Question: QUESTION 8 Now run a cross-sectional regression. Explain the wholesample average excess returns of each stock by the wholesample average MARKETCAP of each stock and

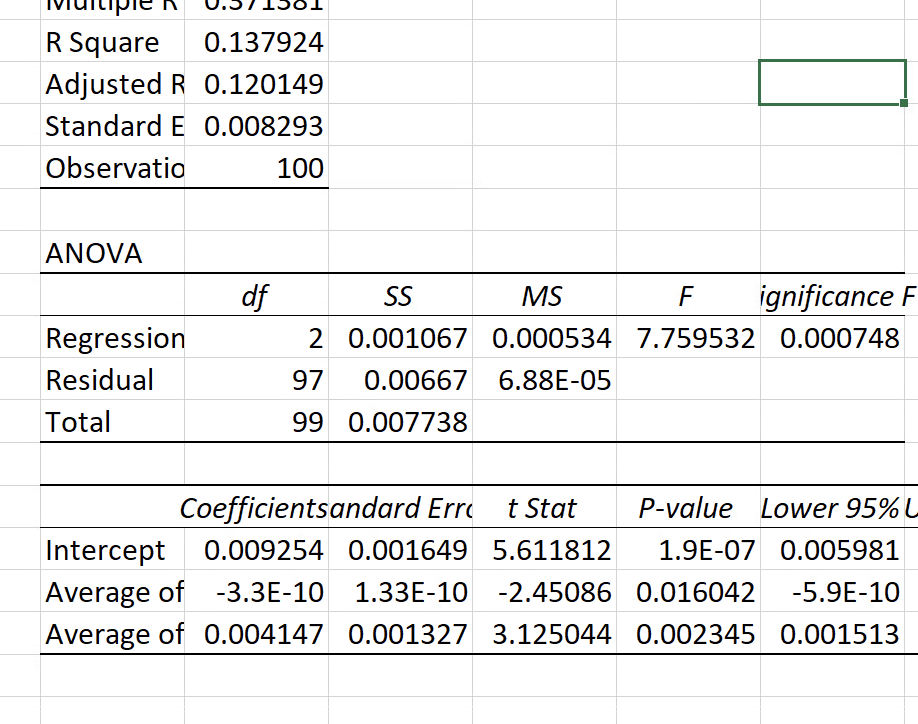

QUESTION 8 Now run a cross-sectional regression. Explain the wholesample average excess returns of each stock by the wholesample average MARKETCAP of each stock and the estimated beta (from Question 5). What do you find? Assume statistical significance is indicated by a t-statistic below -2 or above 2. Select every answer that corresponds with your findings. o I find a negative and statistically significant effect of Beta to explain excess returns. I find a positive and statistically significant effect of Beta to explain excess returns. I find a negative and statistically significant effect of Market Cap to explain excess returns. I find a positive and statistically significant effect of Market Cap to explain excess returns. I find a negative but statistically insignificant effect of Beta to explain excess returns. I find a positive but statistically insignificant effect of Beta to explain excess returns. R Square 0.137924 Adjusted R 0.120149 Standard E 0.008293 Observatio 100 ANOVA df Regression Residual Total SS MS F ignificance F 2 0.001067 0.000534 7.759532 0.000748 97 0.00667 6.88E-05 99 0.007738 Coefficientsandard Erre t Stat P-value Lower 95% L- Intercept 0.009254 0.001649 5.611812 1.9E-07 0.005981 Average of -3.3E-10 1.33E-10 -2.45086 0.016042 -5.9E-10 Average of 0.004147 0.001327 3.125044 0.002345 0.001513

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts