Question: Question 8 ( Fixed Asset Depreciation ) ( 7 0 points ) On June 1 1 , 2 0 2 4 , Swanson takes delivery

Question Fixed Asset Depreciation points

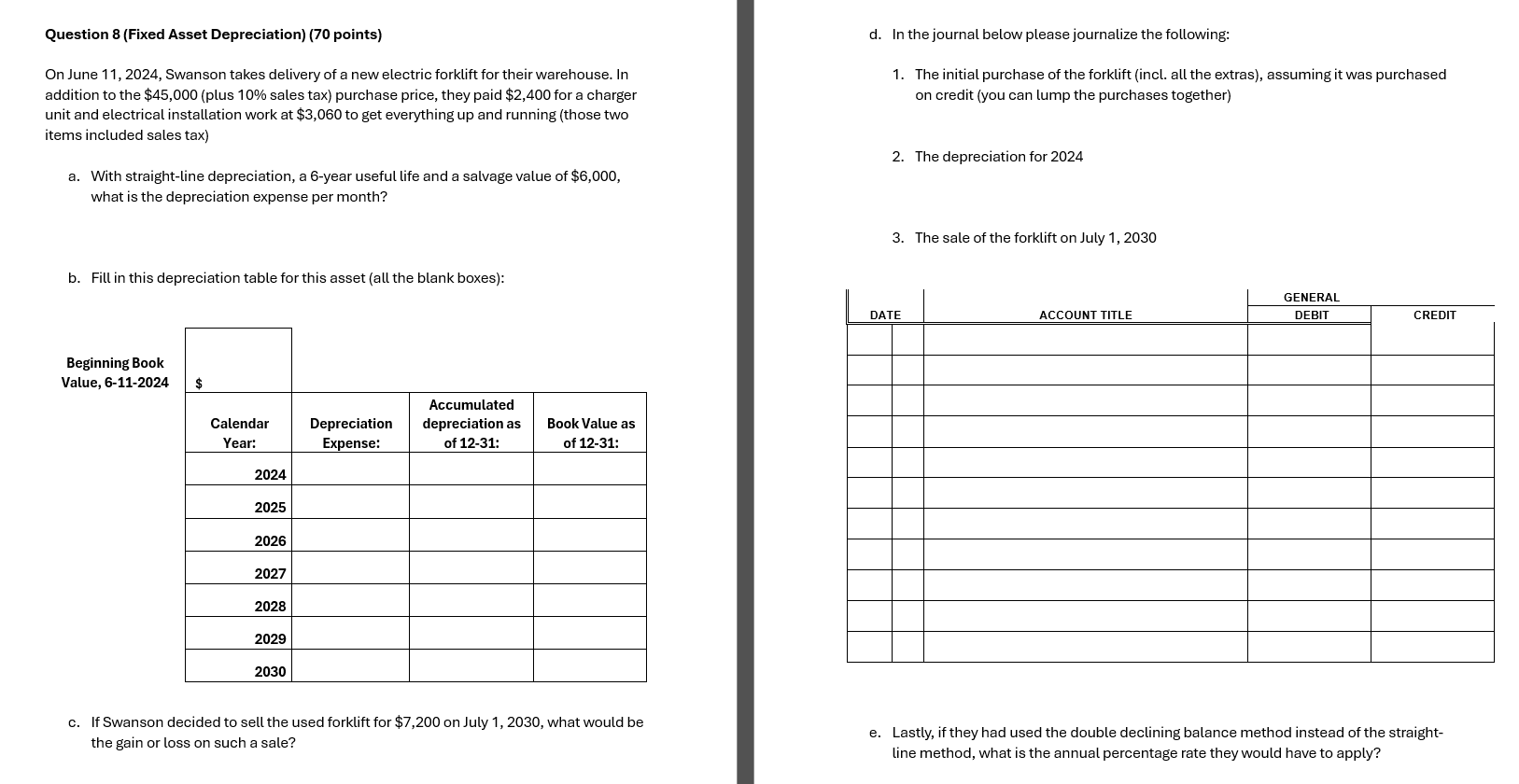

On June Swanson takes delivery of a new electric forklift for their warehouse. In addition to the $plus sales tax purchase price, they paid $ for a charger unit and electrical installation work at $ to get everything up and running those two items included sales tax

a With straightline depreciation, a year useful life and a salvage value of $ what is the depreciation expense per month?

b Fill in this depreciation table for this asset all the blank boxes:

Beginning Book Value, $

Calendar Year: Depreciation Expense: Accumulated depreciation as of : Book Value as of :

c If Swanson decided to sell the used forklift for $ on July what would be the gain or loss on such a sale?

d In the journal below please journalize the following:

The initial purchase of the forklift incl all the extras assuming it was purchased on credit you can lump the purchases together

The depreciation for

The sale of the forklift on July

GENERAL

DATE ACCOUNT TITLE DEBIT CREDIT

e Lastly, if they had used the double declining balance method instead of the straightline method, what is the annual percentage rate they would have to apply?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock