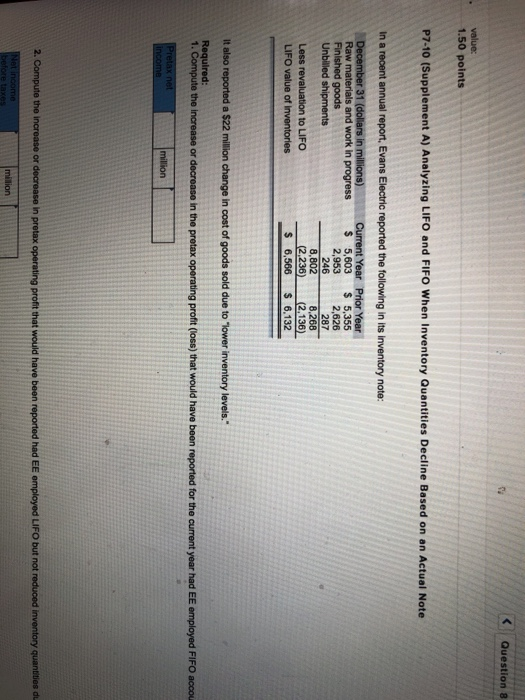

Question: Question 8 . value: 1.50 points P7-10 (Supplement A) Analyzing LIFO and FIFO When Inventory Quantities Decline Based on an Actual Note In a recent

Question 8 . value: 1.50 points P7-10 (Supplement A) Analyzing LIFO and FIFO When Inventory Quantities Decline Based on an Actual Note In a recent annual report, Evans Electric reported the following in its inventory note Raw materials and work in progress Unbilled shipments Less revaluation to LIFO LIFO value of inventories 31 (dollars in milions)Current Year Prior Year $ 5,603 $ 5,355 2,9532,626 287 8,268 246 8,802 2.236) (2.136) S 6,566 S6,132 It also reported a $22 million change in cost of goods sold due to "lower inventory levels." Required: te the 2. Compute the increase or decrease in pretax operating profit that would have been reported had EE employed LIFO but not reduced inventory quanties du

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts