Question: Question 8 View Policies Current Attempt in Progress Match each word or phrase with its description below. Written promise (as evidenced by a formal instrument)

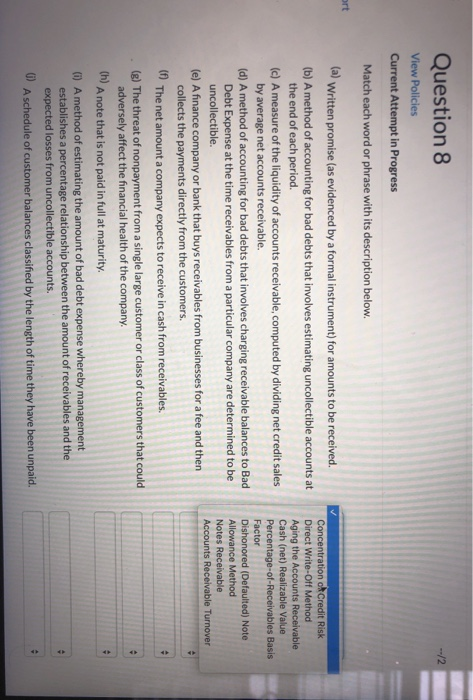

Question 8 View Policies Current Attempt in Progress Match each word or phrase with its description below. Written promise (as evidenced by a formal instrument) for amounts to be received. (b) A method of accounting for bad debts that involves estimating uncollectible accounts at the end of each period. (c) A measure of the liquidity of accounts receivable, computed by dividing net credit sales by average net accounts receivable. (d) A method of accounting for bad debts that involves charging receivable balances to Bad Debt Expense at the time receivables from a particular company are determined to be uncollectible. (e) A finance company or bank that buys receivables from businesses for a fee and then collects the payments directly from the customers. W The net amount a company expects to receive in cash from receivables. (e) The threat of nonpayment from a single large customer or class of customers that could adversely affect the financial health of the company. Concentration of Credit Risk Direct Write-Off Method Aging the Accounts Receivable Cash (net) Realizable Value Percentage-of-Receivables Basis Factor Dishonored (Defaulted) Note Allowance Method Notes Receivable Accounts Receivable Turnover in A note that is not paid in full at maturity. (i) A method of estimating the amount of bad debt expense whereby management establishes a percentage relationship between the amount of receivables and the expected losses from uncollectible accounts. A schedule of customer balances classified by the length of time they have been unpaid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts