Question: Question 8: Return on Investment A. What does the ROI evaluate? What are the strengths and weaknesses of the ROI? B. Calculate the Rol for

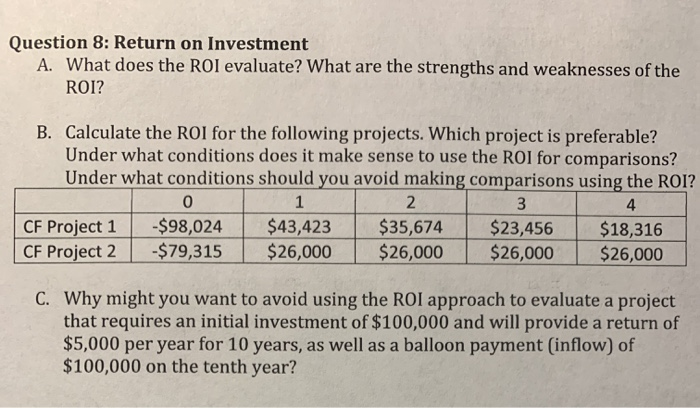

Question 8: Return on Investment A. What does the ROI evaluate? What are the strengths and weaknesses of the ROI? B. Calculate the Rol for the following projects. Which project is preferable? Under what conditions does it make sense to use the ROI for comparisons? Under what conditions should you avoid making comparisons using the ROI? 0 1 2 3 CF Project 1 $98,024 $43,423 $35,674 $23,456 $18,316 CF Project 2 $79,315 $26,000 $26,000 $26,000 $26,000 4 C. Why might you want to avoid using the ROI approach to evaluate a project that requires an initial investment of $100,000 and will provide a return of $5,000 per year for 10 years, as well as a balloon payment (inflow) of $100,000 on the tenth year? Question 8: Return on Investment A. What does the ROI evaluate? What are the strengths and weaknesses of the ROI? B. Calculate the Rol for the following projects. Which project is preferable? Under what conditions does it make sense to use the ROI for comparisons? Under what conditions should you avoid making comparisons using the ROI? 0 1 2 3 CF Project 1 $98,024 $43,423 $35,674 $23,456 $18,316 CF Project 2 $79,315 $26,000 $26,000 $26,000 $26,000 4 C. Why might you want to avoid using the ROI approach to evaluate a project that requires an initial investment of $100,000 and will provide a return of $5,000 per year for 10 years, as well as a balloon payment (inflow) of $100,000 on the tenth year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts