Question: Question 89 --/1 View Policies Current Attempt in Progress Vaughn Manufacturing bought a machine on January 1, 2011 for $800000. The machine had an expected

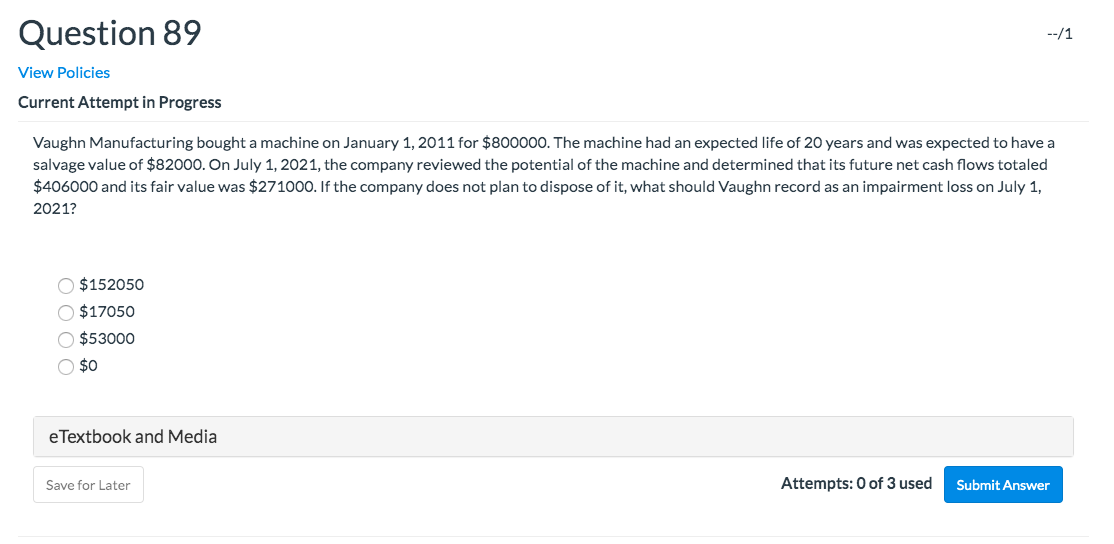

Question 89 --/1 View Policies Current Attempt in Progress Vaughn Manufacturing bought a machine on January 1, 2011 for $800000. The machine had an expected life of 20 years and was expected to have a salvage value of $82000. On July 1, 2021, the company reviewed the potential of the machine and determined that its future net cash flows totaled $406000 and its fair value was $271000. If the company does not plan to dispose of it, what should Vaughn record as an impairment loss on July 1, 2021? $152050 $17050 $53000 $0 e Textbook and Media Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts