Question: question 8. this is the grap and question Beta coefficients and the capital asset pricing model Personal Finance Problem Katherine Wilson is wondering how much

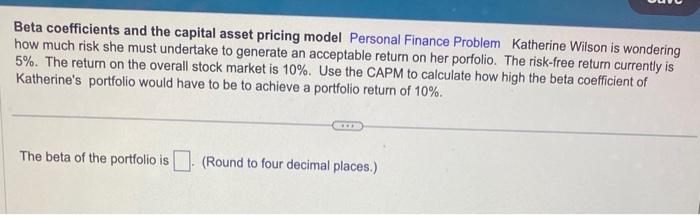

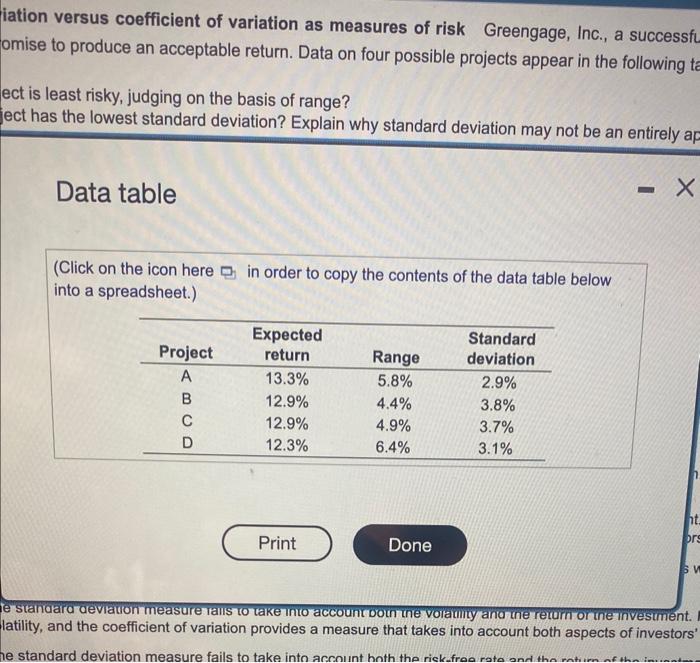

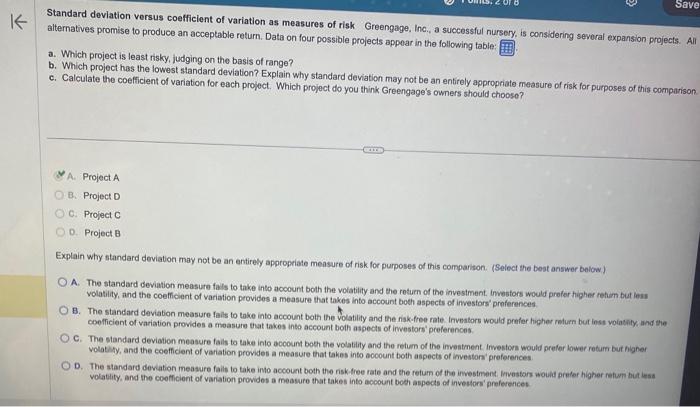

Beta coefficients and the capital asset pricing model Personal Finance Problem Katherine Wilson is wondering how much risk she must undertake to generate an acceptable return on her porfolio. The risk-free return currently is 5%. The return on the overall stock market is 10%. Use the CAPM to calculate how high the beta coefficient of Katherine's portfolio would have to be to achieve a portfolio return of 10%. The beta of the portfolio is (Round to four decimal places.) iation versus coefficient of variation as measures of risk Greengage, Inc., a successft omise to produce an acceptable return. Data on four possible projects appear in the following ect is least risky, judging on the basis of range? ect has the lowest standard deviation? Explain why standard deviation may not be an entirely ap Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) stanaara deviaton measure talis to take mino account dotn tne volatiny ana ne recurn on ine latility, and the coefficient of variation provides a measure that takes into account both aspects of investors' Standard deviation versus coefficient of variation as measures of risk Greengage, Inc., a successful nursery, is considering several expansion projects. All alternatives promise to produce an acceptable return. Data on four possible projects appoar in the following table:. a. Which project is least risky, judging on the basis of range? b. Which project has the lowest standard devlation? Explain why standard deviation may not be an entirely appropriate measure of risk for purposes of this comparison. c. Calculate the coefficient of variation for each project. Which project do you think Greengage's owners should chooso? A. Project A B. Project D C. Project C 0. Project B Explain why standard deviation may not be an entirely appropriate mensure of risk for purposes of this comparison. (Select the best answer below) A. The standard deviation measure fals to take into account both the volatility and the rotum of the investment. investors would prefar higher refum but ies. volatility, and the coefficient of variation provides a measure that takes into account boeh aspects of investors' proferences. B. The standard deviation measure fails to toke into account both the volatility and the riak-free rate. Inveators would prefer hipher return but inst volatily, and the coefficient of variation provides a moasure that takes into account both aspects of imvestors' preferences. C. The standard deviation measure fails to take into account both the volatility and the retum of the investment Investorn would prefer lower return bur figner volat y, and the coefficient of variation provides a measure that takes into account both aspects of inveatorn' preferences D. The standard devation measure fails to take indo account both the nisk-free rate and the retum of the investment lrivestors wouid prefor higher netum but iest volatity, and the cootficient of variation provides a measure that takes into account both aspects of investors' preferences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts