Question: Question 9 (10 marks) Acme Co operates in a world with perfect capital markets where there are no taxes. Acme pays out all available earnings

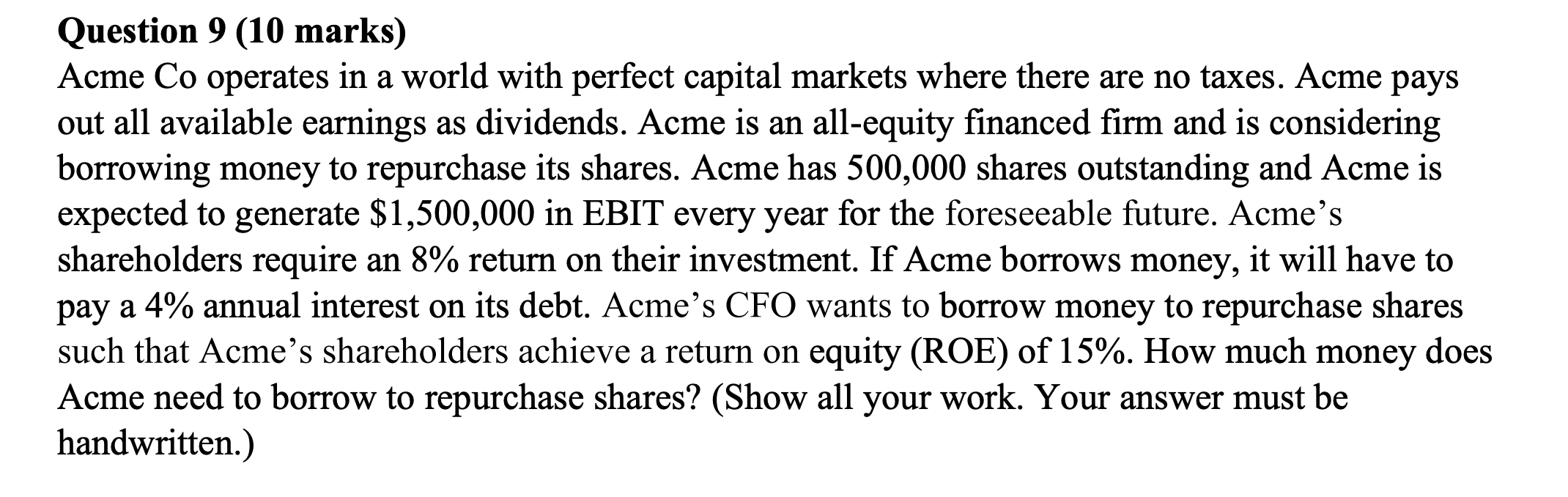

Question 9 (10 marks) Acme Co operates in a world with perfect capital markets where there are no taxes. Acme pays out all available earnings as dividends. Acme is an all-equity financed firm and is considering borrowing money to repurchase its shares. Acme has 500,000 shares outstanding and Acme is expected to generate $1,500,000 in EBIT every year for the foreseeable future. Acme's shareholders require an 8% return on their investment. If Acme borrows money, it will have to pay a 4% annual interest on its debt. Acmes CFO wants to borrow money to repurchase shares such that Acme's shareholders achieve a return on equity (ROE) of 15%. How much money does Acme need to borrow to repurchase shares? (Show all your work. Your answer must be handwritten.) a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts