Question: question 8 Question 1 5 pts USPAP regulations state an appraiser must estimate the value of an income producing property based on approaches to value.

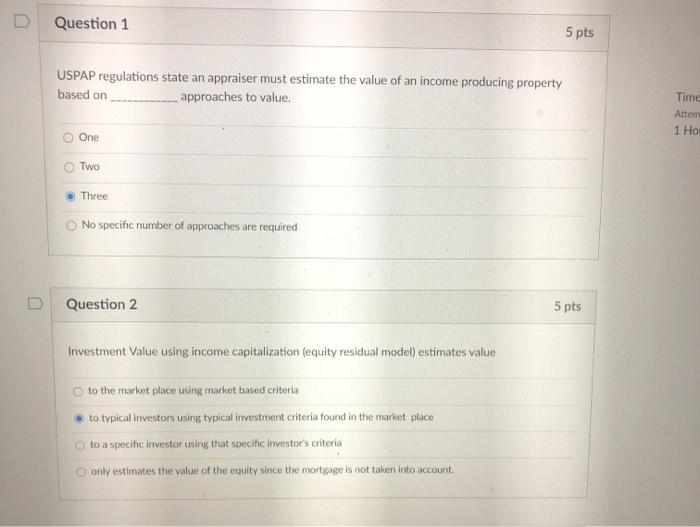

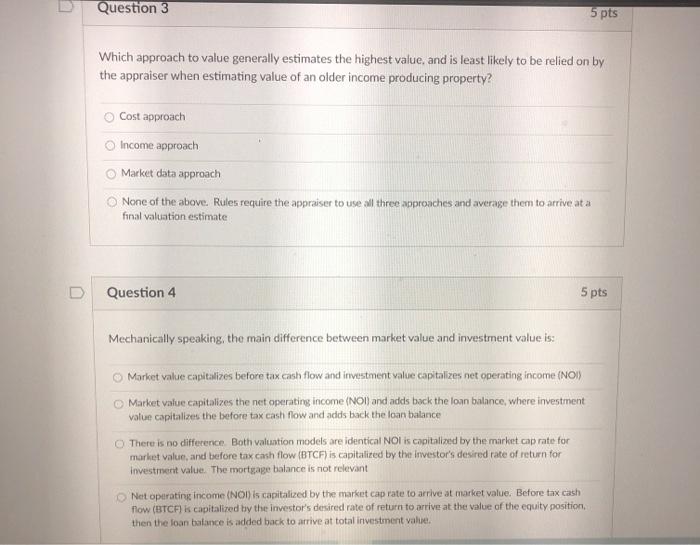

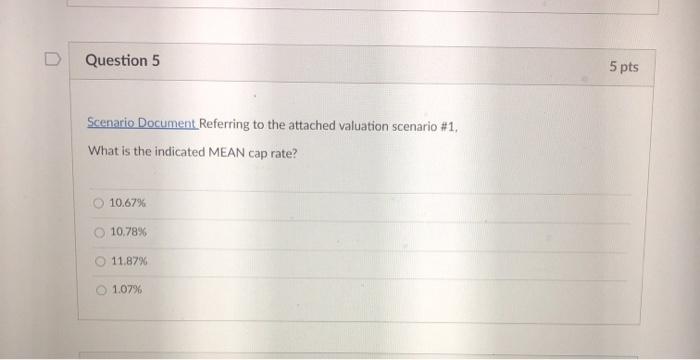

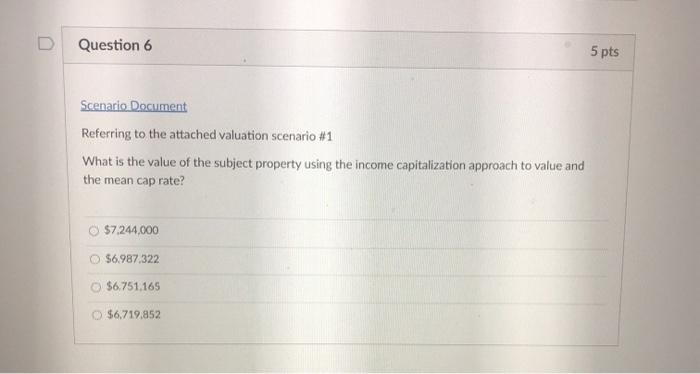

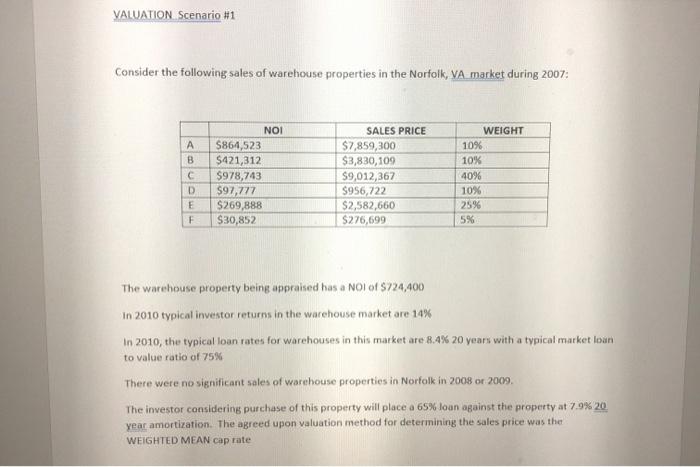

Question 1 5 pts USPAP regulations state an appraiser must estimate the value of an income producing property based on approaches to value. Time Attem 1 Ho One TWO Three No specific number of approaches are required D Question 2 5 pts Investment Value using income capitalization (equity residual model) estimates value to the market place using market based criteria to typical investors using typical investment criteria found in the market place to a specific investor using that specific inwestor's criteria only estimates the value of the equity since the mortgage is not taken into account. Question 3 5 pts Which approach to value generally estimates the highest value and is least likely to be relied on by the appraiser when estimating value of an older income producing property? Cost approach Income approach Market data approach None of the above. Rules require the appraiser to use all three approaches and average them to arrive at a foral valuation estimate Question 4 5 pts Mechanically speaking, the main difference between market value and investment value is: Market value capitalizes before tax cash flow and investment value capitalizes net operating income (NOI) Market value capitalizes the net operating income (NOI) and adds back the loan balance, where investment value capitalizes the before tax cash flow and adds back the loan balance There is no difference. Both valuation models are identical Nol is capitalized by the market cap rate for market value and before tax cash flow (BTCF) is capitalized by the investor's desired rate of return for investment value. The mortgage balance is not relevant Net operating income (NOI) is capitalized by the market cap rate to arrive at market value. Before tax cash flow (BTCF) is capitalized by the investor's desired rate of return to arrive at the value of the equity position, then the loan balance is added back to arrive at total investment value D Question 5 5 pts Scenario Document Referring to the attached valuation scenario #1. What is the indicated MEAN cap rate? 10.67% 10.78% 11.8796 1.07% Question 6 5 pts Scenario Document Referring to the attached valuation scenario #1 What is the value of the subject property using the income capitalization approach to value and the mean cap rate? $7.244.000 $6.987.322 $6.751.165 $6.719.852 Question 7 5 pts Referring to the attached valuation scenario #1 Scenario Document What is the weighted mean cap rate? 10.73% 11.01% 10.78% 11.20% nuection 8 ste Question 8 5 pts Referring to the attached valuation scenario #1 Scenario Document What is the value of the property using the weighted mean cap rate? $6,751,165 $6,719,852 $6,585,455 The value can not be determined using this method Question 9 5 pts VALUATION Scenario #1 Consider the following sales of warehouse properties in the Norfolk, VA market during 2007: A B C D NOI S864,523 S421,312 $978,743 $97,777 $269,888 $30,852 SALES PRICE $7,859,300 $3,830,109 $9,012, 367 $956,722 $2,582,660 $276,699 WEIGHT 10% 10% 40% 10% 25% 5% F The warehouse property being appraised has a NOI of S724,400 In 2010 typical investor returns in the warehouse market are 14% In 2010, the typical loan rates for warehouses in this market are 8.4% 20 years with a typical market loan to value ratio of 75% There were no significant sales of warehouse properties in Norfolk in 2008 or 2009 The investor considering purchase of this property will place a 65% loan against the property at 7.9%20 year amortization. The agreed upon valuation method for determining the sales price was the WEIGHTED MEAN cap rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts