Question: Question 8 (Mandatory) (15 points) JAYCO is considering acquiring the manufacturer of a key component part used to build its automobiles. The acquisition cost is

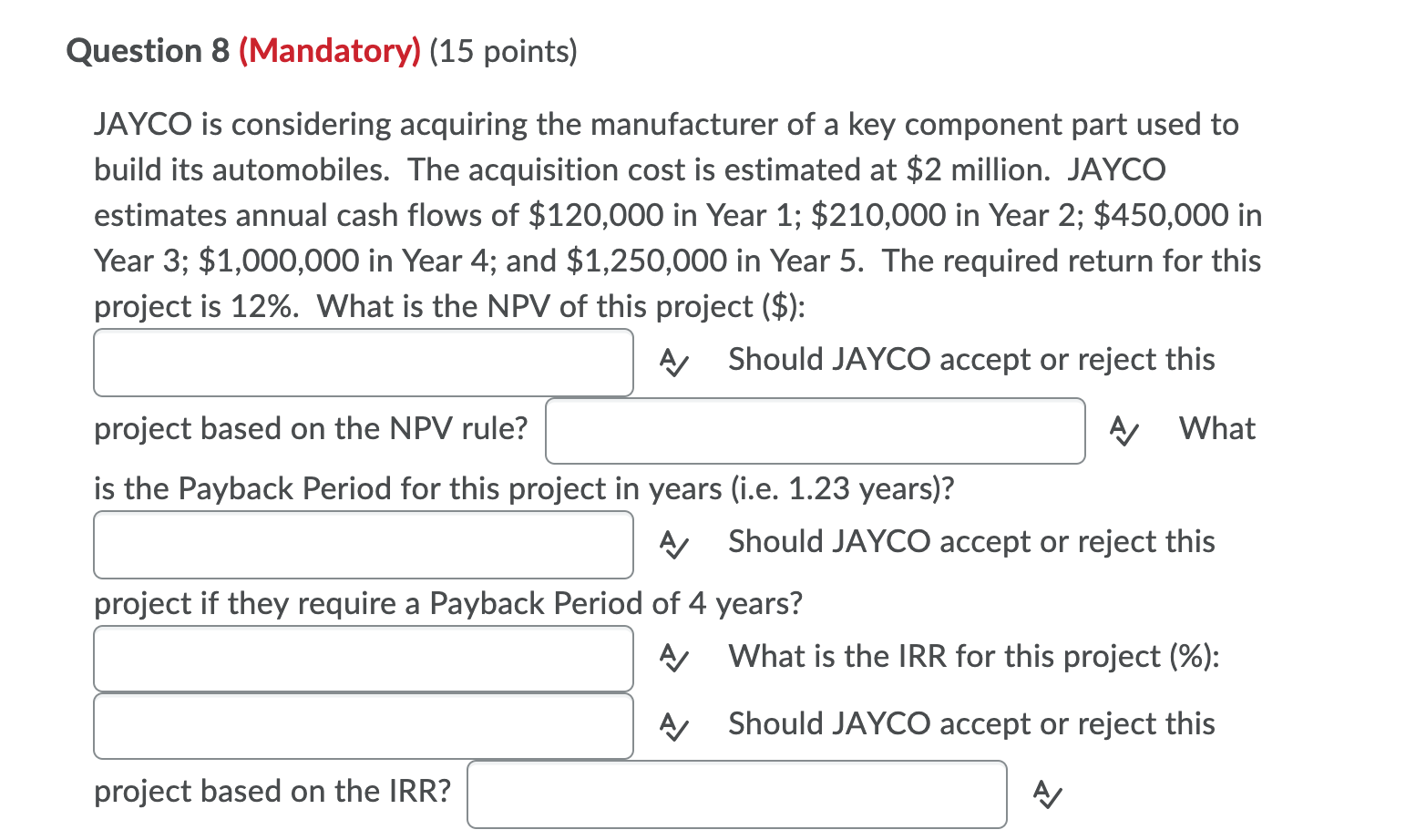

Question 8 (Mandatory) (15 points) JAYCO is considering acquiring the manufacturer of a key component part used to build its automobiles. The acquisition cost is estimated at $2 million. JAYCO estimates annual cash flows of $120,000 in Year 1; $210,000 in Year 2; $450,000 in Year 3; $1,000,000 in Year 4; and $1,250,000 in Year 5. The required return for this project is 12%. What is the NPV of this project ($): A Should JAYCO accept or reject this project based on the NPV rule? What is the Payback Period for this project in years (i.e. 1.23 years)? Should JAYCO accept or reject this project if they require a Payback period of 4 years? What is the IRR for this project (%): A Should JAYCO accept or reject this project based on the IRR? AJ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts