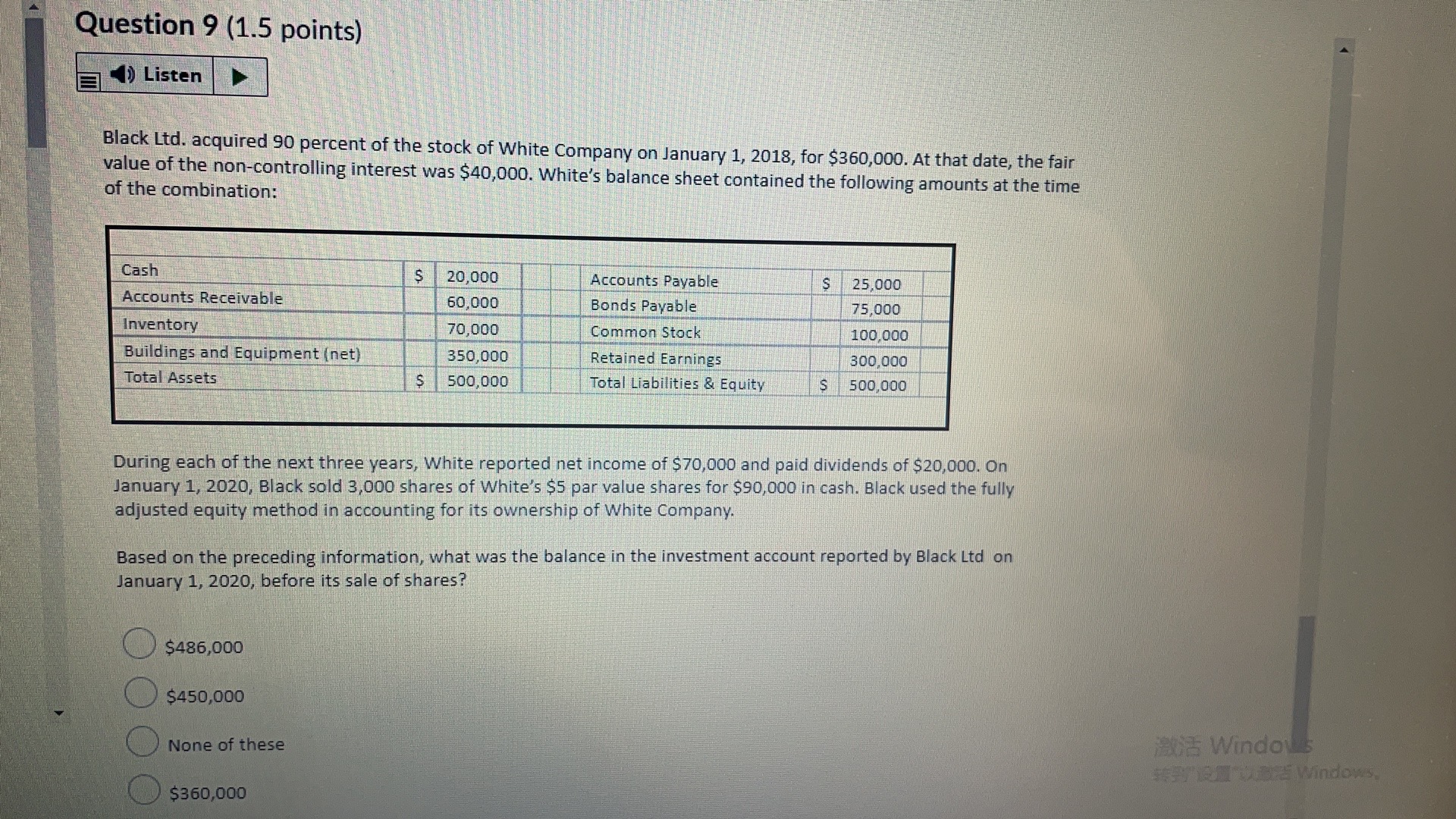

Question: Question 9 (1.5 points) ) Listen Black Ltd. acquired 90 percent of the stock of White Company on January 1, 2018, for $360,000. At that

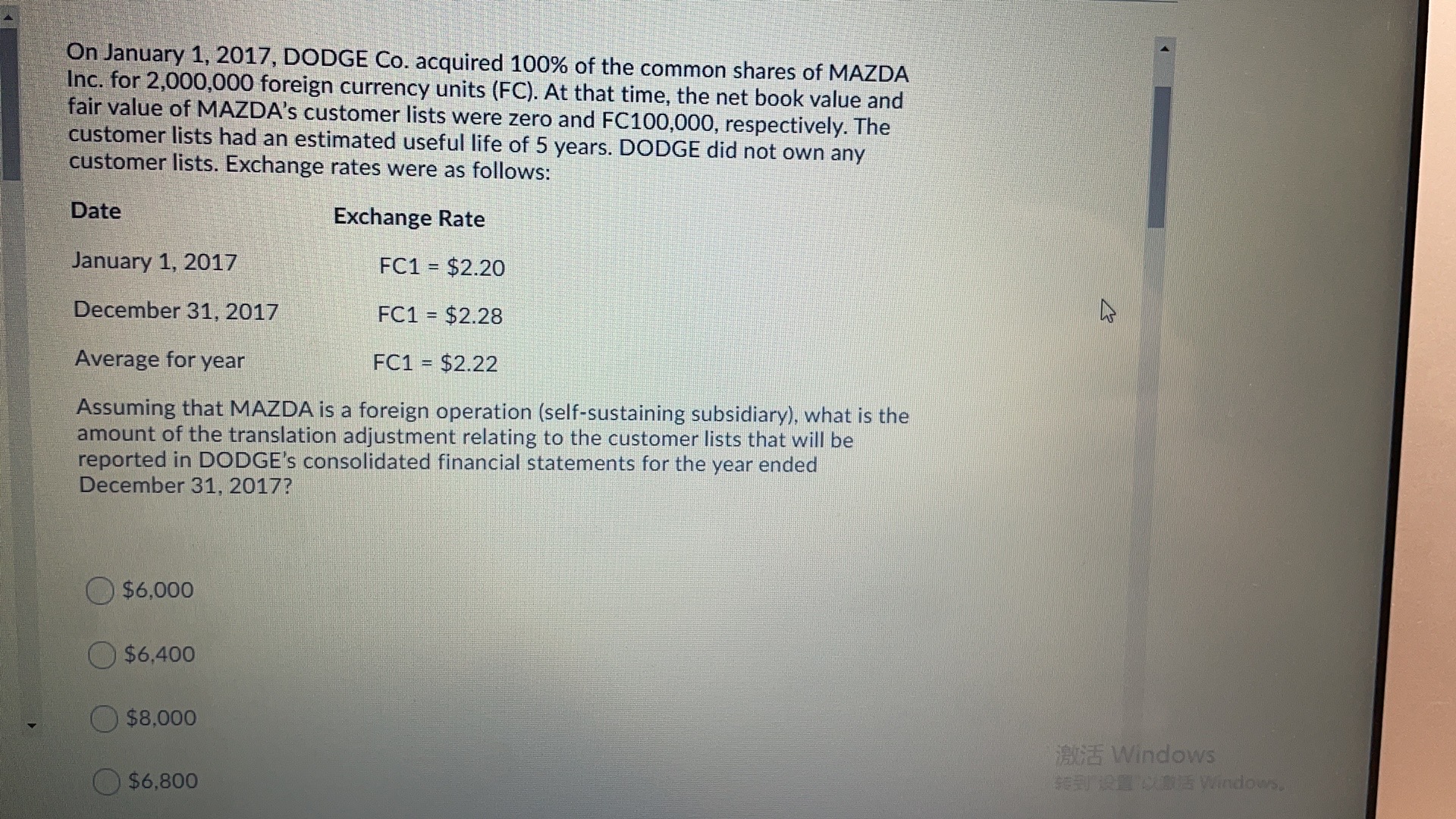

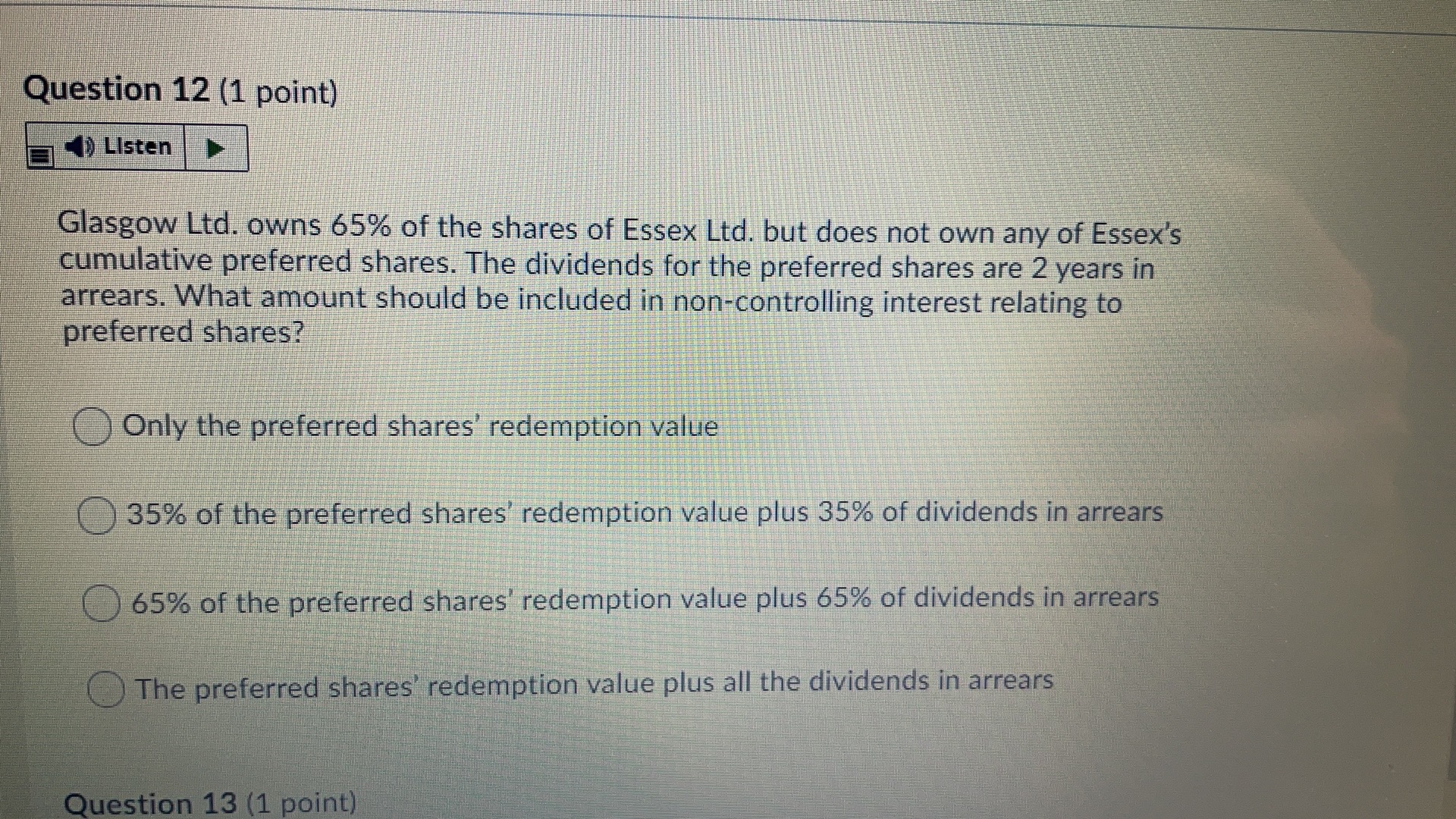

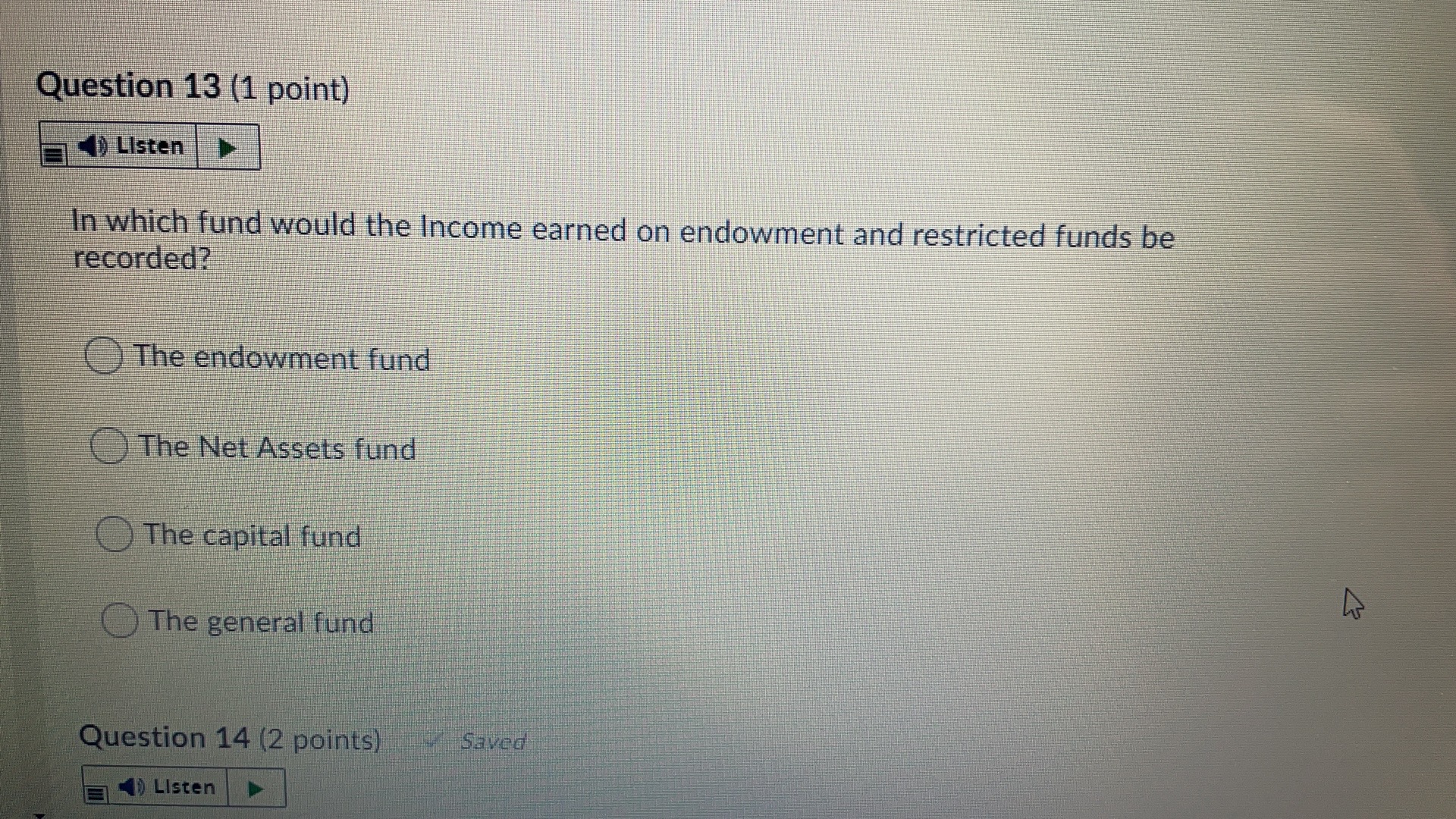

Question 9 (1.5 points) ) Listen Black Ltd. acquired 90 percent of the stock of White Company on January 1, 2018, for $360,000. At that date, the fair value of the non-controlling interest was $40,000. White's balance sheet contained the following amounts at the time of the combination: Cash S 20,000 Accounts Payable S 25,000 Accounts Receivable 60,000 Bonds Payable 75,000 Inventory 70,000 Common Stock 100,000 Buildings and Equipment (net) 350,000 Retained Earnings 300,000 Total Assets $ 500,000 Total Liabilities & Equity S 500,000 During each of the next three years, White reported net income of $70,000 and paid dividends of $20,000. On January 1, 2020, Black sold 3,000 shares of White's $5 par value shares for $90,000 in cash. Black used the fully adjusted equity method in accounting for its ownership of White Company. Based on the preceding information, what was the balance in the investment account reported by Black Lid on January 1, 2020, before its sale of shares? $486,000 OO $450,000 CE Windows None of these HaraRE Windows. OO $360,000On January 1, 2017, DODGE Co. acquired 100% of the common shares of MAZDA Inc. for 2,000,000 foreign currency units (FC). At that time, the net book value and fair value of MAZDA's customer lists were zero and FC100,000, respectively. The customer lists had an estimated useful life of 5 years. DODGE did not own any customer lists. Exchange rates were as follows: Date Exchange Rate January 1, 2017 FC1 = $2.20 December 31, 2017 FC1 = $2.28 Average for year FC1 = $2.22 Assuming that MAZDA is a foreign operation (self-sustaining subsidiary), what is the amount of the translation adjustment relating to the customer lists that will be reported in DODGE's consolidated financial statements for the year ended December 31, 2017? $6,000 $6,400 $8,000 BCE Windows $6,800 FEET RET OGLE Windows.Question 12 (1 point) Listen Glasgow Ltd. owns 65% of the shares of Essex Ltd. but does not own any of Essex's cumulative preferred shares. The dividends for the preferred shares are 2 years in arrears. What amount should be included in non-controlling interest relating to preferred shares? Only the preferred shares' redemption value 35% of the preferred shares' redemption value plus 35% of dividends in arrears 65% of the preferred shares' redemption value plus 65% of dividends in arrears The preferred shares' redemption value plus all the dividends in arrears Question 13 (1 point)Question 13 (1 point) Listen In which fund would the Income earned on endowment and restricted funds be recorded? The endowment fund The Net Assets fund The capital fund The general fund Question 14 (2 points) Saved () Listen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts