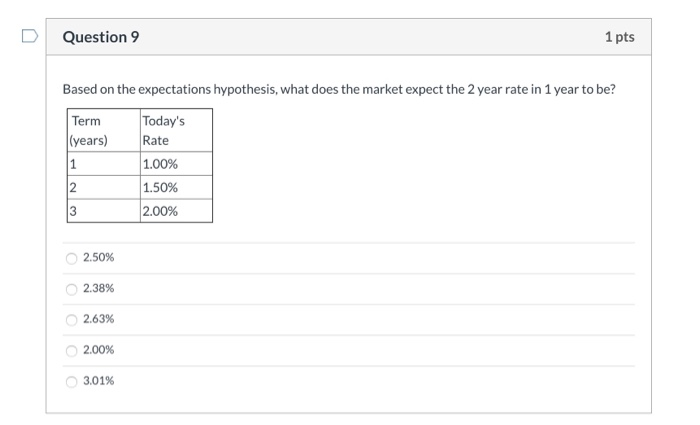

Question: Question 9 1 pts Based on the expectations hypothesis, what does the market expect the 2 year rate in 1 year to be? Term (years)

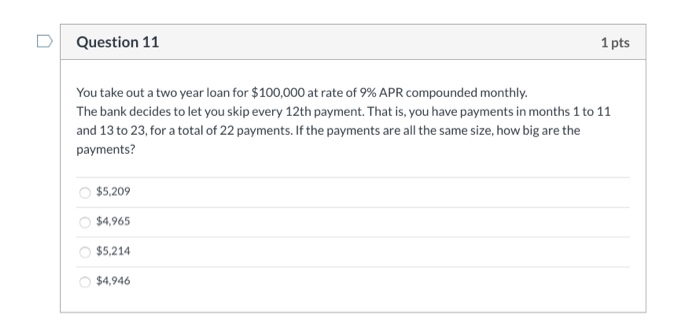

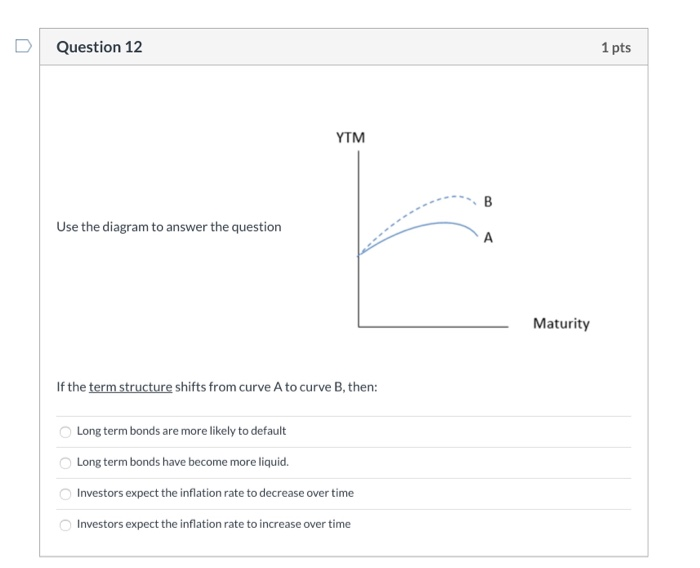

Question 9 1 pts Based on the expectations hypothesis, what does the market expect the 2 year rate in 1 year to be? Term (years) Today's Rate 1.00% 1.50% 2.00% 2.50% 2.38% 2.63% 2.00% 3.01% Question 11 1 pts You take out a two year loan for $100,000 at rate of 9% APR compounded monthly The bank decides to let you skip every 12th payment. That is, you have payments in months 1 to 11 and 13 to 23, for a total of 22 payments. If the payments are all the same size, how big are the payments? $5,209 $4,965 $5,214 $4,946 Question 12 1 pts YTM Use the diagram to answer the question Maturity If the term structure shifts from curve A to curve B, then: Long term bonds are more likely to default Long term bonds have become more liquid. Investors expect the inflation rate to decrease over time Investors expect the inflation rate to increase over time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts