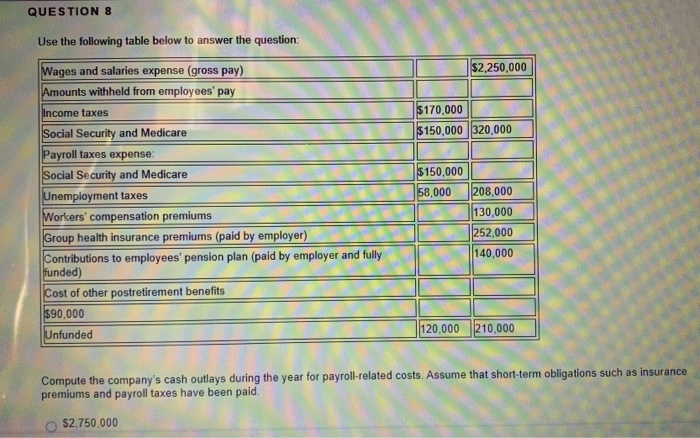

Question: QUESTION 8 Use the following table below to answer the question: $2,250,000 Wages and salaries expense (gross pay) Amounts withheld from employees' pay $170,000 Income

QUESTION 8 Use the following table below to answer the question: $2,250,000 Wages and salaries expense (gross pay) Amounts withheld from employees' pay $170,000 Income taxes $150,000 320,000 Social Security and Medicare Payroll taxes expense: $150,000 Social Security and Medicare Unemployment taxes Workers' compensation premiums 208,000 130,000 252,000 140,000 58,000 Group health insurance premiums (paid by employer) Contributions to employees' pension plan (paid by employer and fully funded) Cost of other postretirement benefits $90,000 120,000 210,000 Unfunded Compute the company's cash outlays during the year for payroll-related costs. Assume that short-term obligations such as insurance premiums and payroll taxes have been paid. $2,750,000 Compute the company's cash outlays during the year for payroll-related costs. Assume that short-term obligations such as insurand premiums and payroll taxes have been paid. $2,750,000 $3,070,000 O $1,930,000 $3,510,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts