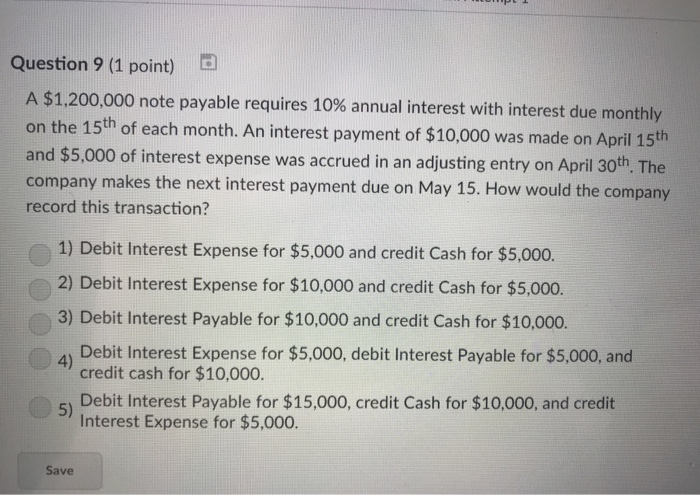

Question: Question 9 (1 point) D A $1,200,000 note payable requires 10% annual interest with interest due monthly on the 15th of each month. An interest

Question 9 (1 point) D A $1,200,000 note payable requires 10% annual interest with interest due monthly on the 15th of each month. An interest payment of $10,000 was made on April 15 and $5,000 of interest expense was accrued in an adjusting entry on April company makes the next interest payment due on May 15. How would the company record this transaction? th 30th, The 1) Debit Interest Expense for $5,000 and credit Cash for $5,000. 2) Debit Interest Expense for $10,000 and credit Cash for $5,000. 3) Debit Interest Payable for $10,000 and credit Cash for $10,000. 4, Debit Interest Expense for $5,000, debit Interest Payable for $5,000, and credit cash for $10,000 s Debit Interest Payable for $15,000, credit Cash for $10,000, and credit 5) Interest Expense for $5,000. Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts