Question: question 8 will upvote thanks :) D Question 8 3 pts In 2018, a married couple is in the 22% bracket until their income goes

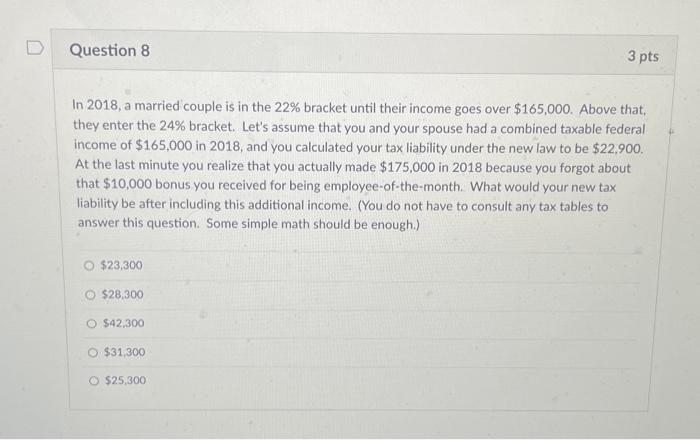

D Question 8 3 pts In 2018, a married couple is in the 22% bracket until their income goes over $165,000. Above that, they enter the 24% bracket. Let's assume that you and your spouse had a combined taxable federal income of $165,000 in 2018, and you calculated your tax liability under the new law to be $22,900. At the last minute you realize that you actually made $175,000 in 2018 because you forgot about that $10,000 bonus you received for being employee-of-the-month. What would your new tax liability be after including this additional income. (You do not have to consult any tax tables to answer this question. Some simple math should be enough.) $23,300 O $28,300 O $42,300 $31,300 O $25,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts