Question: Question 8 of 11 -/2 E View Policies Current Attempt in Progress Kragan Clothing Company manufactures its own designed and labeled athletic wear and sells

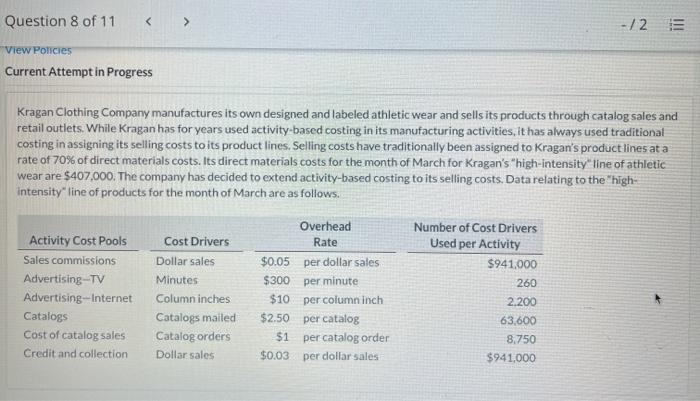

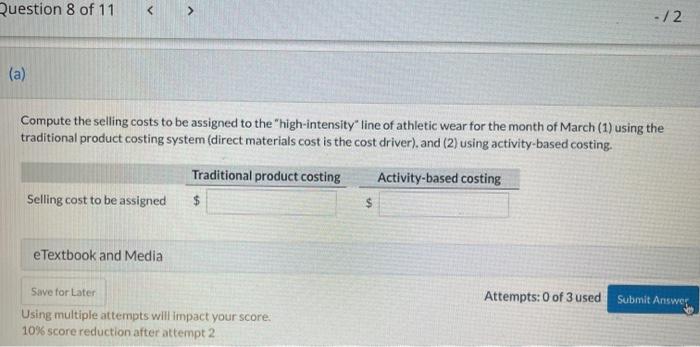

Question 8 of 11 -/2 E View Policies Current Attempt in Progress Kragan Clothing Company manufactures its own designed and labeled athletic wear and sells its products through catalog sales and retail outlets. While Kragan has for years used activity-based costing in its manufacturing activities, it has always used traditional costing in assigning its selling costs to its product lines. Selling costs have traditionally been assigned to Kragan's product lines at a rate of 70% of direct materials costs. Its direct materials costs for the month of March for Kragan's "high-intensity" line of athletic wear are $407,000. The company has decided to extend activity-based costing to its selling costs. Data relating to the "high- Intensity" line of products for the month of March are as follows. Activity Cost Pools Sales commissions Advertising TV Advertising-Internet Catalogs Cost of catalog sales Credit and collection Cost Drivers Dollar sales Minutes Column inches Catalogs mailed Catalog orders Dollar sales Overhead Rate $0.05 per dollar sales $300 per minute $10 per column inch $2.50 per catalog $1 per catalog order $0.03 per dollar sales Number of Cost Drivers Used per Activity $941,000 260 2.200 63,600 8.750 $941,000 Question 8 of 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts