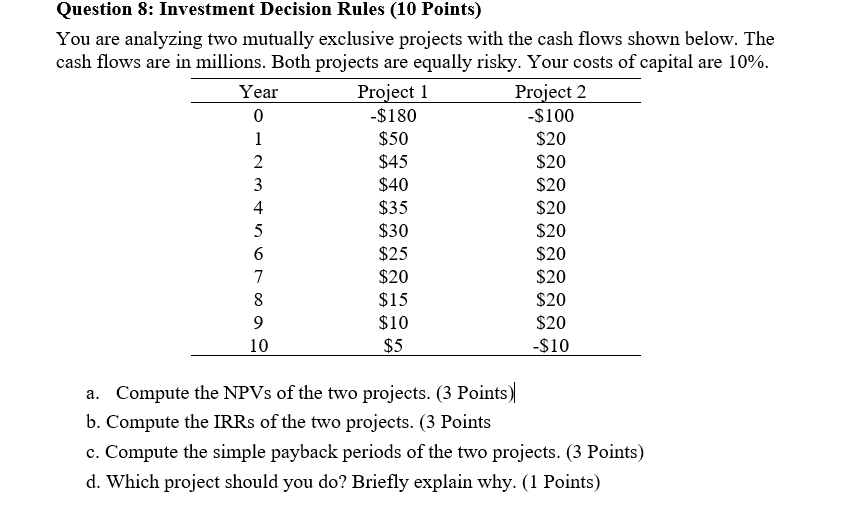

Question: Question 8: Investment Decision Rules (10 Points) You are analyzing two mutually exclusive projects with the cash flows shown below. The cash flows are in

Question 8: Investment Decision Rules (10 Points) You are analyzing two mutually exclusive projects with the cash flows shown below. The cash flows are in millions. Both projects are equally risky. Your costs of capital are 10%. Year Project 1 Project 2 0 -$180 -$100 1 $50 $20 2 $45 $20 3 $40 $20 4 $35 $20 5 $30 $20 6 $25 $20 7 $20 $20 8 $15 $20 9 $10 $20 $5 -$10 10 a. Compute the NPVs of the two projects. (3 Points) b. Compute the IRRs of the two projects. (3 Points c. Compute the simple payback periods of the two projects. (3 Points) d. Which project should you do? Briefly explain why. (1 Points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock