Question: Question 8 View Policies Current Attempt in Progress Cullumber Company sells equipment on March 31, 2021, for $32,910 cash. The equipment was purchased on January

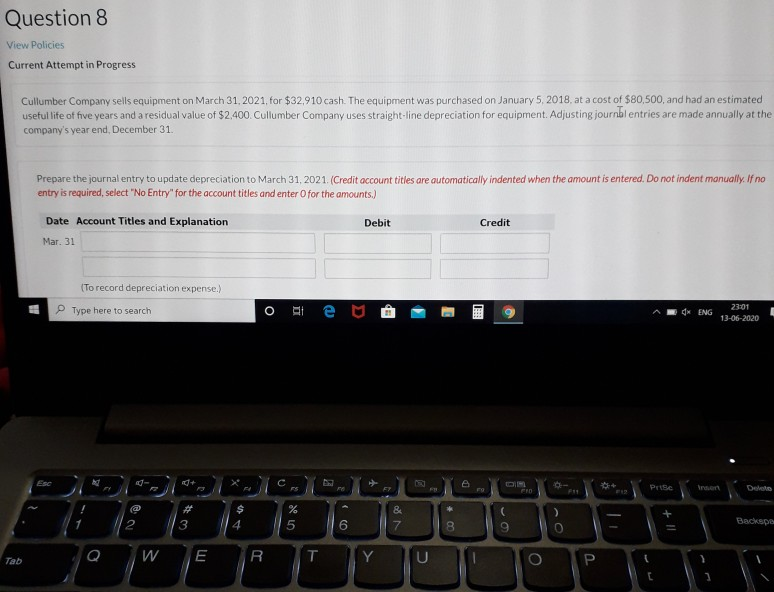

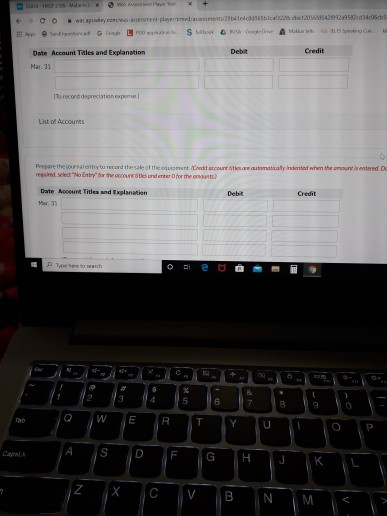

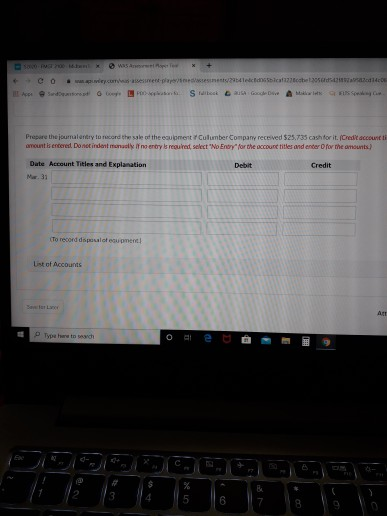

Question 8 View Policies Current Attempt in Progress Cullumber Company sells equipment on March 31, 2021, for $32,910 cash. The equipment was purchased on January 5, 2018, at a cost of $80,500, and had an estimated useful life of five years and a residual value of $2,400. Cullumber Company uses straight-line depreciation for equipment. Adjusting journbl entries are made annually at the company's year end, December 31. Prepare the journal entry to update depreciation to March 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Mar. 31 (To record depreciation expense.) O Type here to search T e M CK ENG 23:01 13-06-2020 27 C A FIO Prise Trauen & 7 3 # 00 5 6 9 Backen E R T Y Tab U o 4 tycomment peu 25451205645420ch Sub SA Date Account Titles and Explanation Debat Credit Mar. 31 To record depreciation List of Accounts Prepare the journalentynucord the sale of the intenditore e manded when the mount is entered De reed select "Money for the counted for the Date Account Titles and Explanation Debat Credit Mar 13 Prototh + 4 S 6 7 9 Q W E R T Y U A S D F G H N V B N www.complecache. Srabook Prepare the journey to record the select the coulement Culumber Company received $25.735 cash for it. (Credit account amount is entered. Do not indentmenly if no entry is required, select "No Endry for the account titles and ender for the amounts Debit Credit Date Account Titles and Explanation Mar 31 To record dialogue List of Accounts AL Type hare to see ei B S 5 6 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts