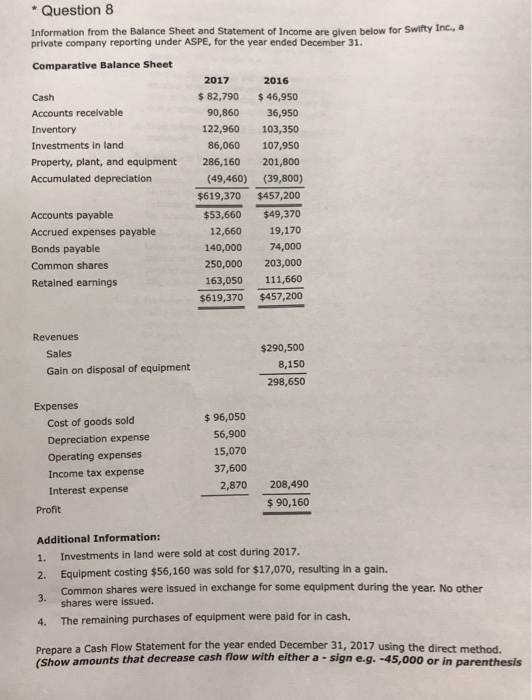

Question: * Question 8 Information from the Balance Sheet and Statement of Income are given below for Swifty Inc private company reporting under ASPE, for the

* Question 8 Information from the Balance Sheet and Statement of Income are given below for Swifty Inc private company reporting under ASPE, for the year ended December 31. Comparative Balance Sheet Cash Accounts receivable Inventory Investments in land Property, plant, and equipment Accumulated depreciation 2017 $ 82,790 90,860 122,960 86,060 286,160 (49,460) $619,370 $53,660 12,660 2016 $ 46,950 36,950 103,350 107,950 201,800 (39,800) $457,200 $49,370 19,170 74,000 203,000 111,660 $457,200 Accounts payable Accrued expenses payable Bonds payable Common shares Retained earnings 250,000 163,050 $619,370 Revenues Sales Gain on disposal of equipment $290,500 8,150 298,650 Expenses Cost of goods sold Depreciation expense Operating expenses Income tax expense Interest expense Profit $ 96,050 56,900 15,070 37,600 2,870 208,490 $ 90,160 Additional Information: 1. Investments in land were sold at cost during 2017. 2. Equipment costing $56,160 was sold for $17,070, resulting in a gain. Common shares were issued in exchange for some equipment during the year. No other 3 shares were issued. 4. The remaining purchases of equipment were paid for in cash. Dronare a Cash Flow Statement for the year ended December 31, 2017 using the direct method (Show amounts that decrease cash flow with either a - sign e.g. -45,000 or in parenthesis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts