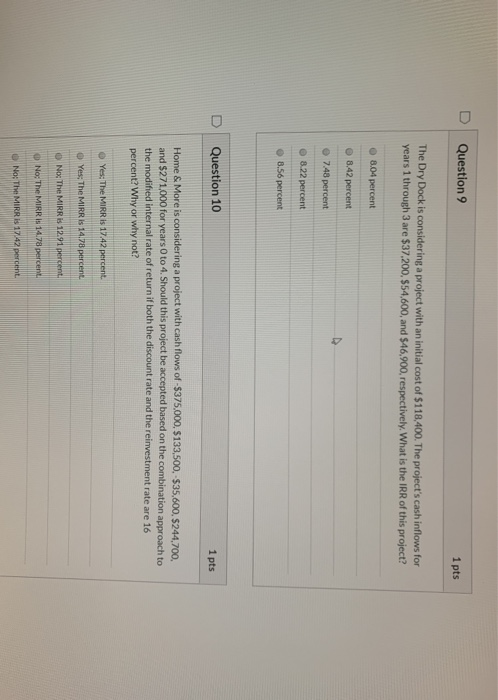

Question: Question 9 1 pts The Dry Dock is considering a project with an initial cost of $118,400. The project's cash inflows for years 1 through

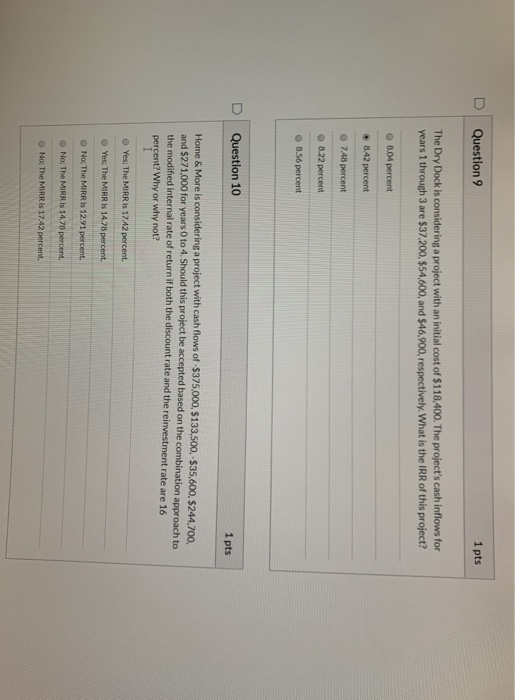

Question 9 1 pts The Dry Dock is considering a project with an initial cost of $118,400. The project's cash inflows for years 1 through 3 are $37.200, 554,600, and $46,900, respectively. What is the IRR of this project? 8.04 percent 8.42 percent 7.48 percent O 8.22 percent 8.56 percent Question 10 1 pts Home & More is considering a project with cash flows of -$375.000, $133,500,-$35,600, $244.700. and $271,000 for years 0 to 4. Should this project be accepted based on the combination approach to the modified internal rate of return if both the discount rate and the reinvestment rate are 16 percent? Why or why not? Yes. The MIRR IS 12.42 percent. Yes: The MIRR IS 14.78 percent O No: The MIRR$ 12.91 percent No: The MIRR IS 14.78 percent Nas T MIRR 1742 percent. D Question 9 1 pts The Dry Dock is considering a project with an initial cost of $118.400. The project's cash inflows for years 1 through 3 are $37.200, 554,600 and $46,900, respectively. What is the IRR of this project? 8.04 percent 8.42 percent 7.48 percent 8.22 percent 8.56 percent Question 10 1 pts Home & More is considering a project with cash flows of $375,000, 5133,500,-$35,600,5244,700, and $271,000 for years 0 to 4. Should this project be accepted based on the combination approach to the modified internal rate of return if both the discount rate and the reinvestment rate are 16 percent? Why or why not? Yes: The MIRR IS 1742 percent Yes: The MIRR IS 14.78 percent. No The MIRR IS 12.91 percent Nos The MIRR IS 14.78 percent. No The MIRRI 1742 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts