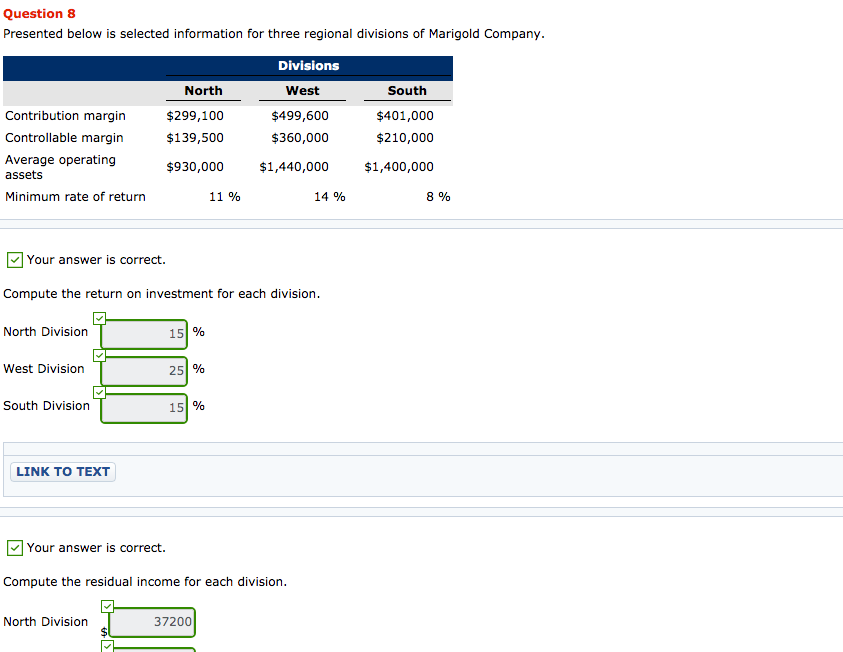

Question: Question 8 Presented below is selected information for three regional divisions of Marigold Company. Divisions North West South $299,100 $139,500 $499,600 $360,000 $401,000 $210,000 Contribution

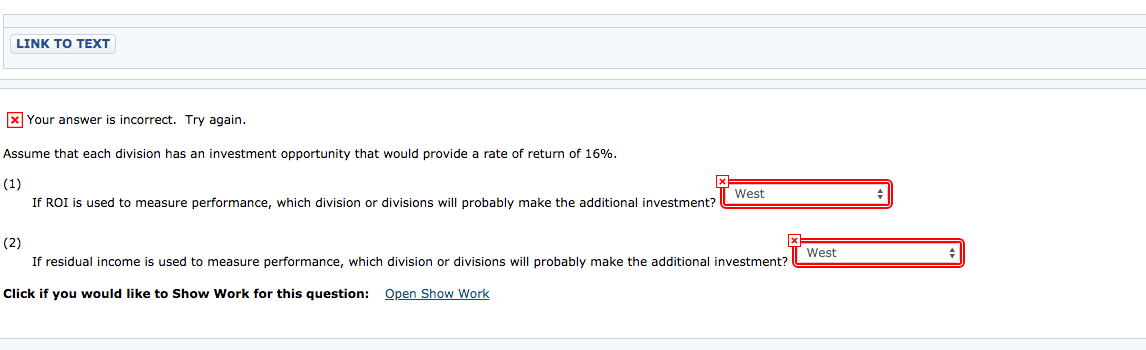

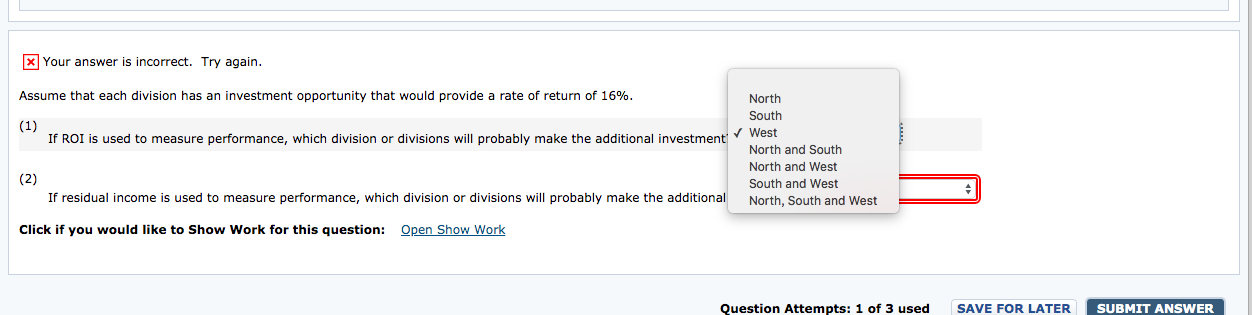

Question 8 Presented below is selected information for three regional divisions of Marigold Company. Divisions North West South $299,100 $139,500 $499,600 $360,000 $401,000 $210,000 Contribution margin Controllable margin Average operating assets Minimum rate of return $930,000 $1,440,000 $1,400,000 11 % 14 % 8 % Your answer is correct. Compute the return on investment for each division. North Division West Division 1 South Division 1 LINK TO TEXT Your answer is correct. Compute the residual income for each division. North Division 37200 LINK TO TEXT x Your answer is incorrect. Try again. Assume that each division has an investment opportunity that would provide a rate of return of 16%. (1) T West If ROI is used to measure performance, which division or divisions will probably make the additional investment? (2) West If residual income is used to measure performance, which division or divisions will probably make the additional investment? Click if you would like to Show Work for this question: Open Show Work x Your answer is incorrect. Try again. Assume that each division has an investment opportunity that would provide a rate of return of 16%. North South (1) FROT If ROI is used to measure performance, which division or divisions will probably make the additional investment (2) North and South North and West South and West North, South and West If residual income is used to measure performance, which division or divisions will probably make the additional , which division or divisions will probably make the additional Click if you would like to Show Work for this question: Open Show Work Question Attempts: 1 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts