Question: Question 8 - Make or buy analysis (15 marks Answer the questions below regarding a decision on whether to outsource the production of units where

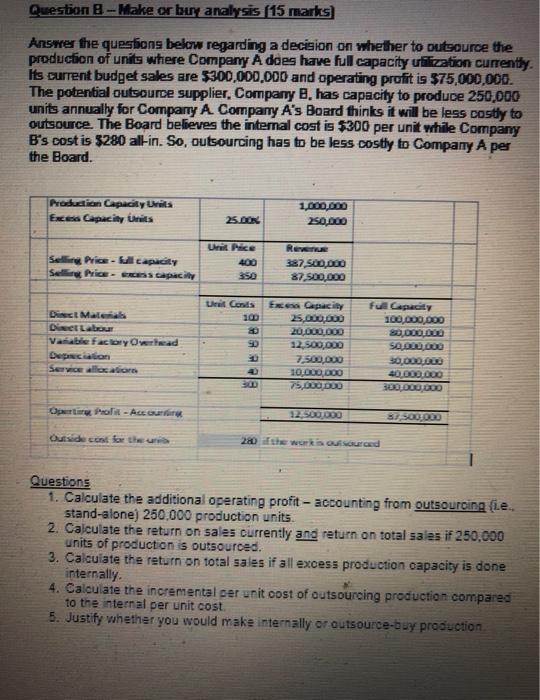

Question 8 - Make or buy analysis (15 marks Answer the questions below regarding a decision on whether to outsource the production of units where Company A does have full capacity utilization currently Its current budget sales are $300,000,000 and operating profit is $75,000,000. The potential outsource supplier. Company B. has capacity to produce 250,000 units annually for Company A Company A's Board thinks it will be less costly to outsource. The Board believes the internal cost is $300 per unit while Company B's cost is $280 all-in. So, outsourcing has to be less costly to Company A per the Board. Production Capacity Units Exceed Capacity Units 1,000,000 250.000 25.00K Una Pice Selling Price capacity Selore Price - Escapacity Renu 387,500,000 87,500,000 350 Un Conis Direct Maletas Die Latour Variable factory Od Depcion Servicios sam Exces Capacity 25,000,000 20,000,000 12,500,000 7,500,000 10.000.000 75,000 DID Ful Gapacity 100,000,000 ,000,000 SOLO,000 30.000.000 40.000.000 200100 , DDD Open Profit - Accu 12,500,000 31, 00.000 Outside cost for the 280 the work out our ad Questions 1. Calculate the additional operating profit - accounting from outsourcing (ie.. stand-alone) 250,000 production units. 2. Calculate the return on sales currently and return on total sales if 250,000 units of production is outsourced. 3. Calculate the return on total sales if all excess production capacity is done internally 4. Calculate the incremental per unit cost of outsourcing production compared to the internal per unit cost. 5. Justify whether you would make internally or outsource-buy production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts