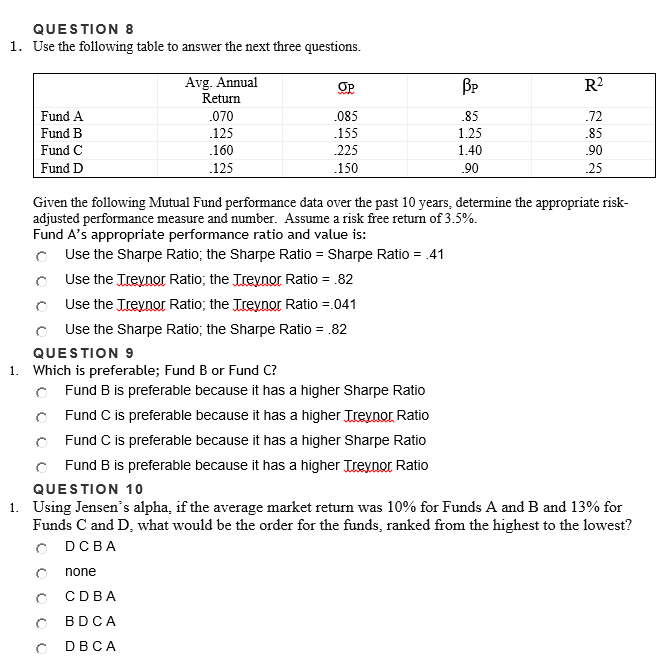

Question: QUESTION 8 Use the following table to answer the next three questions. 1. Avg. Annual Return 070 125 160 125 OP R2 Fund A Fund

QUESTION 8 Use the following table to answer the next three questions. 1. Avg. Annual Return 070 125 160 125 OP R2 Fund A Fund B Fund C Fund D 085 155 225 150 85 1.25 1.40 90 72 85 .90 25 Given the following Mutual Fund performance data over the past 10 years, determine the appropriate risk adjusted performance measure and number. Assume a risk free return of 3.5%. Fund A's appropriate performance ratio and value is: Use the Sharpe Ratio, the Sharpe Ratio = Sharpe Ratio .41 Use the Treynor Ratio, the Treynor Ratio.82 c Use the Treynor Ratio, the Treynor Ratio.041 Use the Sharpe Ratio, the Sharpe Ratio = .82 QUESTION 9 1. Which is preferable; Fund B or Fund C? Fund B is preferable because it has a higher Sharpe Ratio Fund C is preferable because it has a higher Jreynor Ratio Fund C is preferable because it has a higher Sharpe Ratio Fund B is preferable because it has a higher Treynor Ratio QUESTION 10 Using Jensen's alpha, if the average market return was 10% for Funds A and B and 13% for Funds C and D, what would be the order for the funds, ranked from the highest to the lowest? 1. DCBA none CDBA C BDCA DBCA QUESTION 8 Use the following table to answer the next three questions. 1. Avg. Annual Return 070 125 160 125 OP R2 Fund A Fund B Fund C Fund D 085 155 225 150 85 1.25 1.40 90 72 85 .90 25 Given the following Mutual Fund performance data over the past 10 years, determine the appropriate risk adjusted performance measure and number. Assume a risk free return of 3.5%. Fund A's appropriate performance ratio and value is: Use the Sharpe Ratio, the Sharpe Ratio = Sharpe Ratio .41 Use the Treynor Ratio, the Treynor Ratio.82 c Use the Treynor Ratio, the Treynor Ratio.041 Use the Sharpe Ratio, the Sharpe Ratio = .82 QUESTION 9 1. Which is preferable; Fund B or Fund C? Fund B is preferable because it has a higher Sharpe Ratio Fund C is preferable because it has a higher Jreynor Ratio Fund C is preferable because it has a higher Sharpe Ratio Fund B is preferable because it has a higher Treynor Ratio QUESTION 10 Using Jensen's alpha, if the average market return was 10% for Funds A and B and 13% for Funds C and D, what would be the order for the funds, ranked from the highest to the lowest? 1. DCBA none CDBA C BDCA DBCA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts