Question: question #83. please list the steps in how to find the PARTIAL year depreciation for this problem, the answer is E. $19,166.67 83. Lomax Enterprises

question #83. please list the steps in how to find the PARTIAL year depreciation for this problem, the answer is E. $19,166.67

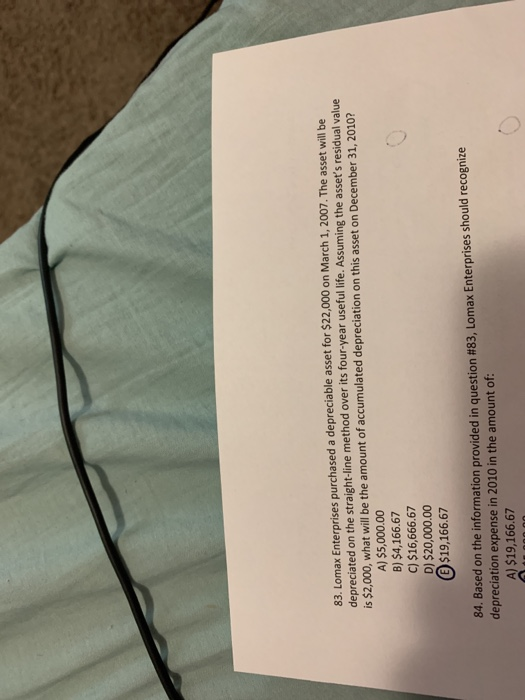

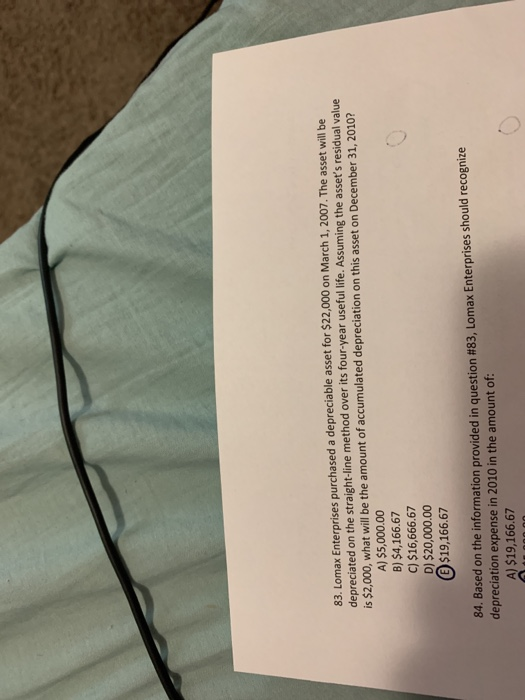

83. Lomax Enterprises purchased a depreciable asset for $22,000 on March 1, 2007. The asset will be depreciated on the straight-line method over its four-year useful life. Assuming the asset's residual value is $2,000, what will be the amount of accumulated depreciation on this asset on December 31, 2010? A) $5,000.00 B) $4,166.67 C) $16,666.67 D) $20,000.00 @$19,166.6 84, Based on the information provided in question #83, Lomax Enterprises should recognize depreciation expense in 2010 in the amount of A) $19,166.67

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock