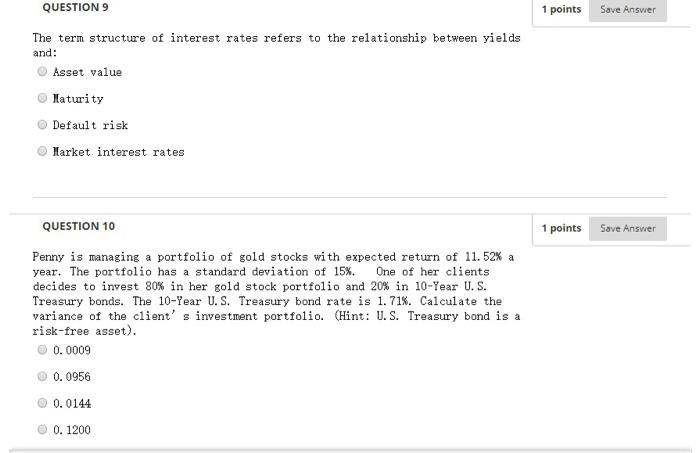

Question: QUESTION 9 1 points Save Answer The term structure of interest rates refers to the relationship between yields and: Asset value Haturity Default risk larket

QUESTION 9 1 points Save Answer The term structure of interest rates refers to the relationship between yields and: Asset value Haturity Default risk larket interest rates QUESTION 10 1 points Save Answer Penny is managing a portfolio of gold stocks with expected return of 11.52% a year. The portfolio has a standard deviation of 15%. One of her clients decides to invest 80% in her gold stock portfolio and 20% in 10-Year U.S. Treasury bonds. The 10-Year U.S. Treasury bond rate is 1.71%. Calculate the variance of the client's investment portfolio. (Hint: U.S. Treasury bond is a risk-free asset). 0.0009 0.0956 0.0144 0. 1200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts