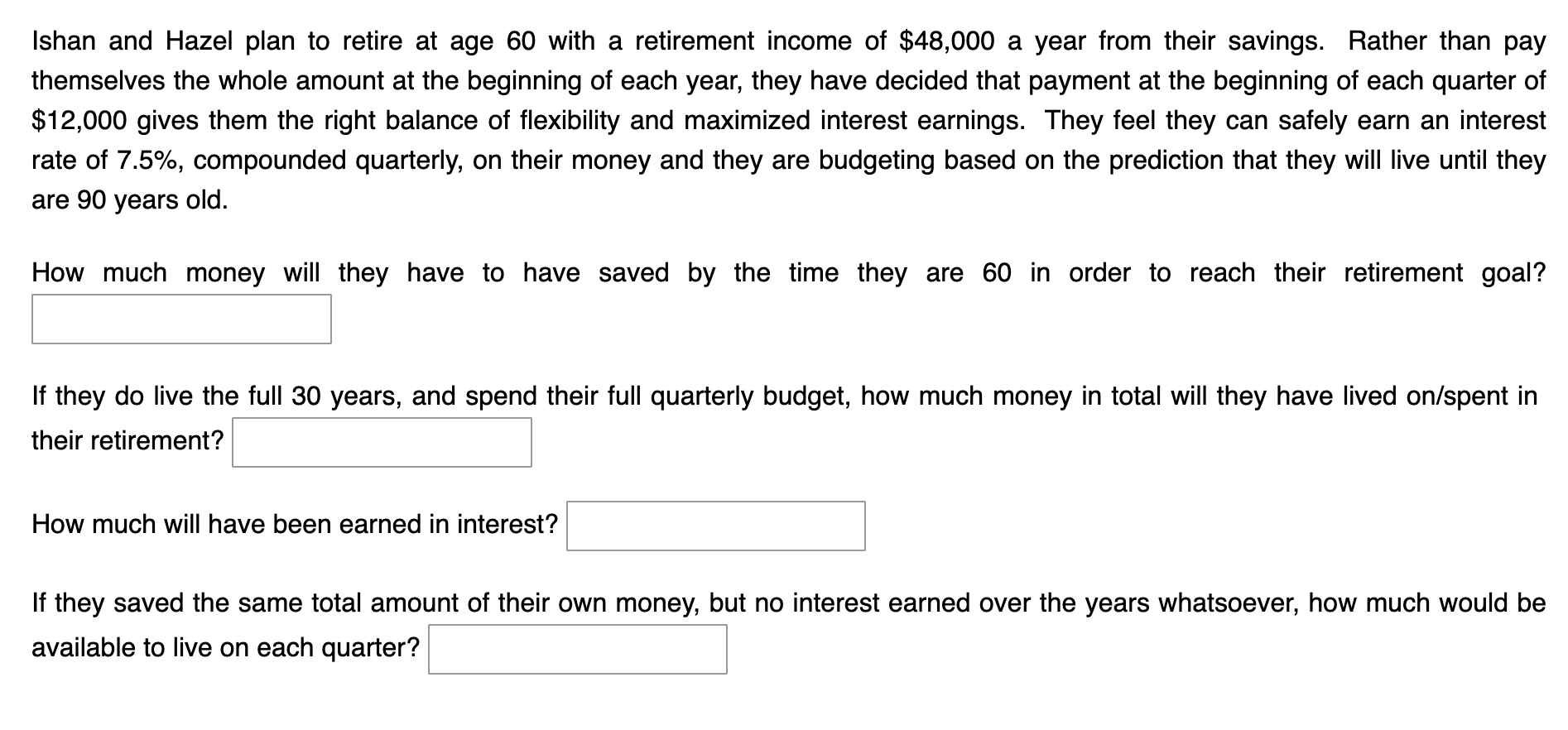

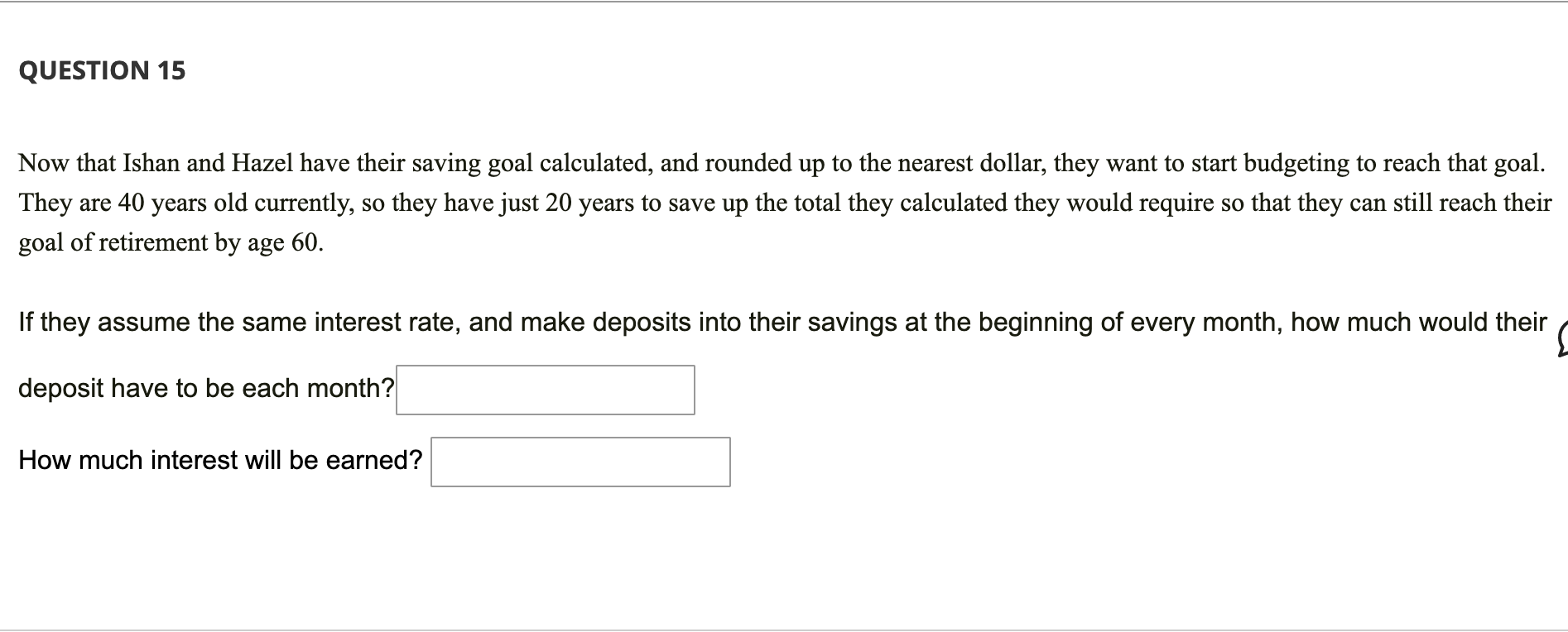

QUESTION 15 Now that Ishan and Hazel have their saving goal calculated, and rounded up to the nearest dollar, they want to start budgeting to reach that goal. They are 40 years old currently, so they have just 20 years to save up the total they calculated they would require so that they can still reach their goal of retirement by age 60. If they assume the same interest rate, and make deposits into their savings at the beginning of every month, how much would their deposit have to be each month? How much interest will be earned? QUESTION 8 Aya and Sakura would like to buy a house and their dream home costs $500,000. Their goal is then to save $50,000 for a down payment and then would take out a mortgage loan for the rest. They plan to put their monthly saved amount in a conservative mutual fund that has a track record of a 5.2% rate of return. To be sure they don't go spending this money on other things, they are going to move it into their investment account at the beginning of each month. Their hope is to be able to buy this home in 7 years. What would their monthly savings amount have to be to reach this goal? What will be the total interest earned be? QUESTION 9 Aya and Sakura have now saved up their down payment to buy a home, but they still need to borrow to cover the rest. For the home they want this will require a mortgage of $450,000 to cover the remaining amount and they're not sure whether they could afford the monthly loan payments. The bank has offered them a mortgage interest rate of 3.25%, compounded monthly. How much would they have to be able to afford to pay each month in order to pay off their mortgage in 25 years? What is the total amount that would be paid to the lender after 25 years of payments? QUESTION 10 What if Aya and Sakura could only afford a monthly payment of $1800? What would be the maximum mortgage amount they could afford to borrow from the bank, if all the other conditions were the same? What is the total amount that would be paid to the lender over 25 years? Sharon convinces Dante that because school is both very expensive and very important, they should consider an investment account with a higher rate of return. They explored their options and have selected a very conservative index mutual fund that has a performed with a return of 4.7%, compounded monthly How much will they have saved by their child's 18th birthday with this higher rate of return? How much interest will be earned? Ishan and Hazel plan to retire at age 60 with a retirement income of $48,000 a year from their savings. Rather than pay themselves the whole amount at the beginning of each year, they have decided that payment at the beginning of each quarter of $12,000 gives them the right balance of flexibility and maximized interest earnings. They feel they can safely earn an interest rate of 7.5%, compounded quarterly, on their money and they are budgeting based on the prediction that they will live until they are 90 years old. How much money will they have to have saved by the time they are 60 in order to reach their retirement goal? If they do live the full 30 years, and spend their full quarterly budget, how much money in total will they have lived on/spent in their retirement? How much will have been earned in interest? If they saved the same total amount of their own money, but no interest earned over the years whatsoever, how much would be available to live on each quarter? QUESTION 15 Now that Ishan and Hazel have their saving goal calculated, and rounded up to the nearest dollar, they want to start budgeting to reach that goal. They are 40 years old currently, so they have just 20 years to save up the total they calculated they would require so that they can still reach their goal of retirement by age 60. If they assume the same interest rate, and make deposits into their savings at the beginning of every month, how much would their deposit have to be each month? How much interest will be earned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts