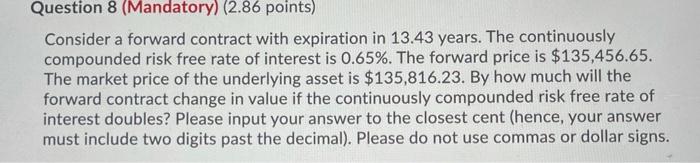

Question: Question 8 (Mandatory) (2.86 points) Consider a forward contract with expiration in 13.43 years. The continuously compounded risk free rate of interest is 0.65%. The

Question 8 (Mandatory) (2.86 points) Consider a forward contract with expiration in 13.43 years. The continuously compounded risk free rate of interest is 0.65%. The forward price is $135,456.65. The market price of the underlying asset is $135,816.23. By how much will the forward contract change in value if the continuously compounded risk free rate of interest doubles? Please input your answer to the closest cent (hence, your answer must include two digits past the decimal). Please do not use commas or dollar signs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts