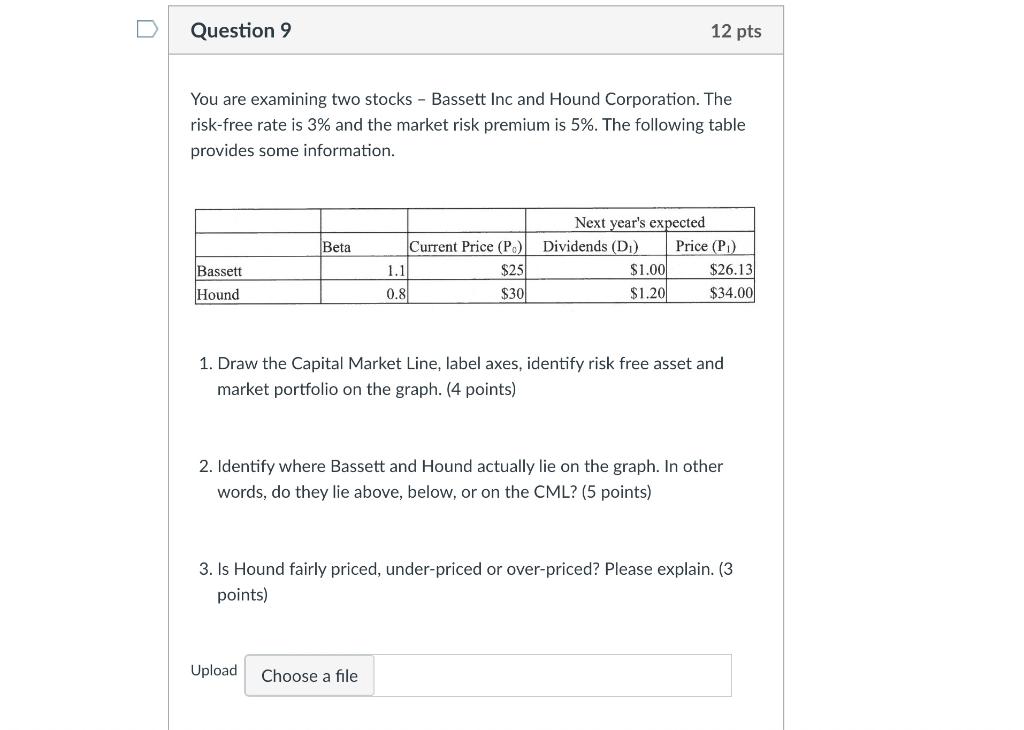

Question: Question 9 12 pts You are examining two stocks - Bassett Inc and Hound Corporation. The risk-free rate is 3% and the market risk premium

Question 9 12 pts You are examining two stocks - Bassett Inc and Hound Corporation. The risk-free rate is 3% and the market risk premium is 5%. The following table provides some information. Beta Current Price (PO) $25 Next year's expected Dividends (D) Price (P1) $1.00 $26.13 $1.201 $34.00 1.1 Bassett Hound 0.8 $30 1. Draw the Capital Market Line, label axes, identify risk free asset and market portfolio on the graph. (4 points) 2. Identify where Bassett and Hound actually lie on the graph. In other words, do they lie above, below, or on the CML? (5 points) 3. Is Hound fairly priced, under-priced or over-priced? Please explain. (3 points) Upload Choose a file

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts