Question: question 8 ch 3 extra c ! Required Information We explain how to use T-accounts to show the flow of costs in a job-order costing

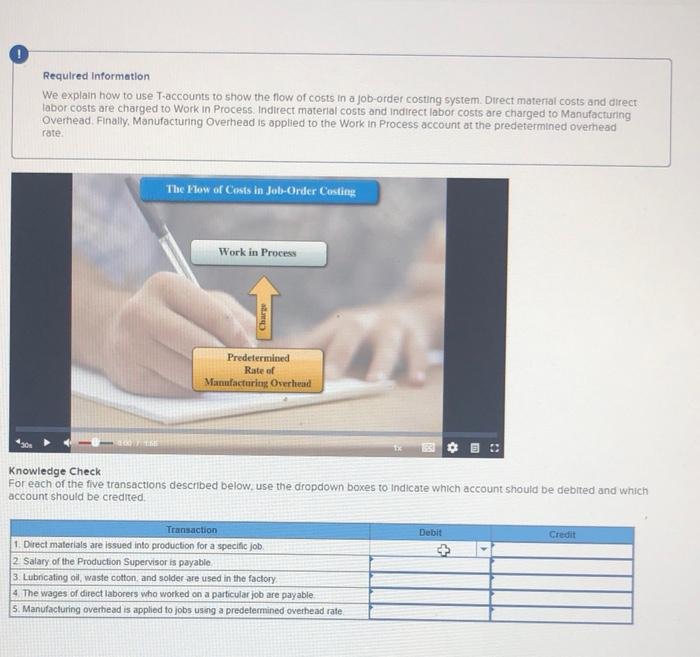

! Required Information We explain how to use T-accounts to show the flow of costs in a job-order costing system. Direct material costs and direct labor costs are charged to Work in Process. Indirect material costs and indirect labor costs are charged to Manufacturing Overhead. Finally, Manufacturing Overhead is applied to the Work in Process account at the predetermined overhead rate. 2007 THE The Flow of Costs in Job-Order Costing Work in Process Predetermined Rate of Manufacturing Overhead Knowledge Check For each of the five transactions described below, use the dropdown boxes to indicate which account should be debited and which account should be credited. Transaction 1. Direct materials are issued into production for a specific job. 2 Salary of the Production Supervisor is payable 3. Lubricating oil, waste cotton, and solder are used in the factory. 4. The wages of direct laborers who worked on a particular job are payable 5. Manufacturing overhead is applied to jobs using a predetermined overhead rate Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts