Question: Question 8 Trudy ( 5 4 ) transferred her benefit in her provident fund to a provident preservation fund on 3 0 April 2 0

Question

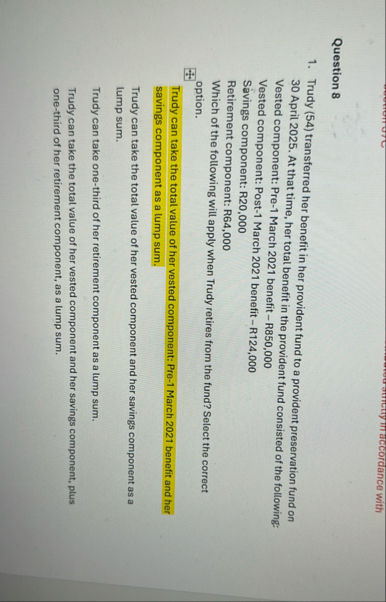

Trudy transferred her benefit in her provident fund to a provident preservation fund on April At that time, her total benefit in the provident fund consisted of the following:

Vested component: Pre March benefit R

Vested component: Post March benefit R

Svings component: R

Retirement component: R

Which of the following will apply when Trudy retires from the fund? Select the correct option.

Trudy can take the total value of her vested component: Pre March benefit and her savings component as a lump sum.

Trudy can take the total value of her vested component and her savings component as a lump sum.

Trudy can take onethird of her retirement component as a lump sum.

Trudy can take the total value of her vested component and her savings component, plus onethird of her retirement component, as a lump sum.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock