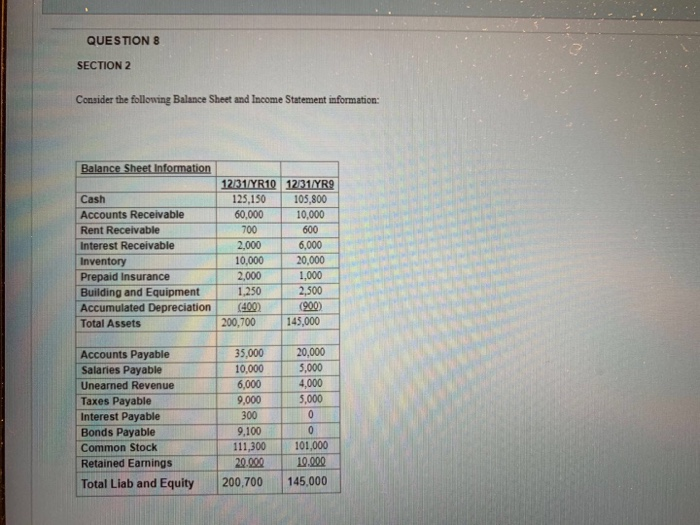

Question: QUESTION 8 SECTION 2 Consider the following Balance Sheet and Income Statement information: Balance Sheet Information Cash Accounts Receivable Rent Receivable Interest Receivable Inventory Prepaid

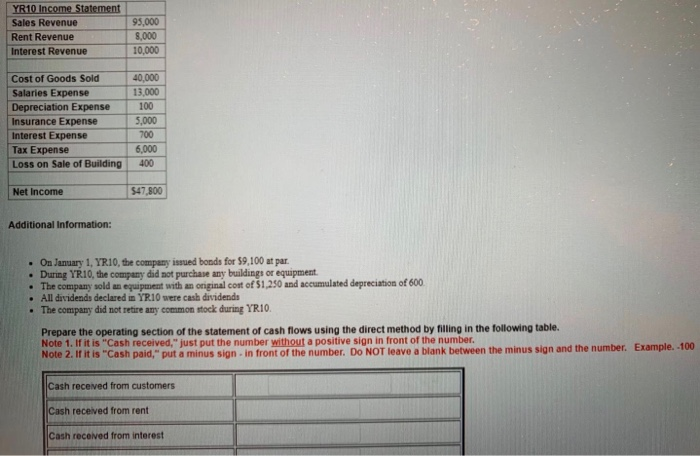

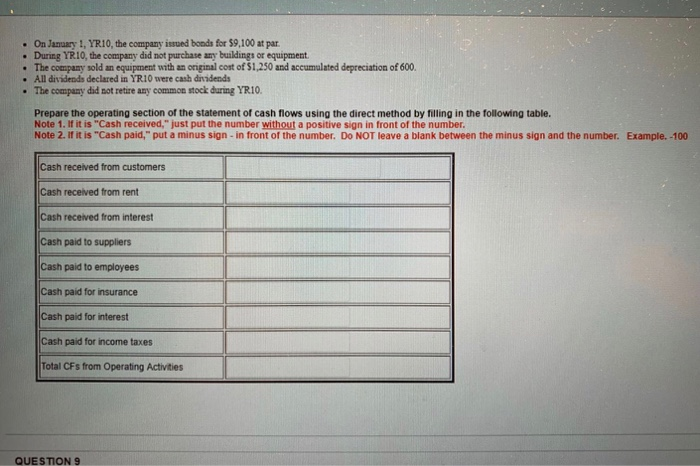

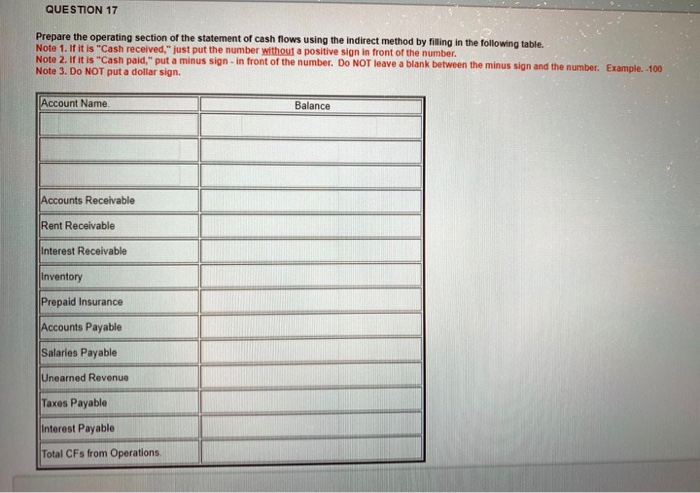

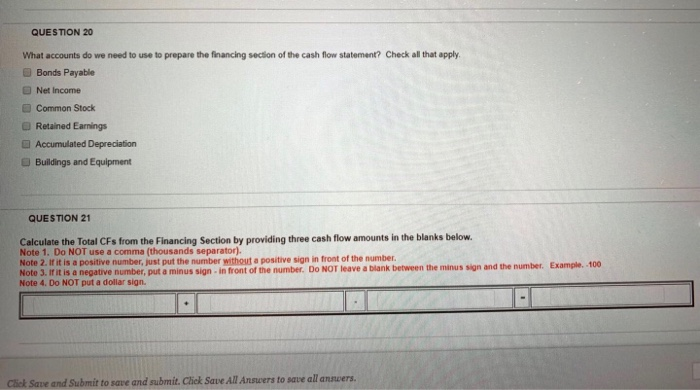

QUESTION 8 SECTION 2 Consider the following Balance Sheet and Income Statement information: Balance Sheet Information Cash Accounts Receivable Rent Receivable Interest Receivable Inventory Prepaid Insurance Building and Equipment Accumulated Depreciation Total Assets 12/31/YR10 12/31 YR9 125,150 105,800 60,000 10,000 700 600 2,000 6,000 10,000 20,000 2,000 1,000 1.250 2,500 (400) (900) 200,700 145,000 Accounts Payable Salaries Payable Unearned Revenue Taxes Payable Interest Payable Bonds Payable Common Stock Retained Earnings Total Liab and Equity 35,000 10,000 6,000 9,000 300 9,100 111,300 20.000 200,700 20,000 5,000 4,000 5,000 0 0 101,000 19.000 145,000 YR10 Income Statement Sales Revenue Rent Revenue Interest Revenue 95,000 8,000 10,000 Cost of Goods Sold Salaries Expense Depreciation Expense Insurance Expense Interest Expense Tax Expense Loss on Sale of Building 40,000 13,000 100 5,000 700 6,000 400 Net Income $47,800 Additional Information: On January 1, YR10, the company issued bonds for 59,100 at par. During YR10, the company did not purchase any buildings or equipment. The company sold an equipment with an original cost of $1,250 and accumulated depreciation of 600 . All dividends declared in YR10 were cash dividends The company did not retire any common stock during YRIO. Prepare the operating section of the statement of cash flows using the direct method by filling in the following table. Note 1. If it is "Cash received," just put the number without a positive sign in front of the number. Note 2. If it is "Cash paid," put a minus sign in front of the number. Do NOT leave a blank between the minus sign and the number. Example. 100 Cash received from customers Cash received from rent Cash received from interest On January 1, YR10, the company issued bonds for $9,100 at par. . During YRIO, the company did not purchase any buildings or equipment The company sold an equipment with an original cost of $1,250 and accumulated depreciation of 600. . All dividends declared in YRIO were cash dividends . The company did not retire any common stock during YRIO. Prepare the operating section of the statement of cash flows using the direct method by filling in the following table. Note 1. If it is "Cash received," just put the number without a positive sign in front of the number. Note 2. if it is "Cash paid," put a minus sign - in front of the number. Do NOT leave a blank between the minus sign and the number. Example. -100 Cash received from customers Cash received from rent Cash received from interest Cash paid to suppliers Cash paid to employees Cash paid for insurance Cash paid for interest Cash paid for income taxes Total CFs from Operating Activities QUESTION 9 QUESTION 18 What accounts are needed to prepare the investing section of the cash flow statement? Check all that apply. Net Income Bonds Payable Retained Earnings Common Stock Accumulated Depreciation Buildings and Equipment QUESTION 19 Prepare journal entries to record the sale of an equipment by filling in the table below. Note 1. Do NOT use a comma (thousands separator). Note 2. Put an NA In the spaces that are irrelevant Account debited Account Credited DR CR Cliel Saw and Sumitomand mit Helme All Amare nellana QUESTION 17 Prepare the operating section of the statement of cash flows using the indirect method by filling in the following table. Note 1. If it is "Cash received, just put the number without a positive sign in front of the number. Note 2. If it is "Cash paid," put a minus sign-in front of the number. Do NOT leave a blank between the minus sign and the number. Example 100 Note 3. Do NOT put a dollar sign. Account Name Balance Accounts Receivable Rent Receivable Interest Receivable Inventory Prepaid Insurance Accounts Payable Salaries Payable Unearned Revenue Taxes Payable Interest Payable Total CFs from Operations QUESTION 20 What accounts do we need to use to prepare the financing section of the cash flow statement? Check all that apply Bonds Payable Net Income Common Stock Retained Earnings Accumulated Depreciation Buildings and Equipment QUESTION 21 Calculate the Total CFs from the Financing Section by providing three cash flow amounts in the blanks below. Note 1. Do NOT use a comma (thousands separator). Note 2. If it is a positive number, just put the number without a positive sign in front of the number Note 3. if it is a negative number, put a minus sign-in front of the number. Do NOT leave a blank between the minus sign and the number. Example 100 Note 4. Do NOT put a dollar sign. Click Save and Submit to save and submit. Chick Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts