Question: QUESTION 9 10 points Save Ar Non-annual compounding: See Section 5-15 for formulas and examples So far, we have focused on annual compounding. What about

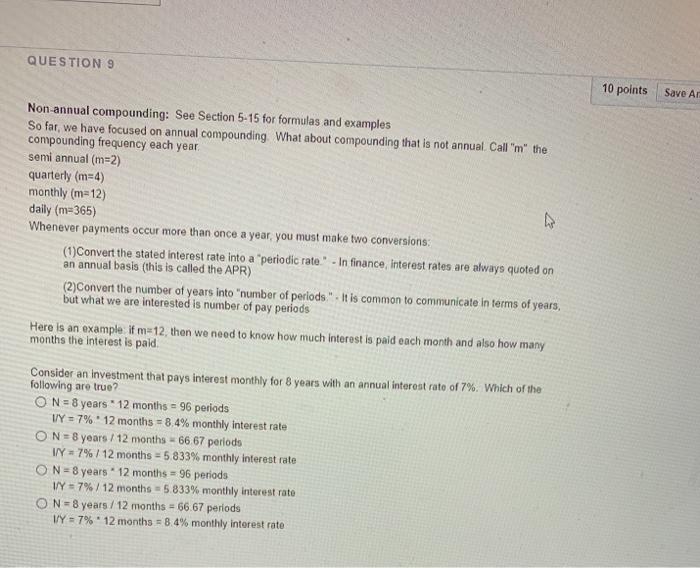

QUESTION 9 10 points Save Ar Non-annual compounding: See Section 5-15 for formulas and examples So far, we have focused on annual compounding. What about compounding that is not annual Call "m" the compounding frequency each year semi annual (m=2) quarterly (m=4) monthly (m-12) daily (m=365) Whenever payments occur more than once a year, you must make two conversions: (1) Convert the stated interest rate into a periodic rate." - In finance Interest rates are always quoted on an annual basis (this is called the APR) (2)Convert the number of years into "number of periods." It is common to communicate in terms of years, but what we are interested is number of pay periods Here is an example if m=12, then we need to know how much interest is paid each month and also how many months the interest is paid Consider an investment that pays interest monthly for 8 years with an annual interest rate of 7%. Which of the following are true? O N = 8 years - 12 months = 96 periods VY=7%. 12 months = 8.4% monthly interest rate ON = 8 years / 12 months 66 67 periods IVY + 7%/ 12 months = 5.833% monthly interest rate O N = 8 years * 12 months = 96 periods VY = 7%/ 12 months = 5 833% monthly interest rate ON = 8 years / 12 months = 66.67 periods VY = 7% 12 months = 8.4% monthly interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts