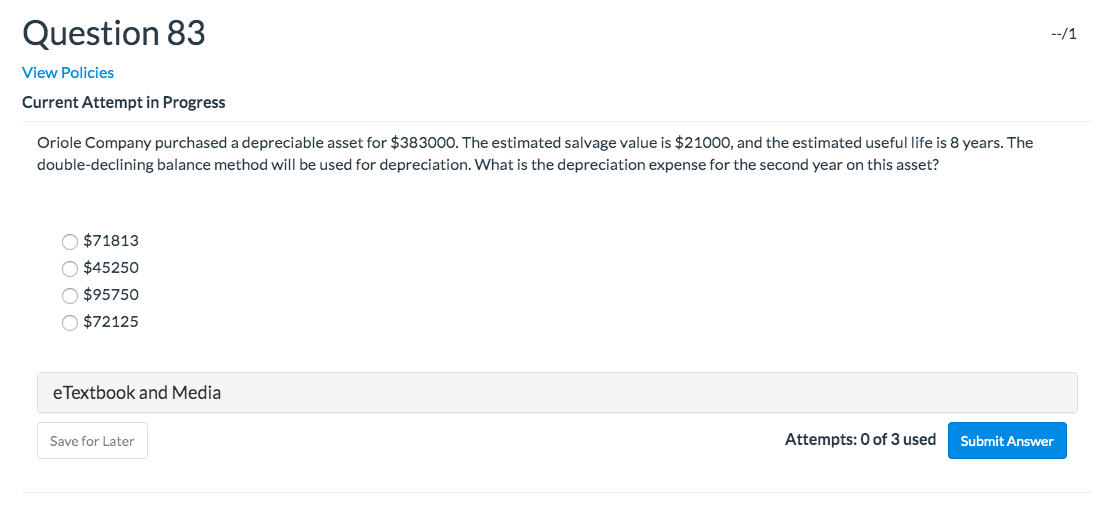

Question: Question 83 --/1 View Policies Current Attempt in Progress Oriole Company purchased a depreciable asset for $383000. The estimated salvage value is $21000, and the

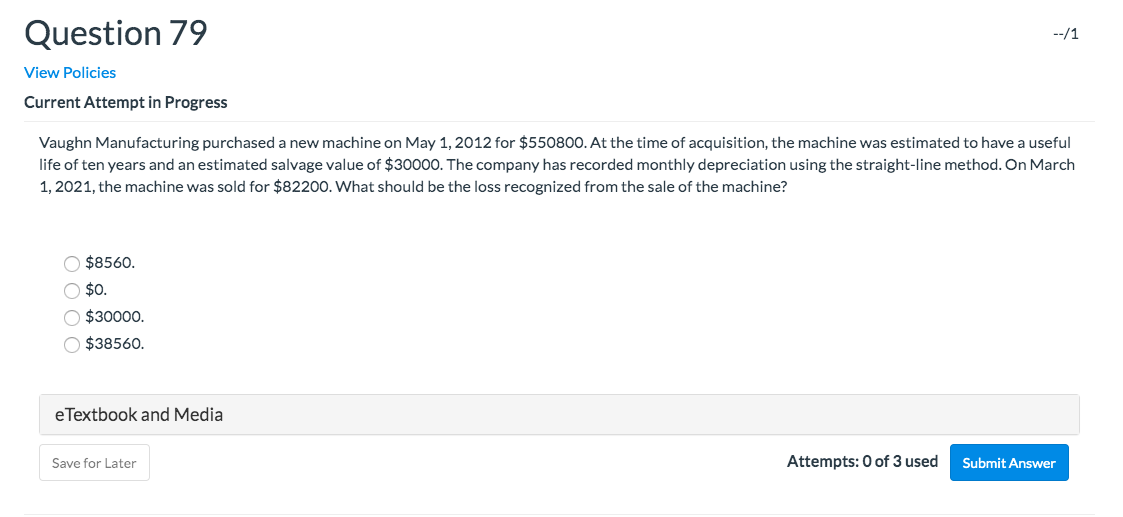

Question 83 --/1 View Policies Current Attempt in Progress Oriole Company purchased a depreciable asset for $383000. The estimated salvage value is $21000, and the estimated useful life is 8 years. The double-declining balance method will be used for depreciation. What is the depreciation expense for the second year on this asset? $71813 O$45250 $95750 $72125 e Textbook and Media Save for Later Attempts: 0 of 3 used Submit Answer Question 79 --/1 View Policies Current Attempt in Progress Vaughn Manufacturing purchased a new machine on May 1, 2012 for $550800. At the time of acquisition, the machine was estimated to have a useful life of ten years and an estimated salvage value of $30000. The company has recorded monthly depreciation using the straight-line method. On March 1, 2021, the machine was sold for $82200. What should be the loss recognized from the sale of the machine? $8560. $0. $30000. $38560. e Textbook and Media Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts