Question: Question 9 (1 point) What would you not advise concerning the valuation of inventories? Cash discounts that approximate a fair interest rate must be deducted

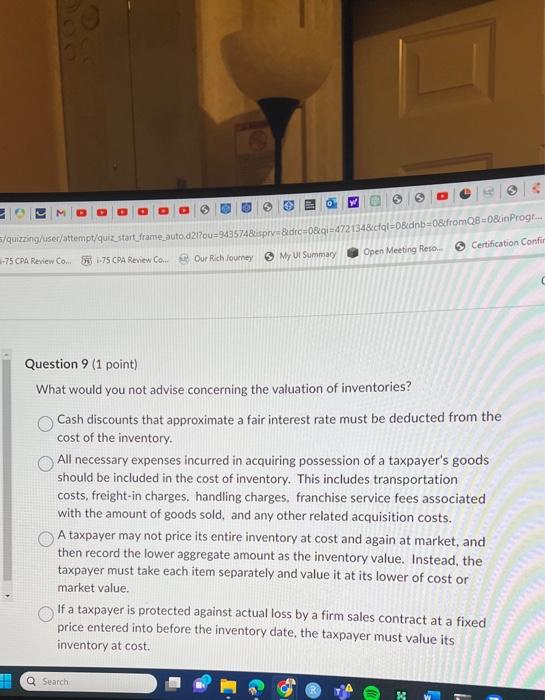

Question 9 (1 point) What would you not advise concerning the valuation of inventories? Cash discounts that approximate a fair interest rate must be deducted from the cost of the inventory. All necessary expenses incurred in acquiring possession of a taxpayer's goods should be included in the cost of inventory. This includes transportation costs, freight-in charges, handling charges, franchise service fees associated with the amount of goods sold, and any other related acquisition costs. A taxpayer may not price its entire inventory at cost and again at market, and then record the lower aggregate amount as the inventory value. Instead, the taxpayer must take each item separately and value it at its lower of cost or market value. If a taxpayer is protected against actual loss by a firm sales contract at a fixed price entered into before the inventory date, the taxpayer must value its inventory at cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts